Prime London rental market experiences double-digit annual rental growth for the first time in over a decade. The return of office workers, international students and corporate relocation has seen demand for rental properties rocket over the past few months. Coupled with some landlords selling up in the face of regulatory changes and an improving sales market, the lack of stock is stark, pushing up competition and prices across the board.

Jessica Tomlinson

- Double-digit rental growth for prime London as it catches up with the country

- Local variation across prime rental markets

- Flats make comeback in the capital, family houses hold sway in the country

- Available rental stock continues to decline

- A city story – but it’s not just the capital

- Outlook and forecasts for the prime rental market

Average rental values for prime properties across London increased by 3.4% over the first three months of 2022, with annual growth reaching a high of 11.1%. This is the first time in over a decade the prime London rental market has seen double-digit rental growth.

The past 12 months’ performance is in stark contrast to the same period to March 2021 when prime rents in London experienced falls due to the pandemic. The strong rebound seen over recent months means rental values of prime properties across London are now 5.0% above where they were pre-pandemic on average; though this varies considerably by property type and location.

Meanwhile, the growth in rental values of prime homes across the commuter belt eased slightly to 7.7% in the year to March 2022. Nonetheless, given the consistent strong market of the past two- years, rents here have increased by an average of 13.1% since the first lockdown.

Over the past 12 months the strongest performers across all markets has been the North and East, and prime central London, whose markets were initially most severely impacted by the pandemic. Here, annual increases have been supported by two consecutive quarters of particularly strong rental growth, as demand has bounced back to leave a shortage of stock available on the open market. This said, over the past two-years South West London, with its strong family house market, remains the top-performer in the capital with total rental growth of 10.3% over this period.

Beyond London, some locations, such as Rickmansworth and Guildford, have experienced less frenzied demand. However, Sevenoaks, Weybridge and Tunbridge Wells all saw rental growth above 4.0%, due to a combination of a return in corporate demand and an acute lack of available rental stock.

From the second half of 2021 we have seen a return in key tenant groups back to the capital, particularly young professionals, students and corporate relocators. As such, rental values of flats have seen a significant recovery, with annual rental growth of 11.7% on the back of a 3.4% increase over the first three months of this year.

This means rents of prime flats across London are now 2.1% above March 2020. By contrast rents for houses are now 9.0% above that pre-pandemic base; having risen by 10.2% in the past year as the race for space has continued to underpin demand for larger homes.

In comparison, rental growth of houses continues to outpace that of flats in the commuter zone. This reflects the underlying depth of demand from families looking to rent within a striking distance of London, which continues to be supplemented by those accidental tenants unable to buy in an incredibly competitive sales market in the country.

A key driver of rental growth over the first quarter is a continued lack of stock. 64% of Savills agents surveyed reported that stock levels had fallen in the first three months of 2022, with almost half of London agents (44%) stating that it had fallen significantly. This tallies with the latest figures from data provider TwentyCi, which shows that the number of properties available to rent in the capital is down 44% on last year, and 25% on the pre-pandemic norm.

With some landlords selling up in the face of regulatory changes, there is strong competition for that stock which is available across the board. Indeed, the number of new applicants per available property so far in 2022 remain at high levels, with 6.9 in London and 8.3 across the country markets. Both are well above the 2019 average.

Given the strong competition, our agent’s estimate that a third (33%) of deals have resulted in competitive bidding over the last quarter. While some tenants have widened their search criteria, with an estimated 36% of tenants looking across multiple locations in order to secure a property.

Over the next three months, 43% of Savills offices expect that stock levels will begin to increase, though not significantly. This suggests that it is unlikely we will see the imbalance between supply and demand change significantly over the short-term at least.

As we have seen a return to the office, the priorities of many tenants have shifted back to pre-pandemic norms.

Proximity to a train or tube station was the top priority for London tenants over the first quarter of this year, with accessibility to their place of work coming in third.

Across the commuter belt, urban areas are now driving rental growth. Over the 12 months to March 2022 rental values in cities and towns have increased by 8.4% and 8.7% respectively. That compares to annual growth of 6.5% for rural locations and 5.5% for villages.

This characterises the shift in demand back to more urban areas, as many tenants are drawn back to the convenience of transport links and local amenities. Although, schools was ranked as the top priority for tenants across the commuter belt, proximity to train or tube and place of work ranked second and third.

Across London we anticipate rental values to continue to increase over 2022, further supported by strong wage growth in a fluid employment market.

In the commuter belt we expect rental growth to continue to ease as the pandemic induced drivers of demand ease and stock gradually begins to return to the rental market.

We are not yet seeing any impact from the cost of living crisis, with two-thirds of agents (66%) agreeing that it has not yet had any impact on tenant budgets. However, affordability will inevitably be squeezed in the coming months, especially among younger tenants for whom increases in energy and other costs typically take up a higher proportion of earnings.

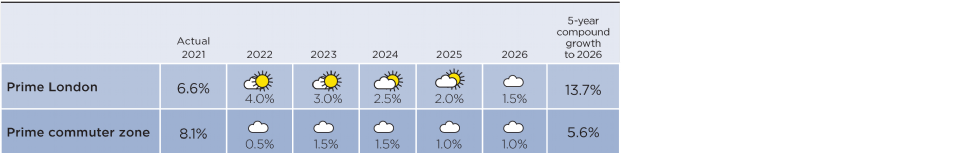

Prime rental forecasts

Source: Savills Research

Note These forecasts apply to average rents in the second-hand market. New build rental values may not move at the same rate.

< View our latest Q1 2022 updates here.

For more information, please contact your nearest Lettings office or arrange a market appraisal with one of our local experts.

.jpg)