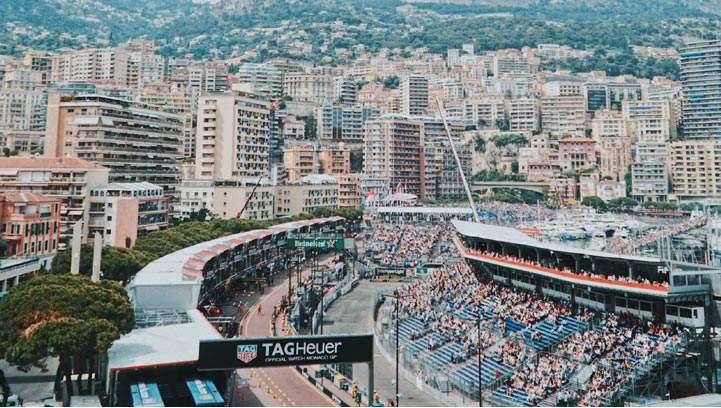

Monaco property market reaches new highs as Principality continues its Covid-19 recovery

Reaching new highs

Average prices in the Principality have topped €50,000 per square metre for the first time

As the world learns to live with Covid-19, business continues apace in Monaco. The Principality has managed the pandemic well, and at the time of writing, has begun to ease its health measures in concert with falling infection rates. This has contributed to a bumper year for the property market within the Principality, with the perceived stability boosting desirability and pushing prices to all-time highs.

For the first time the average property price in the Principality has crossed the €50,000 per square metre threshold, firmly cementing Monaco as the most expensive location to purchase residential property globally. This is a 9% increase from 2020 and a 74% increase over the decade.

The increase in prices across Monaco was buoyed by a 7% increase in transactions over 2021, with 440 properties sold. However, the number of transactions across the Principality remains 30% below 2019 volumes. While the majority (57%) of the transaction volumes were comprised of studios and one-bedroom apartments, properties with four or more bedrooms saw a 42% increase in transactions from 2020 to 2021. This increase reflects the global trend in buyers searching for more space, even in space-constrained locations like Monaco.

This trend can also be seen when examining residential transactions by price point across Monaco. Transactions for properties between €5m and €10m increased by 38% from 2020, while transactions below the €5m price point only grew by 2% year on year. Properties in the €5m–€10m range tend to be larger sized. At the top of the market, transactions for properties priced above €10m fell by 14% from 2020; however, this fall is directly related to a lack of supply rather than a lack of demand.

Half of the districts across Monaco saw transaction volumes increase year on year. Promisingly, each of the districts with positive transaction growth saw the number of transactions increase from 2020 volumes between 13% to 71%.

La Condamine saw the highest increase in transactions, up by 71% year on year, though total sales for the district accounted for only 12% of the total volumes for Monaco. Monte Carlo and La Rousse saw transactions fall by 1% and 4%, respectively, though combined, these two districts account for 56% of the total transactions in Monaco for the year. Such a high percentage of the total transactions is unsurprising given these two districts account for 43% of the total housing stock in the Principality.

Monte Carlo also saw the highest average price per square metre of all the districts at nearly €60,000 per square metre, closely followed by Larvotto and Fontvieille. The least expensive district is the Jardin Exotique, where the average price is closer to €35,400 per square metre.

The new build market

Monaco is land-constrained, and this results in relatively few new developments coming online each year. Historically new builds have made up only a small fraction of the total sales, averaging 5% of the total since 2006. The high point for new build sales occurred in 2018, where they accounted for 14% of the total sales. In 2021, new build sales accounted for 5% of total sales in the Principality, meeting the historic average.

There are five large projects in the pipeline: Mareterra, L’Exotique, Villa Palazzino, Bay House Monaco, and the second stage development of Villa Portofino. The most ambitious of these developments, Mareterra, will add 110 apartments, 10 villas, a new port, a public car park, and a public park, along with other infrastructure, all built on land reclaimed from the sea. Each of these projects will bring much-needed stock to the Principality – a total of 260 apartments and 19 villas – but will do little to keep up with the consistently high demand across Monaco.

The Monaco rental market

Consistent with the sales market, Monaco is the most expensive location in which to rent residential property, ahead of New York City, Hong Kong, and Tokyo. Following the trend seen globally of people returning to urban locations, rental prices in Monaco have rebounded from their 2020 lows to an average price of €91.08 per square metre per month.

Rental values across the Savills Prime Residential Index: World Cities increased by 3.0% in the six months to December 2021, and over 85% of cities saw positive rental growth over the period. Promisingly for the Principality, new build rental properties like Palais de la Plage in the Larvotto district continue to let up quickly as new build properties and their associated amenities remain appealing to tenants who are still looking to rent property.

Outlook

- Continued rebound

Monaco had a strong year in the face of continued global uncertainty, though international demand had been limited due to travel restrictions. The market in Monaco is likely to continue its growth trajectory as international travel returns, driven by a younger, more tech-savvy demographic who are attracted by the Principality’s perceived safe-haven status.

- Size matters

Lockdowns globally have brought the desire for larger properties, even in space-constrained Monaco. This trend is likely to continue as people return to urban centres, further increasing sales for larger properties in the Principality.

- New build projects

Villa Portofino and L’Exotique are both expected to complete in 2022 and will aim to help ease supply constraints in the Principality with their 10 and 66 units, respectively. The ambitious land reclamation project, Mareterra, will be brought to market at the end of 2024.

- The rental market

The return of international travel has benefitted the rental market in Monaco, as new residents are likely to rent an apartment as they acclimatise to the Monégasque lifestyle. These new residents will likely serve to continue to boost rents to pre-pandemic levels in the Principality.

.jpg)