Savills Research marks out the likely impact of COVID-19 on European occupational and investment markets

Economy

A number of major global economies have launched initial monetary and fiscal stimuli packages in response to Covid-19 to contain the negative economic growth. Initial responses show the US Fed cut interest rates to 0–0.25% and launched a $700bn stimulus programme, which has now been extended to $2.2bn as the number of US individuals seeking unemployment benefits jumped from 0.3 million to 3.3 million in less than a week.

In Europe, a number of EU28 countries have shut borders and the European Central Bank (ECB) has responded by announcing a €750bn government bond acquisition programme in addition to its €120bn asset purchase program to stimulate domestic demand. Reuters data indicates that Germany has agreed a €750bn fiscal package, whilst the French government has guaranteed up to €300bn of corporate borrowing. Similarly, the Bank of England (BoE) has responded by cutting interest rates from 0.25% to 0.1% and will subsequently increase government bond acquisitions. As a result, there has been increased volatility of European 10-year sovereign bond yields, which rose above 1% in some southern European markets, before recovering to levels comparable with those prior to the outbreak. As of 1 April 2020, 422,000 cases have been reported across the EU28, with most European governments advising 'non-essential' workers to remain at home, with restaurants, bars, cafes all closed. Looking further east, official figures indicate that China’s coronavirus outbreak has been brought under control, with reported cases flatlining.

Germany has agreed a €750bn fiscal package, whilst the French government has guaranteed up to €300bn of corporate borrowing

Savills European Research

However, given the evolving nature of events, most of the consequences are likely to become visible only slowly and in some cases with a considerable time lag. The concrete consequences and, above all, the extent of these consequences depend very much on the further course of the virus spread and are difficult to predict due to the complex chain of effects.

The next question on many investors’ minds is “what will be the shape of the economic recovery?” Some European economists are adjusting their hopes of a 'V' shaped recovery to that of a 'U' shape. In the instance that, following a return to usual activity, a second spike in infections arises, this will further delay growth prospects and could prove a tipping point for unemployment levels to rise. Basel regulatory framework imposed post-Global Financial Crisis (GFC) should ensure that a banking crisis is not a realistic scenario, although real estate lending from banks will remain tight in the current environment.

The eurozone consumer confidence index marked a monthly fall of five points to -11.6, the lowest level since November 2014, which will drag on consumption levels. This is expected to fall further over the next couple of months following social distancing guidelines and in line with the lowest oil prices recorded since 2002, points to eurozone deflation of c.1% by the summer – the lowest level on record. Latest economic growth forecasts indicate that the eurozone economy will contract by 12.5% q/q in Q2 2020, as numerous businesses come to a standstill, and governments will have no choice but to provide support to businesses and households on an unprecedented scale. This indicates overall eurozone GDP will fall by 6% in 2020, but this is likely to rebound by the same level during 2021.

Offices

Going into 2020, European average office vacancy rates stood at 5.4%, the lowest rate on record, with core markets including Paris and Berlin hovering just above 1%. We initially factored in more development commitments for the year, and tenants forced to sign for lease extensions given a shortage of alternatives.

Following the Covid-19 outbreak, development activity will be much more restrained due to a contraction of lending to new schemes. Tenants in conventional office leases are likely to re-gear, given few city centre alternatives with record low vacancy rates and delays to delivery of new space. Thus, we expect the rental growth story is likely to be delayed by 6–12 months.

However, some business failures and/or subletting activity could see some new space return to the market. The Euro Area Services Purchasing Managing Index (PMI) plunged to a record low of 28.4 in March 2020, below market expectations of 39, although this was dragged down by the more consumer-facing industries including leisure and tourism. More attention will be paid to the financial health of tenants and we will likely observe an increase in the proportion of landlords asking for monthly rental payments to smooth out operational cash flow. Assuming the virus is contained in the first half of the year, we expect occupational demand to return to usual levels during 2021, with governments able to commit further fiscal reserves to stimulate demand if need be, as they claim they will do “whatever it takes”.

The flexible office agenda gathered further pace in 2019, accounting for 12% of Europe’s total leasing activity, up from 10% the previous year, with larger well-known technology and banking corporates opting to sign for flex space for the first time. Paris CBD observed 23% of take-up from the flex space sector last year, for example. Since Covid-19, flexible workspaces have shown lower capacity utilisation (with many governments encouraging or insisting on home working) especially with regard to their event rooms. Once normal leasing activity resumes, however, we do expect tenants to seek more flexible lease lengths than before the pandemic, especially for the businesses affected by construction delays.

Overall, we do not expect Covid-19 to have a material impact on the occupational demand for office space

Savills European Research

A number of factors at play are influencing the demand for workspace as the office sector has been put through an unexpected test nobody could have predicted. Technology including Microsoft Teams and Zoom has facilitated workers to work from home more easily and enabled companies to adopt agile working strategies. As workers become more aware of the technology on offer, we expect the workplace to adapt to encourage more collaboration. However, increased home distractions, intermittent internet access and the provision of a suitable home-working environment are likely to maintain existing demand levels.

Overall, we do not expect Covid-19 to have a material impact on the occupational demand for office space. The greater change is likely to be in the number of companies who choose to adopt agile working policies and how the allocation of workspace will cater for more collaborative working.

Omnichannel Retail

Retail

The short-term closure of most retail stores, food courts and leisure services has caused a major contraction in shopping centre footfall. The grocery sector is the least affected and has actually seen revenues rise due to the closure of restaurants and many people cooking at home, as well as people stocking up on essentials. The largest stores reported almost 19% YoY increases in turnover during the last week of February. Leisure and fashion segments are the most impacted.

There are a number of common themes across occupiers in terms of how they are looking to reduce costs such as reducing capital expenditure through supply chains and store refurbs, amongst others. It is likely that some retailers will fall into insolvency, with some tenants asking for rent holidays/deferments for three months typically. In terms of service charge, retailers are typically asking landlords for this to be kept to a minimum and paid on a monthly basis. For deals that are yet to complete, occupiers are seeking longer rent-free periods.

In London’s West End, footfall was down 93% YoY for the week commencing 23 March

Savills European Research

In London’s West End, footfall was down 93% YoY for the week commencing 23 March. Retail park footfall showed stronger resilience due to presence of foodstores and grocery panic buying – footfall was down 61% YoY (-56% WoW).

We expect further retail store rationalisation and investment across omnichannel strategies as retailer margins are squeezed and the share of online retail rises. This will apply downward pressure on rents and intensify the need for alternative rental models, involving more lease flexibility and turnover-based rents. Close collaboration between landlords and tenants around re-gears will become more important in shopping centres in order to survive short-term negative implications and until social distancing measures are removed. Some incentives may be required to attract customers back including further discounting. Facilities managers will also need to improve hygiene protocols, which may require better ventilation, cleaning routines and contactless fixtures.

Logistics

2019’s US/China trade wars, Brexit negotiations and lower EU28 domestic growth marked a weaker year for the eurozone manufacturing sector. Euro-area manufacturing PMIs (Purchasing Managers Indices) delivered readings well below the 50 mark (separating expansion from contraction) throughout the year, although this has since recovered towards the start of 2020. German automotive production contracted and countries in the associated supply chain observed the knock-on effects. Despite this, the second highest ever level of logistics take-up was recorded in Poland last year, whilst the Czech Republic marked a 9% increase YoY as production facilities accounted for 43% of total space. Prime logistics rents grew by an average of 6% across the European markets, with Lisbon, Warsaw Suburbs and Stockholm all observing double-digit growth last year, and this sentiment has been carried into early 2020.

2019 marked an 8% fall in total European leasing activity on the previous year, as a result of the shortage of supply. Average vacancy rates remain low across European markets, including the Netherlands (6.5%), Spain (5.8%), Poland, (7.1%), Czech Republic (3.7%), Romania (5.0%) and the UK (6.7%).

Following the Covid-19 outbreak, a number of European countries have temporarily shut their borders and instructed workers to stay at home in order to contain the virus, which has created warehouse labour shortages. Likewise, the contraction in China’s manufacturing output and the shortages of workers offloading shipping containers at port terminals is creating global supply constraints.

We have observed some logistics operators increasing stockpiling activity given the increased online retail spend by consumers and to shelter themselves from any disruption to the upstream supply chain. Amazon, for example, reported that off the back of “a significant increase” in online retail sales, they are creating 100,000 full and part-time jobs in the US. Lower levels of consumer confidence have led consumers to stockpile necessity goods, whilst delaying luxury purchases. As a result, more luxury goods are being stored in warehouses for longer periods, adding further pressure on supply.

Online spend only accounts for 3% of the total food and drink sales in Europe, Covid-19 could be a catalyst to ignite the online sales growth in this sector

Savills European Research

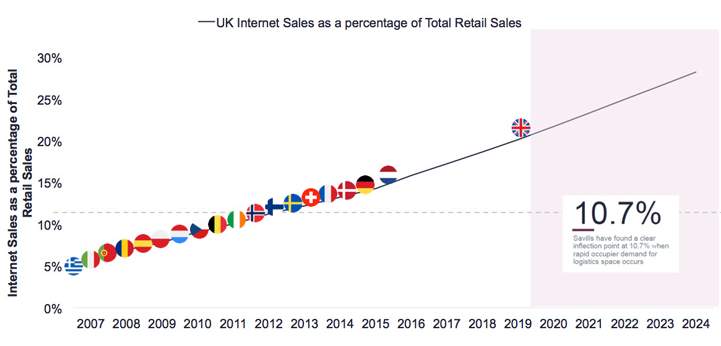

Online retail sales growth continues to exceed analysts’ expectations and given the Covid-19 outbreak has increased consumer dependence on e-commerce, it is likely that this shift will accelerate faster, particularly for countries with lower penetration rates. Online retail sales accounted for an estimated 11.8% of Western Europe’s total retail sales during 2019, above the 10.7% tipping point where demand for logistics space increased significantly in the UK. Forrester’s latest forecasts indicate that online retail will account for 17.8% of Western Europe’s total retail sales by 2024. Assuming industry standards of 75,000 sq m space for every €1bn spent online, this indicates a need for an additional 16.7 sq m of logistics facilities in Western Europe to cater for the growth on online retail over the next five years. Although Forrester’s data indicates that online spend only accounts for 3% of the total food and drink sales in Europe, Covid-19 could be a catalyst to ignite the online sales growth in this sector.

The speed of getting materials to construction sites is being delayed due to labour and mobility issues and it is likely that some of the development forecast for completion in the second half of 2020 will be delivered into early 2021. Likewise, some developers are likely to take stock of the current situation before committing to new schemes, which will add further pressure onto Europe’s already undersupplied warehouse markets.

We generally expect logistics leasing demand to remain resilient during 2020, with online retailers and 3PLs competing for remaining logistics facilities in response to consumer trends. Lease negotiation periods are likely to extend and in this respect, it is possible that the rental growth anticipated for 2020 rental growth will be delayed until 2021.

UK is leading the way in online sales

Source: ONS, Ecommerce Foundation, Eurosender, Forrester Research, Savills Research, full year 2019 data

Hotels

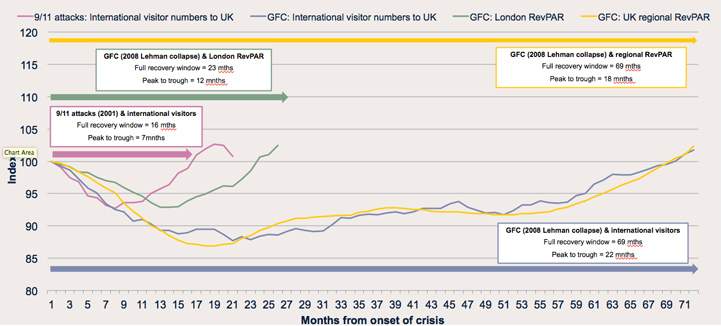

The spread of Covid-19 is a relatively new and unique global event, unlike SARS, which remained largely contained to China/Asia Pacific. As a result there are no direct historical comparators from which to draw from. However, we have looked to the 9/11 attacks of 2001 and the GFC in order to gain some potential insight in terms of speed of recovery taking London as an example (see below).

Recovery periods from previous global shocks

Source: Savills Research; STR; ONS (analysis based on month/month change on rolling 12-month performance)

The hotel sector has been one of the first commercial property sectors to be affected by Covid-19, as European airlines have cancelled thousands of flights and governments unveil repatriation agreements with airlines to return home stranded tourists.

Italian markets, alongside those that typically attract a significant number of Chinese tourists such as Paris, may be more adversely impacted both in terms of demand and operational performance. However, some of these gateway cities could see a sharp bounce in demand once the virus is contained. Recovery in northern Italian cities could take longer due to perceived risks remaining higher for longer.

Those European cities where corporate and event demand accounts for a larger share, such as Amsterdam, Frankfurt and Barcelona could also be more exposed to RevPAR declines this year. One potential bright spot for 2020 could be seen in the domestic leisure markets. With the appetite for international travel softening, we are likely to see growth in the staycation market over the latter part of 2020. Nevertheless, even with a ‘mild’ course of events, considerable losses in turnover and, without state support, insolvencies are to be expected.

It is too early to call what the implication will be on pricing. Investor appetite may see some softening but this is likely to materialise through deal delay similar to what we saw during the latter part of 2019 ahead of the General Election. It is important to remember that the current situation should hopefully be short-lived with the longer-term fundamentals of the sector to remain robust.

Residential

Multifamily

The short-term implications for the Multifamily sector will be closely linked to rising unemployment risk and the potential inability of households to meet their rental obligations. Government fiscal stimuli across Europe are aiming to protect businesses and households from these effects, including tenant protective measures. For example, in Germany, landlords will no longer be able to evict tenants who fall behind on their rent due to the coronavirus crisis. Rental growth will freeze in the medium term, however, the demand and supply imbalance for rental stock that is observed in many European cities will persist as construction activity slows down. Besides, in times of uncertainty demand for rental is rising. However, if the perceived risk of living in a downtown multifamily building rises, demand may shift to less dense housing options in less dense urban areas. Also, if working from home becomes more established, households may look for more spacious units. All the above are likely to have a negative impact on demand for co-living and micro-living concepts.

Student housing

The reliance of Purpose Built Student Accommodation (PBSA) on foreign students and especially Chinese will be the biggest risk for the sector. The Covid-19 outbreak has forced international students to return home and the ones that have stayed are asking for PBSA providers to waive rents. Indeed the majority have cancelled contracts of students returning home or provided rent-free periods and discounts for next year’s contracts. The negative impact on PBSA rental income is estimated to last between a semester and a full academic year.

What will happen beyond this time frame will depend on student mobility trends going forward. Past experience shows that education comes out stronger in periods of uncertainty e.g. post GFC when many people who lost their jobs returned to universities. However, the current situation is likely to prompt more students to study closer to home and live with their parents. Also, long-distance learning may become a safer and cheaper option for extended learning, until the employment market picks up. Government aid to students will also be of critical importance for their university choices. Chinese students may choose to study in Asian universities and we could see more European universities opening branches in Asia.

We believe that the most resilient markets for student housing now will be the ones with demand and supply imbalances for mainstream student accommodation, which targets mainly the local student populations and where the student housing product has less dependency on international students.

Investment Markets

We expect investment transaction volumes to recede over the course of the year, particularly as there remains a shortage of openly marketed stock and the bidding process is less competitive than previously. PropertyEU reported that a number of European retail parks and shopping mall sales have been withdrawn or postponed, although a number of office and logistics transactions have completed during the week commencing 23 March 2020. Similarly, in the UK, a number of deals that were in advanced stages have also closed during this period. Bans on travel and self-isolation guidance will make inspecting assets and conducting technical due diligence more difficult in the short term, as virtual tours will become increasingly important.

The temporary uncertainty is also likely to have a negative impact on the availability of debt capital. Debt will become increasingly difficult to obtain unless terms have been already agreed, with tighter lending conditions introduced which could present buying opportunities for unleveraged funds. At this stage, it is unlikely that lenders will have been able to take new opportunities to credit committee since the many ‘lockdowns’ across Europe and it remains to be seen as to any reduction in lending volumes. The majority of lenders to whom we have spoken are open for business and we see it as an opportunity for Debt Funds, Private Equity and alternative lenders in general to gain market share.

Investors are likely to wait and see how the markets develop in the coming months, and it is likely transactions will take longer to complete

Savills European Research

During times of increased uncertainty, investors have shifted acquisition activity to core product in core markets with secure income streams which we expect to be the case over the course of 2020. Landlords are likely taking stock of existing portfolios as funds remain cash rich, but more sensitive to pricing. We expect the weight of cross border investment activity to ease, as domestic institutions account for a higher share of investment transactions of markets they are more familiar with. We have not yet observed any signs of distressed selling, although the marketing process of some assets is expected to be delayed into the second half of the year when the bidding process will resume its usual competitiveness. The Euro has fallen against the US dollar following the Fed rate cut, which could also spur some opportunistic US acquisitions of European retail property.

The distortions on the financial markets have opposite effects on the real estate investment markets. Bond yields and interest rates have fallen, making real estate more relatively attractive. Likewise, the stock market volatility has led many multi-asset managers to consider increasing their real estate exposure as a safe haven.

However, investors are likely to wait and see how the markets develop in the coming months, and it is likely transactions will take longer to complete. European average prime office/sovereign bond yield spreads were already 42 basis points (bps) above the long-term average before the virus started, so this is likely to shelter any short-term price movement.

Whereas the GFC represented two consecutive years of weak investment volumes in 2008/09, the investment environment is now different, with government bond yields at near-zero rates, capital commitments still strong and the real estate investment market now more transparent than ever, with new technology enabling virtual tours. Investors are still eager to undergo technical due diligence once the quarantines end; however, the lack of prime product will limit sales.

.jpg)