More than a decade of low interest rates has meant that those who could access mortgages were able to borrow cheaply. This, together with undersupply of new dwellings in many countries, fuelled price rises across the globe, outpacing income growth in mature markets.

During the pandemic, this trend has only accelerated. House prices increased by 5% in 2020 across 12 major global cities at a time when their national economies shrank by an average of 5% – remarkable given this was amidst the steepest global economic contraction seen since the Second World War.

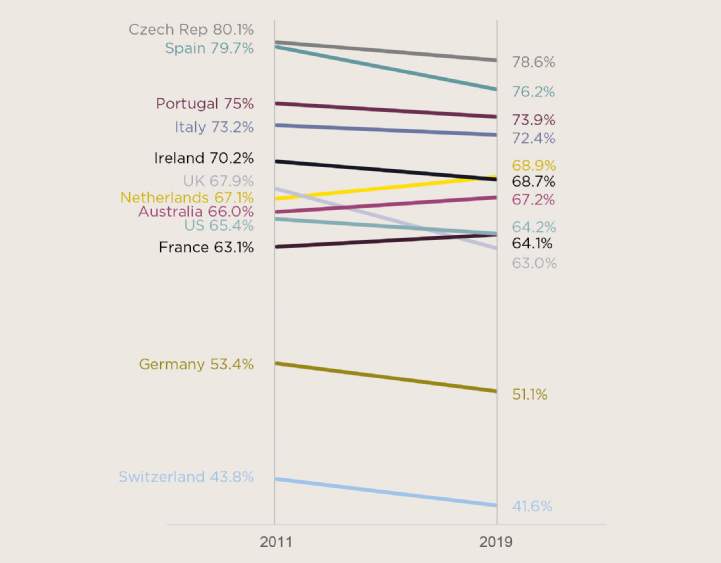

In many markets, there remains an aspiration for home ownership, but rental product – supported by growing institutional investment – has raised the bar by offering ease of living in a high-quality product. Homeownership rates have fallen over the last decade (see chart). A combination of affordability constraints in the sales markets (particularly impacting first-time buyers) and changing lifestyles is boosting demand for renting. There are exceptions, such as France, where sustained levels of home building in the last decade have supported growth in home ownership.

City-dwelling, mobile young people are settling down later in life and flexible rental models suit them well. At the other end of the spectrum, the baby boomer generation is entering retirement age. Healthier for longer, they want many of the same things Generation Y and Z are looking for: quality accommodation, access to amenities and a sense of community. Rental products are emerging to serve them too.

For many, our homes became both living and workplaces during the pandemic. The possibility of increased levels of homeworking in future puts even greater importance on the home, only intensifying interest in the operational residential asset class from investors. This may be particularly the case for single-family rental homes, which offer more living space.

Homeownership rates Selected countries

Source Savills Research using Eurostat, US Census Bureau, Australian Bureau of Statistics

Read the articles within Report: Global Living – 2021 below.

(1).jpg)

.jpg)

.jpg)

.jpg)

.jpg)