With a growing population, changing consumers and a precious environment to consider, challenges are aplenty

The red meat industry faces an unprecedented array of challenges. Turbulent markets, trade agreement uncertainty and worldwide consumption pattern disruption from coronavirus (effects unknown at the time of writing) make for a particularly unpredictable business environment.

It is clear that as populations continue to grow, the weight of demand is negating changes in consumption behaviour of the developed world. Competition from poultry and aquaculture, which are often cheaper and more readily available alternative sources of protein will continue.

Today’s consumers and indeed the consumers of tomorrow will place more weight on the social or environmental credentials of products when deciding what to buy

Savills Rural Research

Before coronavirus, consumption in many developed countries was trending downward as environmental and health concerns weigh on consumers’ minds. Many traditional strongholds of red meat consumption were gradually eating less, but a shift to home consumption could present a temporary or long-term change in consumer behaviour. Producers should be aware that short-term changes may not last if consumers move back to convenience and out-of- home eating again. Flexitarians will continue to demand high quality and value cuts of red meat albeit less frequently.

The UK is well placed to play on its strengths to access these high value markets, but it remains unclear whether or not this will be a factor in trade negotiations, which are likely to focus on financial services with agricultural concessions rather than opportunities. Investment in data and traceability will be justified to meet changing supply chain expectations around climate and environmental impacts. Competition for market share from often cheaper white protein substitutes and an increasing share of plant-based food can still be expected. Wholesalers, manufacturers and retailers need to continue to invest in quality and pass value back down the supply chain to incentivise the higher standards that consumers are demanding from producers.

We are moving from an era where business and consumption was financially focused and social or environmental impacts not recognised. Consumers are placing more weight on the social and environmental credentials of products they buy. Rapid change is inevitable as the UK acts to achieve net zero greenhouse gas emissions by 2050 and while challenging for the industry it could be beneficial too. Production processes that emit less carbon often use less energy, so while improving the environmental impact costs can be cut too.

History shows those who are proactive in planning and adopting innovations will hold a competitive advantage.

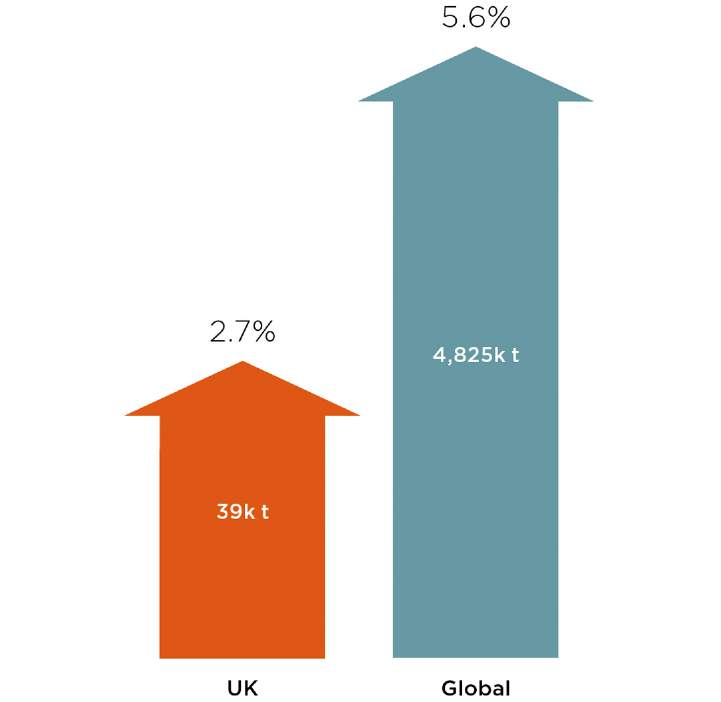

Beef and sheep-meat consumption forecast (2020–2025)

Source: OECD

Read the other articles within Spotlight: Red Meat Outlook below

.jpg)

.jpg)