The semiconductor shortage, aka 'chip shortage', experienced in 2021 and 2022 has been primarily attributed to a combination of factors that disrupted the global supply chain and increased demand for semiconductors

The semiconductor shortage

The Covid-19 pandemic played a significant role in creating this disruption. With more people relying on electronic devices and technologies during lockdowns, the demand for laptops, smartphones, gaming consoles, and home appliances surged. This sudden increase in demand led to a higher need for semiconductors.

The automotive industry was particularly impacted by the pandemic. Many car manufacturers temporarily shut down production as the pandemic spread. However, when the demand for vehicles rebounded faster than anticipated, manufacturers struggled to keep up with the sudden surge in orders for automotive semiconductors. This increased demand from the automotive sector further exacerbated the supply-demand imbalance.

The pandemic also disrupted global supply chains, creating significant challenges for semiconductor production and delivery. Factory shutdowns, logistical issues, and reduced production capacity due to Covid-19 safety measures increased lead times for semiconductors. The highly complex fabrication processes in semiconductor manufacturing require specialised equipment and facilities, and increasing production capacity takes time and substantial investment. The sudden surge in demand outpaced the available manufacturing capacity, resulting in supply shortages.

The semiconductor industry relies on a complex network of suppliers, including raw materials, equipment, and packaging providers

Andrew Blennerhassett, UK & EMEA Logistics Research Analyst

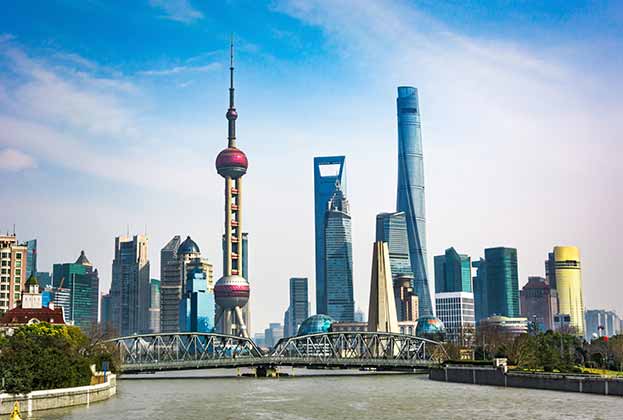

The concentration of semiconductor manufacturing in certain regions, particularly East Asia, contributed to vulnerabilities in the supply chain. Disruptions, such as factory closures and trade restrictions, in these regions, had a ripple effect on the global supply of semiconductors. On top of this, trade tensions and geopolitical issues between major economies, such as the U.S. and China, impacted the semiconductor supply chain.

The semiconductor industry relies on a complex network of suppliers, including raw materials, equipment, and packaging providers. Disruptions at any point in this network can significantly impact the production and supply of semiconductors globally.

The start of 2023 has seen many of these trends reverse

Central Banks have responded to high inflation rates by hiking interest rates, reducing business activity. At the same time, household consumption slowed in the face of a cost-of-living crisis, reducing demand for electrical goods and cars. One positive impact of the economic slowdown has been reduced demand for international freight, allowing the supply chains to recover from the pandemic-era turmoil.

These developments have reduced the strain on semiconductor supply, allowing it to catch up with demand. Simultaneously, semiconductor demand declined in the first half of 2023, but this is likely to be a short-lived trend. Megatrends that include AI, electric vehicles, cloud computing, automation in manufacturing and logistics, the Internet of Things (IoT) and other cutting-edge emerging technologies like AR/VR, quantum computing and 6G network connections will fuel a sharp rise in semiconductor demand.

What’s involved in producing semiconductors?

Semiconductor production has two key areas of focus: Research and Development (R&D) and Fabrication. Both processes have highly intensive capital and labour requirements, with the fabrication of semiconductors being an order of magnitude more intensive in terms of capital requirements. The fabrication process has become dominated by South-East Asian economies. Recent policy changes enacted by the USA, UK and EU primarily focus on stimulating growth in the fabrication of chips.

Attracting fabs, which can produce semiconductors at scale, is the biggest challenge facing the EU and other Western economies. Build costs have risen sharply across all real estate sectors in recent years, and semiconductor fabs have been no exception.

The design of fabs is unique to individual producers and extremely capital-intensive. Furthermore, the energy requirements of the fabs are similarly intensive, with fabs in China reportedly requiring between 30–50MW at peak usage – equivalent to 30,000 to 50,000 residential homes. Given the power-related planning constraints across Europe in recent years, which Savills has noted in recent reports, this is another hurdle for policymakers and semiconductor producers to overcome.

In addition to large initial capital requirements, semiconductor fabrication is highly dependent on the availability of skilled labour. Despite technology and automation playing a significant part in manufacturing processes, a heavy reliance on educated employees to operate complicated equipment is currently unavoidable. To complicate matters further, the technology involved is evolving rapidly, and firms must compete to hire from a shallow labour pool qualified to operate it.

One of the driving forces in the rise of Asia’s semiconductor industries has been a competitive advantage in labour costs. While this disparity has eroded as incomes have risen in these markets, it has left Europe facing an uphill battle to regain lost market share. Indeed, with Western economies already struggling with tight labour markets, government policy will need to smooth this skill gap to make locating in their markets more viable.

Geographical breakdown

Over the last 30 years, the geographic breakdown of semiconductor manufacturing and production has undergone significant changes. One of the most prominent of which has been the aforementioned rise of Asia, with Taiwan, South Korea and China becoming dominant players.

Taiwan has become the lynchpin of the semiconductor market and is home to well-established semiconductor companies, the most notable of which is the Taiwan Semiconductor Manufacturing Company (TSMC).

Taiwan’s rise to dominance has led to deep dependence on the island, even as geo-political tensions in the region have led to analysts questioning the long-term reliability of supply.

South Korea has also established itself as a leader in memory chip production, with domestic producers such as Samsung and SK Hynix playing a significant role in global supply. China has intensified efforts to reduce its reliance on imported chips through its 'Made in China 2025' policy, investing heavily in manufacturing facilities. China faces key technical challenges but has made significant strides in catching up with its competitors.

North America continues to play a significant part in the semiconductor production ecosystem, with major companies like Intel, Qualcomm and Nvidia, all well-regarded for design capabilities, located there. Europe has seen its share of manufacturing slip as Asia’s has risen. Europe’s R&D expertise has proven to be a bulwark for the industry, but it has struggled to compete with Asia on production costs.

Notably, this growth has come at the expense of other Asia Pacific producers whose shares have fallen from 35% to 26%. China’s rise suggests a degree of success in their targeted policies over the last decade, which shows that well-thought-out government intervention can be highly effective in supporting domestic production.

Read the articles within Spotlight: Semiconductors and the logistics sector below.