What does 2020 hold for retailer demand?

Some parts of the UK retail market have seen significant repricing in terms of rents. Central London, in contrast, has shown some degree of resilience but has not been totally immune. In Q419 prime ZA rents across central London softened by an average of 5.8% year on year, an acceleration on the previous quarter. Much of this softening was driven by weakness in ‘fringe’ pitches in the West End. Prime West End, however, showed greater resilience, supported by Bond Street, with ZA rents down 2.0% year on year.

This rate of decline out-paces that seen during the height of the Global Financial Crisis (GFC) where rents in central London declined a total of 3.7% over three quarters of 2009 (Q1–Q3) before returning to growth. Prime West End rents remained static over this period. Heightened political uncertainty last year was partly to blame for weaker occupational demand and softening rents. The big challenge, however, remains total occupational costs due to the burden of Business Rates, which were considerably lower in 2009 than where they are now.

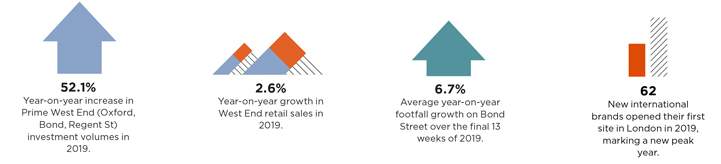

Despite these headwinds brands still want a presence in London. This is reflected in the fact that 2019 was a new peak year for new international brands opening their first sites in London, totalling 62, largely driven by new F&B entrants. Yet, while historically a number of these would have translated into multiple site openings, this activity was muted last year.

Going forward, the softening in headline rents, in conjunction with improved political confidence following the General Election, should help bolster occupational demand. Yet, with the outbreak of the coronavirus, and with it wider global economic uncertainty alongside retailer supply chain issues, this confidence may be tempered over the short term.

Could the coronavirus outbreak have a material impact on central London retail sales?

The West End had a pretty good 2019 in sales growth terms. Annual sales were up 2.6% year on year, largely driven by a 7.1% growth in international tourist spend, according to the New West End Company (NWEC) and PwC. The big unknown for 2020 however, is the potential impact on sales due to coronavirus.

International shoppers in the West End and across the wider central London area, as already noted, are an important consumer group, with them accounting for 43.2% of retail sales in the West End last year. Of these, visitors from mainland China have been major spenders, particularly on Bond Street. For example, historical data from Global Blue suggest that Chinese spend on Bond Street accounts for approximately 25% of total tax-free spend. Yet, this is just tax-free spend and not reflective of total spend.

So, what could be the overall impact on central London retail sales in response to coronavirus?

Firstly, we need to provide some context to Chinese visitor numbers and spend. According to VisitBritain, London welcomed close to 460,000 visitors from mainland China and Hong Kong in 2018, up 22.8% year on year, with a total trip spend of £681 million. While we have seen significant growth in arrivals, this only represents 2.4% and 5.5% of total international visitor numbers and spend. Albeit, the fact that Chinese visitors tend to allocate a larger proportion of their travel budgets to shopping means their share of total retail sales will be marginally higher than that indicated by the ONS data. With bookings from mainland China and Hong Kong to London for the next three months, as at the end of January, already down by over 50%, NWEC are expecting a decline in retail spend within the West End by these visitors over the coming months. Whether this will have a material impact on total spend will depend on how quickly the virus can be contained.

The bigger risk from coronavirus to retail spend in London will be wider implications on the global economy and changes to travel behaviour by those from other countries, alongside softening domestic shopper numbers. On the first point, Oxford Economics current baseline forecast for Global GDP points to a decline of around 1% in Q1 before a return to growth in Q2, albeit these forecasts are constantly evolving in light of new developments.

In light of the economic contractions seen globally during the Global Financial Crisis (GFC), this degree of decline would likely temper annual retail sales performance rather than translate into significant declines. For example, total annual retail sales in London continued to report growth during the height of the GFC in 2008/09 albeit at a slower rate, despite quarterly falls in overseas visitor arrivals and larger declines in global GDP. A marginal decline only emerged in 2010. Having said this, concern surrounding coronavirus could have a more immediate impact on people’s behaviour suggesting that over the short term the potential impact on physical store sales in central London may be more pronounced, something that we will be watching very closely over the coming weeks.

Prime West End retail remains more immune to wider market issues

Central London transaction volumes were relatively muted in 2019 totalling £1,308.9 million, down 28.9% year on year. This is in line with wider challenges in the occupational market coupled with relatively low levels of stock availability.

However, Prime West End (including Oxford, Bond and Regent Street) continued to buck this trend, with investment volumes up 52.1% year on year, reaching £666.8 million. This includes a number of key deals such as the £74 million acquisition of 172 New Bond Street by private Hong Kong investors in May, highlighting the continued demand for well-located prime West End assets.

Looking forward, UK institutions and property companies are likely to continue to shed retail assets which could result in more stock coming to the market. This may unlock further investment opportunities subject to vendor and purchaser pricing expectations being aligned.