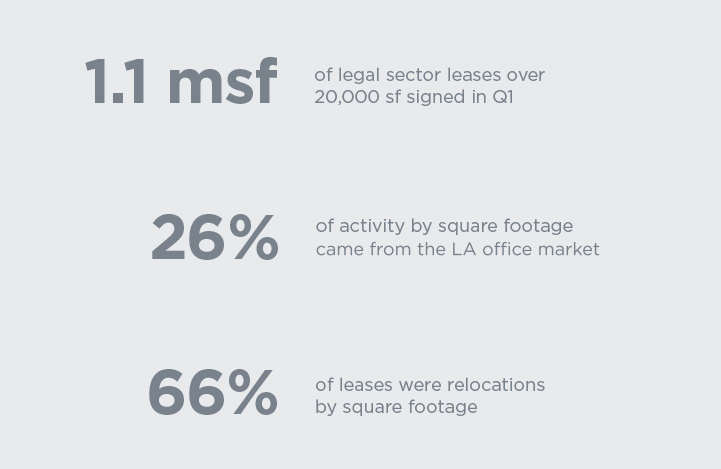

The Legal Tenant analyzed law firm transactions over 20,000 square feet (sf) across key U.S. markets and found, as is typical of most first quarters, the pace of office leasing slowed at the start of the new year. While still well-above the lows seen earlier on in the pandemic, leasing volume within the legal sector was relatively tepid at 1.1 million square feet (msf) compared to the last two quarters which were well above 1.5 msf each.

Los Angeles saw the most demand in Q1 with seven transactions completed, accounting for 26% of national law firm leasing activity (by square footage). In 2020 and 2021, LA placed fourth behind New York, Chicago and Washington, D.C. for total leasing volume, so this marked a sizeable return in law firm demand for the market.

66% of all law firm leases signed in the quarter were relocations by square footage. Relocations dropped off during the pandemic when firms shifted heavily towards renewals. As pandemic uncertainty recedes, law firms are becoming increasingly more confident about taking advantage of soft market conditions and relocating, often into newer, higher-quality spaces.

By the Numbers

For the first time throughout the pandemic, there was not a single law firm lease signed for over 100,000 sf in Q1. The largest transaction of the quarter was completed by Foley & Lardner LLP in a renewal at 3000 K Street NW in Washington, DC for 95,000 sf. Nearly two decades ago, the firm was in over double that amount of space in the same building, reducing their footprint over time by giving back space they didn't need and extending what they did. There may be fewer leases over the 100,000-sf threshold in the future as the square foot per attorney ratio shrinks.

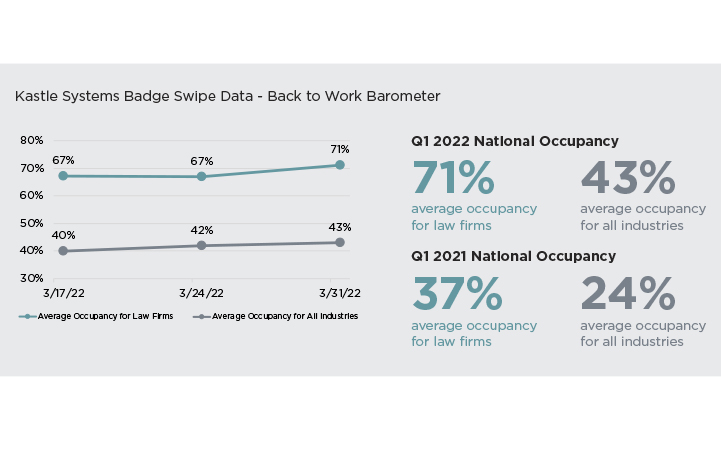

Legal sector occupancy outpaces all other industries in the return to the office

Law firm employees are returning to the physical workplace almost 30% more than other sectors according to data collected by Kastle Systems. While many firms are adopting more remote work flexibility, coming into the office allows for more mentorship opportunities, collaboration, and cultural growth.

As the number of workers returning to the office continues to increase, leasing activity will likely follow suit, and firms are expected to focus on how their leasing decisions will entice employees back to the office.

As activity rises, options are already beginning to dwindle in prime properties within key talent locations, and best-in-class space is seeing an increase in pricing.