Branded residences achieve a premium, on average, of 31% over equivalent non-branded properties, though this figure varies significantly by location

We examined 23 markets across the globe to determine the range of premiums that have been achieved on branded residences. Each premium is based on a sample of properties within each market, matched to comparable, non-branded properties. These are averaged to create an unweighted market premium. Our findings suggest an average global premium of 31%, but with significant variation.

New markets offer opportunity

The highest brand premiums are achieved in emerging markets. Here, luxury brands are particularly appealing to the newly wealthy, a mark of success. Recently established markets like Bangkok, Beijing, and Phuket achieve premiums between 40% and 45%, comparatively higher than more mature markets. Truly emerging markets with few branded properties can command prices that are double to comparable non-branded stock, as demonstrated by both Belgrade and Almaty with premiums of 120% and 150%.

In Phuket and Bangkok, brands have been used to attract interest in schemes in fringe-prime locations. However, location is still an important determinant of viability and a brand alone will not ensure success. There has been evidence of slow sales rates in some such schemes, where the units themselves are not market-driven and overly reliant on the brand power.

Mature markets face some competition

Established world cities with mature prime markets, such as Singapore and London, command comparatively lower premiums (3% and 8% respectively). Some mature markets with wide international appeal, such as Miami and Dubai, can still command higher premiums (of 31% and 29% respectively) due to highly international purchaser bases, with significant amounts of wealth from emerging markets.

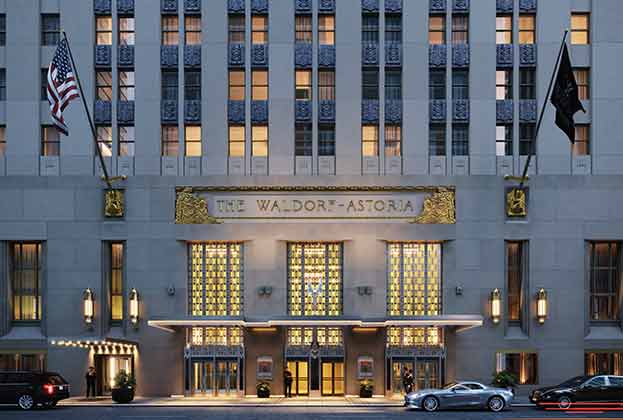

However, market competition and composition play large roles in the potential success of branded schemes. Established markets such as New York have had non-branded schemes which have become brands in their own right. Branded schemes are often found in older, but well-known properties, while many non-branded schemes are new, purpose-built developments.

Well-known architects, exceptional services and amenities, super-tall structures, and ultra-desirable locations seen in non-branded schemes such as One57, Central Park Tower, and 520 & 432 Park Avenue in Manhattan, have led to a 22% branded residence discount, on average.

Premiums for properties in resort locations are varied, dependent on the age and composition of market and its clientele. Tourist hotspots in Mexico and Puerto Rico, long-standing destinations for Americans, achieve lower price premiums than more recently popular tourist destinations like Panama or Phuket.

The Residences at Mandarin Oriental, Moscow. Developed by Capital Group

Matching brand to market

Separate analysis of premiums by chain-scale for selected schemes suggests lower premiums, on average, for luxury hotel branded properties (16%) than non-luxury branded schemes. This is due primarily to their concentration in established cities, with more mature prime property markets, where competition from non-branded luxury product is greater.

Upscale brands, on average, achieve a slightly higher premium of 24%. Many of these brands have been deployed in leisure-focused and resort markets. Here they have been able to distinguish themselves from the more limited non-branded options in the market.

Some non-hotelier offerings have proven to be pioneering in terms of amenities and in setting new standards for the market, seeking to justify higher premiums through the production of the ultimate trophy unit. The Porsche Design Tower in Miami, for example, will send the owner’s car to their residence in a specially designed car lift. Non-hotelier branded schemes are able to achieve premiums that are, on average, 25% greater than similar non-branded offerings.

Read the articles within Spotlight: Branded Residences below.

Further information

Global Residential Development Consultancy

.jpg)

.jpg)