Now into the second half of 2021, many major office markets are showing the earliest signs of stabilization following multiple quarters of pandemic-related challenges. In the third quarter, most cities have recorded a substantial increase in leasing volume as tenants seem willing and eager to re-engage in real estate planning – despite Delta variant concerns. Sublease supply has leveled off, declining across major markets including New York, Los Angeles, Chicago, San Francisco and Washington, D.C., where it had been rapidly increasing over the past 18 months.

COVID’s impact on law firm leasing activity has been mixed. In 2020, the sector showed some signs of resilience as transactions (mostly driven by lease expirations) continued to close. Activity slowed into the first half of 2021, but as seen in other sectors, there has been a resurgence in transaction volume in the third quarter. The Legal Tenant analyzed law firm transactions over 20,000 square feet (sf) across key U.S. markets to share insight on activity through the third quarter of 2021.

Third quarter 2021 records strongest law firm leasing volume since onset of the pandemic, renewals wane in favor of new locations

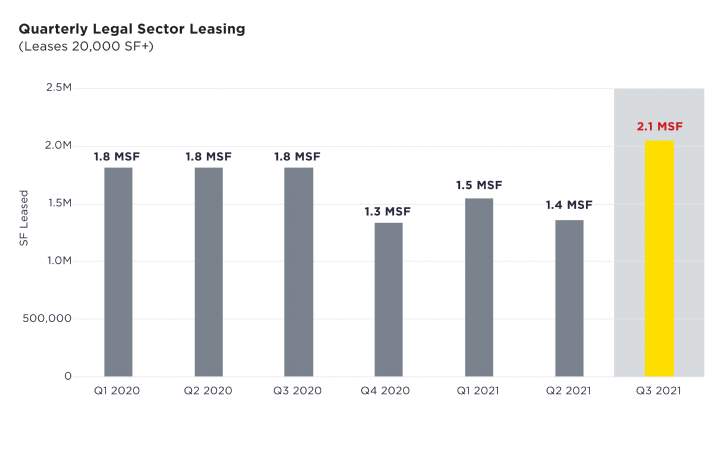

In the third quarter, law firms using over 20,000 square feet (sf) leased a total of 2.1 million square feet (msf) across major markets, the highest quarterly total for the sector since the onset of the pandemic. This was a 51% increase from the previous quarter and a welcome uptick in activity as law firm leasing had stalled earlier in the year.

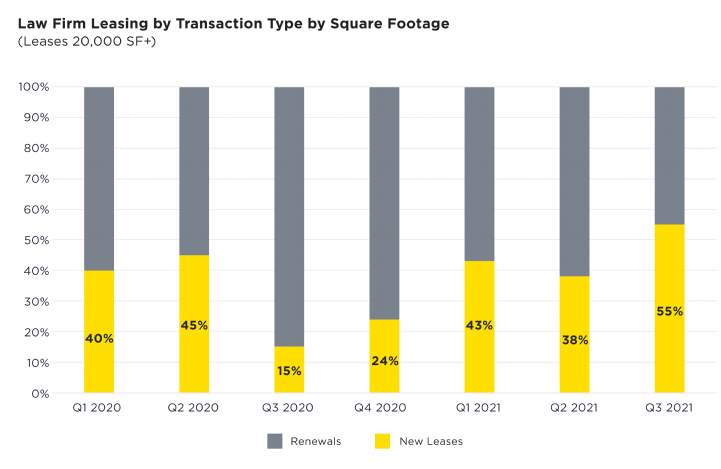

In addition to the overall increase in activity, there was also an increase in law firms signing new leases - opposed to the renewals and restructures that had dominated over the past few quarters. New leases (including relocations and new locations) accounted for 55% of law firm activity in Q3 by square footage - bolstered by a handful of very large transactions.

When looking at transaction type by number of transactions, there are still a substantial amount of renewals, however we are seeing more long-term commitments as opposed to the short-term extensions seen earlier in the pandemic. The increase in long-term leases signed this quarter is a positive sign that law firms are re-engaging in real estate planning with a focus on how they will use office space going forward, post-pandemic. The flight-to-quality and a focus on spaces that feature wellness, abundant amenities and collaborative space is likely to remain going forward as employers are attentive to recruiting and retaining talent and creating spaces where people want to work – particularly as hybrid in-office and remote work plans continue.

Major markets benefit from uptick in activity

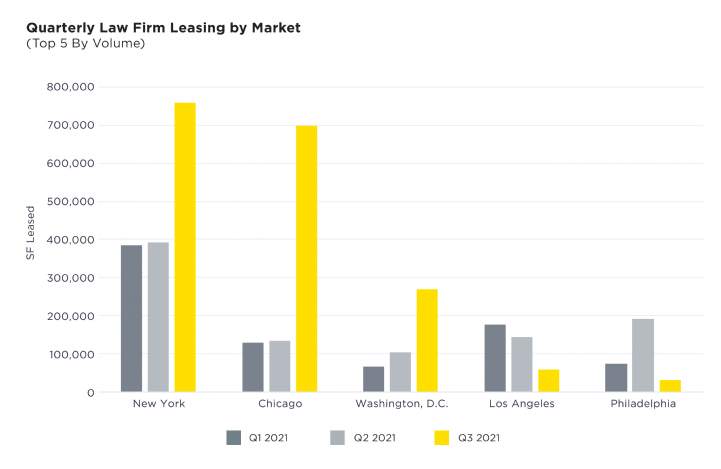

The pandemic’s impact on law firm leasing has varied greatly by market but generally, the largest law firm markets have benefitted from the uptick in legal activity seen in Q3. In New York, law firm leasing volume totaled close to 0.8 msf – a 94% increase from Q2. In Chicago, and primarily due to Kirkland & Ellis’ massive lease, volume quadrupled from Q2 reaching 0.7 msf in Q3. Washington, D.C. saw volume more than double from Q2 with just under 300,000 sf leased. Los Angeles and Philadelphia round out the top five markets in terms of total law firm leasing volume for the year, but activity declined from the second quarter with few large leases seen in each of these markets this quarter.

The increase in activity across these markets (and generally) has occurred despite growing Delta variant concerns. It remains to be seen what the trajectory of the virus will be heading into the winter months, but current volumes are a positive sign that momentum may continue through the remainder of the year. Pent-up demand stemming from deferred real estate plans and short-term solutions earlier in the pandemic will lead to increased activity in the coming quarters and years, as well. While availability remains high in nearly all markets, tenant opportunity persists. Landlords are likely to offer more flexibility in renewals and extensions to keep tenants in place, as well as offer increasingly generous concession packages to secure tenants in relocations. Law firms are well-positioned to leverage softer markets and gain favorable terms.