Key Points

€27.3 BILLION invested in H1 2022

The first half of 2022 saw over €27 billion invested in Multifamily across Europe, the highest H1 investment volume on record.

This has been driven by marked increases in investment in the UK, France and Spain, which saw volumes up by 43%, 31% and 48% respectively compared with the same period in 2021. However, the current macro-economic backdrop is likely to cause a lull in activity through Q3. Nevertheless we expect that, as the market adjusts to these new dynamics, investment activity will pick up again, with strong underlying demand fundamentals supporting a resurgence in activity towards the end of this year.

42% RISE in average rents in Berlin over the past five years

There is a supply and demand imbalance across many European cities, which has led to significant rental growth over recent years. Affordability, as a result, has worsened.

In Spain, over a fifth of renters now spend more than 40% of their income on rent. In response, the potential for rent control regulation has risen up the political agenda. The current economic uncertainty, paired with the possibility of changing regulations, may act as a barrier to investors.

200 BPS RISE in 5-year Euro swap rates between January and August 2022

Inflation is running at multi-decade highs, resulting in hawkish macroeconomic policy and a rise in the cost of debt.

The quoted rate for a 5-year Euro swap has risen from negative territory at the end of 2021 to 1.99% towards the end of August, leaving lower-yielding countries more exposed as debt costs surpass entry yields. Additionally, it has become more challenging to borrow at similar loan to value and loan to cost levels, affecting funding for new developments. However, the strong underlying supply and demand imbalance found in many markets, combined with strong rental growth outlook, will support the Multifamily sector compared with other real estate asset classes.

10-16% annual rise in build costs

During the last 12 months, residential construction costs have skyrocketed. Following years where cost inflation averaged between 1% and 2.5% pa, prices across Europe are now between 10% and 16% higher than they were only a year ago.

Pandemic-driven supply chain issues and increasing energy costs are driving this and as a result, some investors are pausing consideration of new developments. At the same time, we are understandably seeing an increased appetite for operational or nearly completed stock which carries less risk.

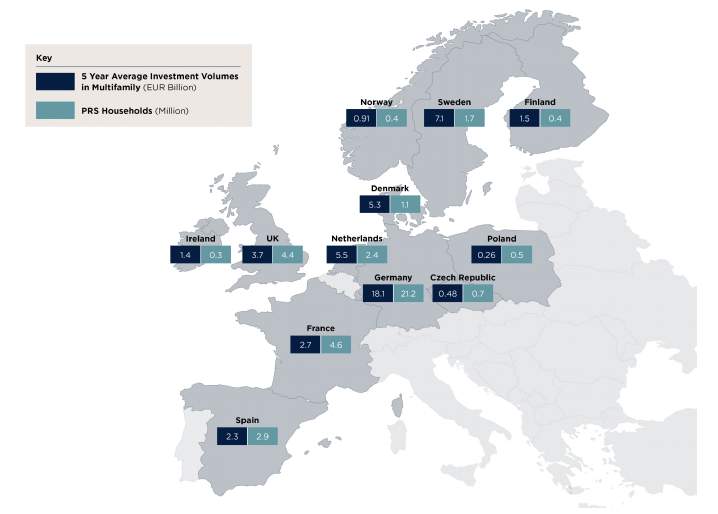

European Multifamily in context

What is Multifamily

Multifamily refers to purpose built, professionally managed blocks of flats for rent, owned by single investors. Although schemes vary by market, they typically include a wide range of amenities and offer renters a high quality service.

Why Multifamily

Demand for high quality rental accommodation is increasing across Europe, driven by rising house prices, urbanisation and changing consumer preferences. Furthermore, Multifamily is one of the few asset classes where landlords are able to regularly rebase rents to capture growth, driving strong income returns.

A robust start to the year, despite macro-economic challenges

During the first half of 2022, there was a major shift in the economic and geopolitical backdrop across Europe. European economies have been battling soaring inflation, which is now at multi-decade highs, driven by global supply chain problems and rising energy costs. Exacerbated by Russia’s invasion of Ukraine and renewed Covid-19 lockdowns in China, there has been a huge impact on the supply and cost of natural gas and oil.

As a result, we have seen a marked shift in monetary policy. The Bank of England has raised interest rates to 1.75%, their highest level since 2008, and the European Central Bank has also raised rates for the first time in 11 years. Five-year Euro swap rates have increased by over 198bps since the start of the year - underpinning a repricing of debt.

Against this backdrop, we saw the strongest H1 for investment in Multifamily on record, with over €27 billion deployed across Europe.

Nonetheless, there was a slowdown in Q2 compared to last year, as investment volumes dropped 9% to c.€11.5 billion, indicating that the macro-economic backdrop could be beginning to affect the sector.

Interestingly however, the fall in investment activity in Q2 was not evenly spread across Europe. Our data suggest that it has been driven by a drop in activity in Germany, Ireland, the Netherlands and Sweden. However, other markets such as the UK, Spain, and Denmark saw investment activity increase compared with the same period last year.

Cross-border investors remain dominant

According to the latest data from RCA, cross-border investors continue to be the largest Multifamily investors, accounting for 40% of capital invested so far in 2022. This falls in line with their average of the past five years (41%).

There has been a marked rise in activity by Private Equity Funds and Institutions, which accounted for over a third of capital invested so far this year, compared with only 18% in 2021. This has come at the expense of Listed Companies and REITs, which saw their share of investment fall from 28% in 2021 to only 2% this year.

We expect that the level of cross-border investment will remain high over the next couple of years, as investors seek higher-yielding opportunities outside of the more established Multifamily markets. We should also see increased activity from Institutional Investors, aiming to increase their exposure to Residential, as an inflationary hedge. Illustrating this point, a recent survey of Korean investors found that 62% wanted to increase their exposure to Residential.

Yields remain stable in most markets

It has been a mixed picture for Multifamily yields across Europe in H1 2022.

In some markets, such as France, Ireland, Germany and Sweden, yields have remained stable. In Germany, this has been due to continued demand from equity-rich investors, which has underpinned yield performance.

Meanwhile in the UK, yields have hardened slightly, as the sector matures and early investments outperform their initial underwrites, driving increased investor appetite.

But in other markets, such as Amsterdam, Madrid and Oslo, yields have moved out slightly, rising by 25bps, 15bps, and 10bps respectively in Q2.

We expect more markets could see yields soften as we continue to move through the year.

For buyers using significant levels of debt, rising borrowing costs will lead to an effectively negative leverage effect in, for example, Germany and the Netherlands, in view of the very low initial level of residential yields. This is likely to continue to dampen activity in these locations in the short term.

Investor appetite still strong, but headwinds likely to cause a short-term lull in activity

With the current economic and political uncertainty, we are seeing a more cautious approach from investors.

Highly leveraged investors have temporarily withdrawn from the market, waiting to see what happens over the next few months with interest rates, inflation and build costs.

Others remain active, although some are taking longer to scrutinise deals before completing. The net effect is likely to be a drag on total transactional activity during Q3.

Nevertheless, we expect that as markets adjust to the new dynamics, investment activity will pick up again towards the end of the year. Appetite for Multifamily remains extremely strong and many investors still have dry powder they need to deploy.

Strong rental growth, but it’s arguably stretching affordability

Across much of Europe there is a significant imbalance between the demand for housing and the level of supply. This mismatch is putting upward pressure on rents. For example, in Berlin rents have risen by 42% over the past 5 years, with Copenhagen, Dublin, Lisbon and Stockholm also recording growth of over 20%.

As a result, affordability is worsening for many living in the Private Rented Sector (PRS).

Latest figures show that the proportion of those having to spend more than 40% of their disposable income on rent has risen to around a quarter in the UK and over 20% in Norway, Spain, and Finland.

Furthermore, there is growing concern among younger households about the ability to access housing. The 2020 OECD Risks That Matter survey shows that across all of Europe those aged 18-29 have a greater concern about accessing adequate housing than the population as a whole.

Some Governments are considering rent regulations

Public dissatisfaction with rising rental costs has prompted some governments to consider tighter regulation in an attempt to control rental inflation. However, this can be a double-edged sword, with the uncertainty causing investors to pause investment until they have clarity on regulation.

The impact on investors varies depending on the type of regulation. If growth in rents is limited, but still linked to inflation, then the attraction of residential as an inflation hedge remains. However, if instead the regulation sets out to cap rental growth without recourse to inflation levels, then it can quickly erode the benefits of investing and dampen investment.

Spain is a good example, as after Catalonia passed rent control legislation in 2020 (later struck down) Spain’s new Housing Law is introducing the mechanism nationwide. The legislation will allow stressed markets - those which have seen very strong rental growth, to impose caps on rents for large landlords (those with more than 10 properties), which could result in rents being reduced to meet the new caps.

The Dutch government announced in early May that it will introduce restrictions to part of the open market sector, and extended the WWS points system to apply to properties with a starting rent of €1,000 or €1,250 per month. This previously only applied to rents of below €752 per month (in 2021).

Although the exact regulations have not yet been set in stone, it has created uncertainty for investors and so is likely to dampen activity over the coming months. The government has also proposed increasing the transfer tax from 8% to 10.1%, which would be the second increase in 18 months.

By contrast, the ability of investors to use indexation in rental contracts on newly built stock in Germany has resulted in an increase in the proportion of capital being invested in funding new developments. In the first half of 2022, this accounted for 43% of the total volumes, despite higher construction costs, which is far above the last five-years’ average of 23%.

A major challenge for investors is uncertainty and the inability to accurately anticipate the rules under which they will be operating. This serves as a barrier to many investors engaging in a particular market, especially when there are opportunities elsewhere with more stable regulations. Therefore, we are likely to see continued strong investor activity in markets with more stable regulatory environments.

Europe needs significant investment in energy efficiency

The need to tackle climate change is now front and centre for European governments. In July 2021, the European Climate Law came into force, which enshrined the goal for the EU to become climate-neutral by 2050. Alongside that, the EU introduced an intermediate target to reduce net greenhouse emissions by at least 55% by 2030, compared to 1990 levels.

It is clear that “greening” the built environment has a critical role to play in achieving these aims.

The latest estimate is that existing buildings account for 36% of total greenhouse gas emissions across the EU, according to the European Commission.

To achieve the intermediate goal, greenhouse gas emissions from buildings will need to be reduced by 60% compared to 2015, alongside increasing the annual renovation to 3% of total stock, up from 0.2% currently, according to the Buildings Performance Institute Europe.

Widespread use of Energy Performance Certificates, but a lack of minimum standards for leasing

A key policy instrument available to EU governments is the use of Energy Performance Certificates (EPCs). These were first introduced in 2002 and have been widely adopted.

Despite their existence, there are very few examples of legislation that set out minimum EPC requirements for the sale or leasing of residential property.

This is due to change - in December 2021, draft EU regulations were published that would, for the first time, set out minimum EPC standards, requiring that all buildings meet EPC F by 2030 in order to be sold or rented out, rising to EPC E by 2033.

Old stock will require significant investment to meet the new proposed standards

Current estimates are that around 35% of residential stock in the EU is over 50 years old, with three quarters being energy inefficient. This presents a significant challenge to meeting the proposed minimum EPC requirements.

Between 2012 and 2016, the European Commission estimates that an average of €127 bn per annum was invested across the EU on energy improvement. However, to reach the emission reduction target by 2030, this would have to rise by an additional €275bn per annum.

Regulatory tightening will present challenges and opportunities

The scale of the challenge, alongside the proposed EU legislation, increases the likelihood of governments tightening regulations. We have already seen the Dutch government introduce rules in 2018 that offices have to meet EPC C by next year in order to be let. It is not a stretch to envisage similar rules coming forward for homes.

While this does present a challenge, it would also create opportunities. Investors with greater risk appetite could acquire ageing stock from landlords who are unable or unwilling to invest, refurbish and reposition to meet new standards. Not only is this an opportunity to create significant value but it would also allow investors to meet their objectives for the ‘E’ in ESG.

At the same time the value of stock delivered in recent years that already meets the new standards will be driven higher as competition for the most efficient stock intensifies. We expect that this will drive some investors to continue fund new developments, with a keen eye on driving energy efficiency above and beyond current requirements. Examples of this are the recently launched Industria fund (see below), which will focus on investing in newly developed highly energy-efficient stock across Germany, and Catella’s Energy Positive Residential Impact Fund.

The changing economic backdrop is pushing up the cost of debt

Inflation soared across Europe during the first half of 2022, as economies emerged from Covid-19 pandemic lockdowns, the economic effects of which have been exacerbated by the war in Ukraine.

The latest figures from Eurostat show that in July the Harmonised Index of Consumer Prices (HICP) reached 8.9% for the Eurozone - the highest level on record. Rates surged even higher than this in the Netherlands (11.6%), Spain (10.7%), and Ireland (9.6%).

As a result there has been a marked shift in rhetoric from the European Central Bank (ECB). At their meeting in July, the bank raised rates by 50bps, the first time it has done so in 11 years, and with further increases on the horizon.

At the Governing Council’s upcoming meetings, further normalisation of interest rates will be appropriate. The frontloading today of the exit from negative interest rates allows the Governing Council to make a transition to a meeting-by-meeting approach to interest rate decisions.

ECB Monetary Decisions Press Release, 21 July 2022

Rising interest rates increasing pressure on yields

This follows similar actions from the Federal Reserve Bank, which has increased rates to 2.25% to 2.50%, and the Bank of England, which has raised rates at each of the last six meetings. The UK base rate is now 1.75%, its highest level since December 2008. Rising rates have put upward pressure on bond yields, which has underpinned a rapid repricing of debt across Europe.

The five-year swap rates for both the Euro and the Pound rose by over 200bps between the end of 2021 and their recent peaks in mid-June.

While there are some markets where lenders have accepted modest margin compression, such as Madrid and Lisbon, margins in the majority of markets have remained stable or moved out slightly - directly adding to investors’ cost of debt.

While the increased cost of borrowing is impacting all property sectors, Multifamily is well placed to weather the rise. The supply and demand imbalance facing a number of markets across Europe means that the sector is still seeing strong rental growth, and it is one of the few sectors where landlords are able to regularly rebase rents to capture growth.

So far, pricing is holding up in most markets, although transactional activity is tailing off in some. This was particularly evident in Germany, where Q2 saw the lowest activity level since 2010, with only 43 transactions.

It is likely that yields will move out in certain markets as a result of the weaker macro-economic conditions, as sellers accept that pricing has to soften in order to attract buyers back to the market. But, this isn’t expected to be universal across Europe. In certain markets, such as the UK, the level of competition for limited opportunities will support yields.

Even in markets where yields are likely to move out, we are not expecting a significant correction, as there remains a substantial weight of capital looking to enter the sector. The main outcome is likely to be a challenging Q3, but with the strong underlying demand fundamentals supporting a resurgence in activity towards the end of the year.

Rising build costs present a further headwind for the sector

Alongside the challenge of increasing debt costs, the sector faces further headwinds from rising construction costs. In the two years prior to Covid-19, build costs rose at an average annual rate of between 0.8% (Italy) and 2.5% (Netherlands and Austria) for countries in western and southern Europe.

In early to mid-2020, construction costs growth slowed, and costs in markets such as Spain and Finland even fell, as Covid-19 resulted in widespread lockdowns and slowed demand for new construction. However, this was short-lived and by early 2021 costs started to climb again, reaching close to 13% in both Spain and Austria by the end of the year.

This was caused by the rising cost of energy, which pushed up the cost of materials such as steel, combined with supply chains that are struggling to recover from pandemic-induced delays. In recent months, the impacts of Russia’s invasion of Ukraine further exacerbated these issues - pushing input prices up by 24% year on year in Norway and Austria and by 16% in Spain.

As a result, construction costs have continued to move upwards, reaching 16.0% annual growth to April 2022 in Austria, 14.3% in Portugal, and 11.1% in the Netherlands.

Labour costs remain subdued in comparison. The latest figures show that these have only risen by 3.4% over the past 12 months in Norway, 4.5% in Portugal, and 1.5% in the Netherlands. This provides some hope that, as supply chain issues are resolved and material costs start to ease, we could see overall construction costs come back down.

CONCLUSIONS

The knock-on effects of rising debt and construction costs have given some investors pause for thought in terms of progressing with new forward funding deals in certain markets.

There are exceptions to this, for instance in the UK where funding remains the primary route to market. Investors there are focused on creating new purpose built stock that meets their ESG requirements and they can capture a higher return through development.

A key factor in these deals is partnering with best-in-class developers who can help manage and mitigate construction cost risks.

In most markets we’re seeing increased interest in operational assets. These provide investors with income from day one and avoid construction risk. However, perhaps unsurprisingly we are seeing greater competition and keener pricing for the best operational assets.

The supply and demand imbalance facing a number of markets across Europe means that the sector is still seeing strong rental growth.

The ability to regularly rebase rents to capture growth in many markets means Multifamily is well placed to weather current high inflation.

Greater focus on reducing carbon emissions and improving energy efficiency presents both challenges and opportunities for the sector, especially given the significant investment needed to ensure homes meet tightening regulations.

Overall, the strong fundamentals of the sector and sheer weight of capital looking to deploy into Multifamily will underpin continued activity, despite the current headwinds.