Price growth continues and activity remains buoyant despite supply constraints

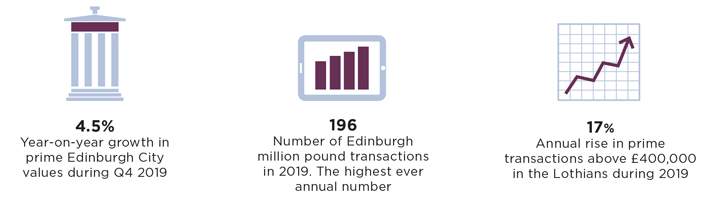

Edinburgh’s residential market is defying uncertainty with prices continuing to rise. Price growth shows no signs of abating, with mainstream and prime values increasing annually by 2.8% and 4.5% respectively at the end of last year. Prices remain underpinned by a prosperous economy and rising population, which have increased by 21% and 12% respectively over the last decade.

Whilst demand remains strong, supply in Edinburgh continues to be constrained, with currently 20% fewer properties available to buy compared to February 2019. Activity in the market from £200,000 to £500,000 remains buoyant though it has not been quite as strong in other price bands.

This has been especially noticeable in the second hand market between £800,000 to £1 million. With price growth pushing the value of stock over the £1 million mark, a gap has emerged in this section of the market. Here the impact of Land and Buildings Transaction Tax (LBTT) continues to be felt, restricting supply and pushing up prices in the capital.

This said, Edinburgh remains relatively affordable compared to other university cities in the UK, with more capacity for price growth, underpinned by continuing economic and population growth. Despite a recent uplift in properties being made available, there remains a surplus of motivated buyers, often frustrated by a lack of choice.

Prime numbers

Constrained supply restricted the number of prime transactions at £400,000 and above in Edinburgh to 1,891 during 2019, down marginally on the 1,931 in 2018. However, performance across inner suburbs and locations close to the city centre remained strong.

The majority of prime transactional activity took place in the New Town and inner suburbs of Grange, Morningside and Merchiston, south of the city centre. The prime markets in both locations remained at a 10-year high, resulting in 557 transactions across these areas in 2019.

Similarly, Murrayfield witnessed a record 159 prime transactions, with market strength spreading west into Corstorphine. Stockbridge and Inverleith also saw their highest ever level of activity above £400,000 with 121 such transactions.

New build boost

Increased new build supply across Edinburgh continues to boost activity in areas where it was previously subdued. The EH1 central postcode was Edinburgh’s strongest performing market, with the overall number of transactions jumping from 112 in 2018 to 172 in 2019, supported by new build sales in Broughton and King’s Stables Road.

Meanwhile, new build supply in the suburbs of Gilmerton, Liberton, Portobello and Balerno has provided a knock-on boost to second hand markets in these areas.

The Lothians

Over the last decade, a net 20,000 people have migrated from Edinburgh to the relatively attainable Lothians, where both the overall number of transactions and average price increased by 6% year on year.

Much of this growth was fuelled by an increase in new build transactions across a range of sites, from the coastal hotspot of Gullane in East Lothian to the commuter locations of Haddington, Prestonpans, Wallyford and East Calder. Meanwhile, previous developments continue to lift the second hand market in Midlothian.

Higher value new build activity in North Berwick and Gullane supported a 28% rise in prime transactions in East Lothian. An improved second hand market in the sought-after town of Linlithgow contributed to the record 84 prime transactions in West Lothian.

Read the articles within Spotlight: Scotland Residential below.

.jpg)