The link between manufacturing activity and demand in the industrial and logistics market is well-explored and self-evident. As long-term demand for manufactured goods rises, manufacturing occupiers will expand their real estate footprints to increase capacity

Real estate and manufacturing

Higher manufacturing output will increase the volume of goods moving through the economy, stimulating demand for logistics demand. Indeed, this effect is apparent in the relation between EU manufacturing output and European take-up, shown below.

This aggregate data underplays the relationship between the two, and we would expect to see similar relationships in national markets. Markets in economies with higher weightings of industrial-based occupation, like Germany and Poland, have a stronger relationship and take-up in these markets will be more sensitive to increases in manufacturing investment. We would also note that most of the variation between the two series is due to Covid-era declines in productivity due to lockdowns.

In 2021, total European manufacturing revenues reached €5,209 billion, while total semiconductor revenue reached €53.8 billion – equating to just over 1% of total European manufacturing revenues. Assuming that manufacturing grows at the compound annual growth rate experienced between 2011 and 2021 (1.07%) and European semiconductor revenues reach the €241.56bn figure needed to achieve the EU’s targets, this share could grow to 4.2% by 2030. This growth represents an additional increase in manufacturing revenues of 2.9% over the period, driving take-up in the European logistics sector.

In the US, research from the Semiconductor Industry Association (SIA) suggests that every $1bn in Gross Value Added to GDP (On a simplistic level, GVA is the total of all revenues from final sales and net subsidies) generates an additional $0.89bn of GVA in indirectly. We would note that much of this indirect GVA would come from complementary manufacturing and logistics industries. This would suggest that the increase in semiconductor revenues by 2030 could roughly generate an additional €167.2bn in revenue per annum in the manufacturing and logistics sectors.

On the ground, Savills is already seeing evidence of take-up driven by semiconductors and manufacturing, with at least one manufacturer of equipment needed for semiconductor production actively looking to expand their footprint in the EU. Across Europe, we have seen an uptick in enquiries from manufacturers. In the UK, Automotive, Manufacturing and Food Production accounted for 28% of total take-up in 2022, well ahead of the long-run average of 23%.

In addition to direct growth in demand from semiconductor producers, we expect to see more expansions amongst the previously mentioned semiconductor equipment manufacturers to facilitate increased production

Andrew Blennerhassett, UK & EMEA Logistics Research Analyst

Requirements from specialist material suppliers of raw materials and chemicals for semiconductors would inevitably grow as production increased. Indeed as output increases, specialised packaging and testing companies that provide protective packaging, ensure proper electrical connection and enable the integration of chips into final products would also grow. All of these firms will either be operating within the logistics real estate market or require the services of 3PLs, stimulating demand for development land and logistics assets. This will inevitably lead to an uplift in demand in the medium to long term, forming part of the ongoing trend of onshoring we have started to observe in Europe.

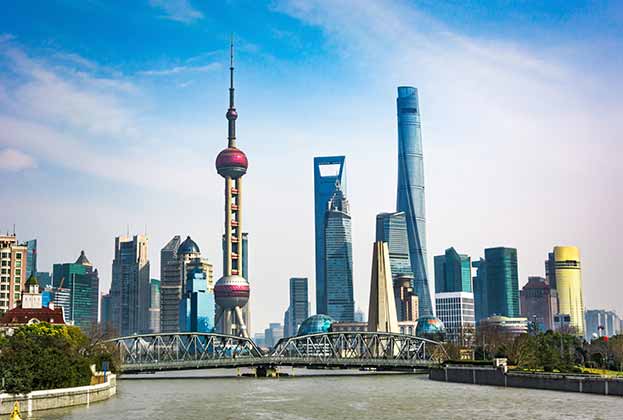

China

Further evidence of the relationship between manufacturing and the logistics sector has been shown using the 'Made in China 2025' strategy as a natural experiment. The paper used a double difference methodology, looking at locations where investment increased through the “Made in China 2025” policy to show a causal relationship between the application of the policies and the high-quality development of the logistics sector. Further empirical research has shown that upgrading and transforming the secondary industrial industry (an industrial activity that converts raw materials into commodities and products) requires simultaneous expansion in the logistics sector.

What this means for logistics real estate is that success in enhancing the development of the European semiconductor industry will not just drive logistics occupier demand but may be reliant on adequate development of logistics itself. One factor in this is technological innovation within the logistics industry, but at a basic level increasing the volume of goods moving through the economy will inevitably require greater real estate footprints. In the context of acute shortages in the supply of suitable logistics buildings and land in recent years, it is clear that a secular increase in demand will put further pressure on supply. From a policymaker’s perspective, it’s imperative that the supply of logistics space can adequately service the manufacturing output that they aim to stimulate.

INTERNATIONAL EXAMPLES

A burgeoning semiconductor industry would drive logistics demand through channels beyond the movement of manufacturing output. Stimulating the industry would drive employment growth in the regions where fabs or research labs are built.

These jobs would, in turn, drive residential demand and, thus, consumer demand. The supply chain-related chaos during the pandemic has made it increasingly clear that logistics space can be considered a form of infrastructure. Without adequate space, it becomes more challenging to supply goods to consumers in a timely or cost-effective manner. Thus, a sudden influx of new households in an area will need a corresponding increase in logistics space to service the resulting consumer demand.

On an international level, there are a plethora of examples of this effect. In Arizona, where Taiwan Semiconductor Manufacturing Company (TSMC) has announced the construction of a new $40bn plant in Northern Phoenix, property prices have surged amidst rising demand.

The site employs 9,000 construction workers, and 600 ‘seed’ engineers were sent from Taiwan, with 600 additional engineers already in training. These engineers crucially also bring their families with them, driving population growth. TSMC has said that the Arizona plant will create 4,500 jobs directly, and they expect the plant will indirectly create an additional 10,000 supply chain-related jobs.

American firm Intel, also present in Arizona, has invested close to $32bn since 1979 and is investing a further $20bn to build two new fabs. Intel estimates they have created 58,600 jobs for the local economy and directly or indirectly support more than 700,000 full-time and part-time jobs in the US – counting for 0.5% of US GDP. In Ireland, Intel has invested more than €17bn to build a fab in Leixlip, bringing the company’s total investment into Ireland to €30bn. The new fab will employ 1,600 new roles directly and has supported more than 5,000 construction jobs over the past three years, boosting economic demand. In mainland Europe, Intel plans to invest a further €17bn in Germany, creating 3,000 permanent high-tech jobs at Intel and ‘tens of thousands of additional jobs across suppliers and partners and has further investment plans in France, Germany, Italy, Poland and Spain. The company plans to invest €80bn in the EU over the next decade along the entire value chain (R&D, Manufacturing, Advanced Packaging).

Read the articles within Spotlight: Semiconductors and the logistics sector below.

.jpg)