Maria Garcia, Principal Sustainability Consultant, Savills, explains how landlords are adjusting their flex offices to meet sustainability criteria

Indoor air quality has become one of the key ESG factors for companies since the reopening of society and return to offices. Ventilation systems and air conditioning are playing an important role, while landlords are implementing monitor sensors, encouraging workers to feel safe on their return to the office.

RESET is the industry standard for indoor air quality that integrates performance-based data with cloud technology to make real-time health data available to occupants of indoor space, differentiating itself from the competition.

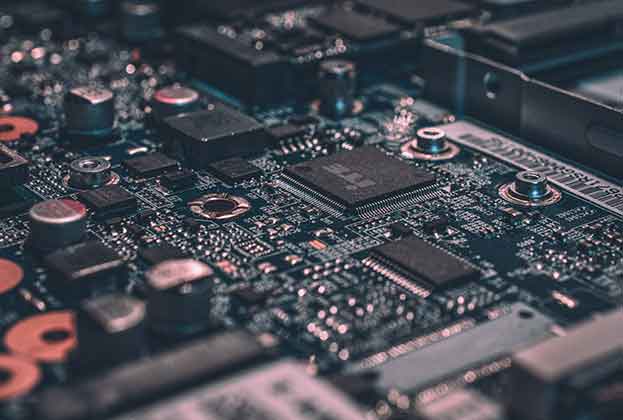

An additional factor is the UK government’s requirement to bring all greenhouse gas emissions to net zero by 2050. One of the difficulties of tracking carbon emissions in shared space is that occupiers are unable to track how much of the carbon emissions are due to their own business operations to meet their sustainability objectives. More tech is now being implemented to track granular data, including smart meters within shared space to create smarter buildings. This is also giving rise to the circular economy within the workplace, such as repurposing existing office carpets and lighting to reduce carbon emissions.

Sustainability services are a major opportunity for flex providers to advise customers who do not have the resources to track emission levels. More flex providers are now appointing sustainability contacts to meet this growing demand.

Social criteria will also become increasingly important to enhance workplace experience and productivity in the post-pandemic workplace. More flex providers are offering mental health and wellbeing services, indoor greenery and workspaces are designed with clear access to natural light.

Some landlords have now taken the stance not to acquire buildings with EPC ratings below F and G to meet growing shareholder demands. On the other hand, some impact investors are retrofitting their existing space and extracting embodied carbon to asset manage to a Grade A spec. Banks are also seeking KPIs in order to provide more favourable loan terms to investors. If carbon emission reduction targets are met during a five-year period, then banks will renew more favourable lending terms in the future.

Read the articles within Spotlight: UK Flex Office Perspectives below.

.jpg)

.jpg)