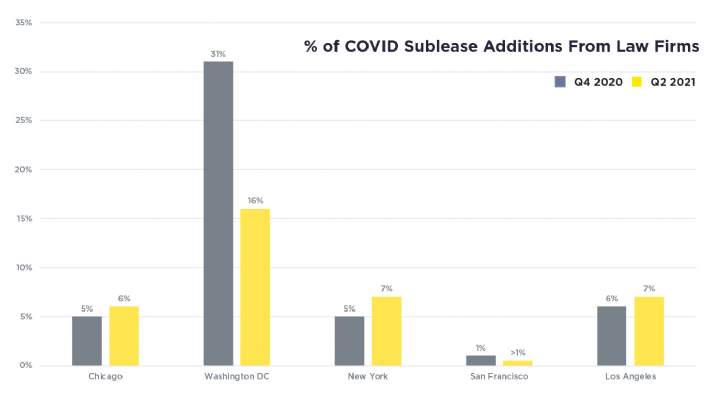

There is A LOT of Sublease Space on the Market, but Not From Law Firms

Over the past year available sublease space has skyrocketed across U.S. office markets due to a number of pandemic factors. Limitations on businesses to safely operate at 100% in-person occupancy left many organizations facing large amounts of unused space while work-from-home policies were enacted. Additionally, challenges amongst a number of industries forced some companies to cut costs while business was down – including real estate costs. As a result, an overabundance of sublease space flooded the market with available sublease space doubling and even tripling in some cities.

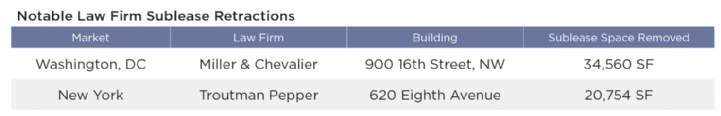

However, with restrictions eased and the country slowly emerging from the pandemic, many organizations began enacting return-to-office plans in the second quarter, bringing employees back to the office – and in many cases back to the space that they had been listing for sublease. Q2 marked the first quarter that sublease inventory in several major markets including New York, Washington, DC, Los Angeles and Chicago began to level off or decline. The reduction in sublease inventory is in part due to opportunistic companies leasing sublease space – generally at lower costs and more flexible terms – but also due to organizations taking their advertised sublease space back off the market as employees refill offices, and spaces listed short-term expiring.