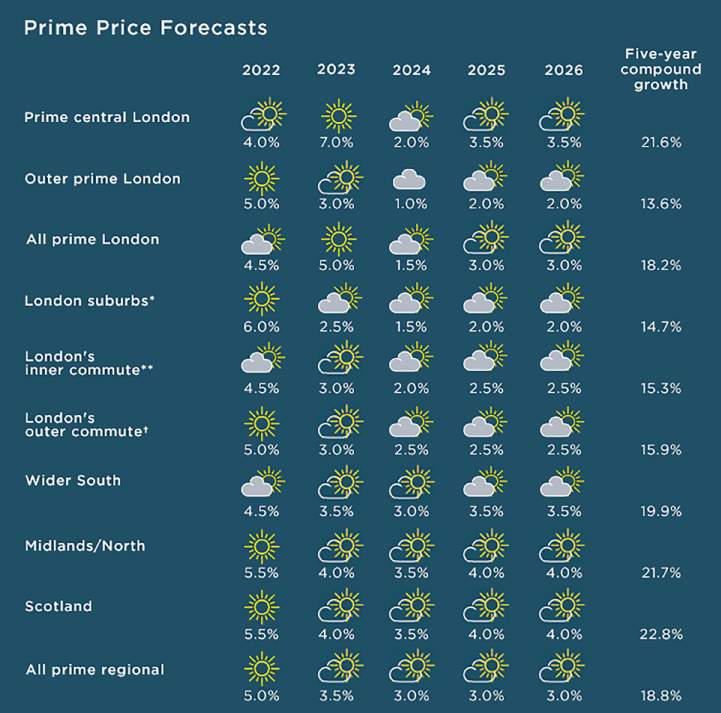

Prime central London set to outpace best performing lockdown markets over the next five years but North of England and Scotland still expected to be the strongest performers across the regional markets.

PRIME CENTRAL LONDON

Some caution remains, but central London’s recovery is underway

Activity levels so far this year have been exceptionally strong in the prime central London market, with £5m+ sales seeing their strongest ever half year. But the war in Ukraine and domestic political instability have caused a degree of caution, which has so far constrained price growth this year.

The catalyst for a more significant recovery is particularly reliant on the pace of return of international buyers.

Overall, the relative value on offer and the prospects for global wealth generation – fuelled in particular by growth in the technology and life sciences sectors – give us confidence for prime central London’s outlook.

Values remain 18% below their 2014 peak, so there continues to be an opportunity for buyers. This is especially true for those buying in foreign currencies, given the devaluation of sterling.

We anticipate more significant levels of growth in 2023, compared to this year. We also expect any recovery to be interrupted by the planned general election in 2024, which could temporarily dampen demand

Frances McDonald, Associate Director, Residential Research

However, until high net worth foreign investors return in their pre-pandemic numbers, we can expect prices to continue to recover at a slow and steady pace rather than with a sharp uptick.

And so we anticipate more significant levels of growth in 2023 compared to this year. We also expect any recovery to be interrupted by the planned general election in 2024, which could temporarily dampen demand.

Requirements to register beneficial ownership of homes held in offshore corporate vehicles could impact on longer-term demand levels and temper the desirability of London as a safe haven for super prime property investment amongst a limited number of buyers.

That being said, historically, offshore corporate vehicles have been used to hold UK property for many different reasons, but the tax benefits of doing so have largely passed and, for many, the anonymity they provided was a convenience rather than a necessity. Accordingly, we have only slightly reduced our outlook for prices over the next five years as a whole despite changing the pattern of anticipated growth.

OUTER PRIME LONDON

Cost of living pressures will begin to squeeze in outer prime London

Beyond central London there continues to be unmet demand from those looking to upsize, and a lack of suitable stock will continue to support prices in the short term despite increases in the cost of debt.

Typically, the top end of the market is less reliant on borrowing than the mainstream, reducing its exposure to further rate rises. However, it is not completely immune to these pressures, and so we expect to see increasing price sensitivity creep into the market over the remainder of the year.

Over the medium term, we expect to see demand supported by the return of workers to the capital. Even with hybrid working becoming more conventional, workers still want to be close to the office, and some of those who bought a home in the country during the pandemic are realising the need for a pied-à-terre, further supporting demand for flats.

From 2023 onwards, we are forecasting slightly lower levels of price growth with rising pressure on buyers’ spending power, though the effect of earlier than expected interest rate rises is likely to be offset by an easing in mortgage regulation and an increased flow of capital coming out of central London.

PRIME REGIONAL

Stock shortage overhang will continue to drive prime regional price growth

Following two years of unprecedented growth, the prime regional markets have started to readjust and price growth is slowing.

Activity at the top end of the market continues to be strong and there remains an imbalance between supply and demand across much of the market. This will continue to support reduced price growth in the immediate future, even though increasing interest rates, the rising cost of living and geopolitical uncertainty are beginning to impact buyers’ confidence and spending power.

How much buyer budgets change over the remainder of this year will largely depend on further interest rate rises. This will have a more significant impact on markets which typically take on more debt. While higher levels of disposable income means buyers are more insulated against economic pressures, any change in sentiment across the wider mainstream housing market does have capacity to feed up into higher price bands.

As a result, we are likely to see a continued slowdown in growth towards the end of this year and realistic pricing will once more become all-important. This will be particularly true for markets which have seen the strongest growth since the start of the pandemic, namely London’s suburbs and the coastal and rural markets in the south of England.

Longer term, the value gap between the prime markets of Scotland, and the Midlands and North of England, when compared to those in the South, means there’s more capacity for growth in the former regions. As such, these markets are expected to be the strongest performing regions over the next five years.

Sources: Savills Research | Note: *Within the M25 **Within a 30-minute commute †Within a one-hour commute. These forecasts apply to average prices in the second-hand market. New build values may not move at the same rate

Click here to read our UK mainstream residential property forecasts