Strong activity fuels rental recovery

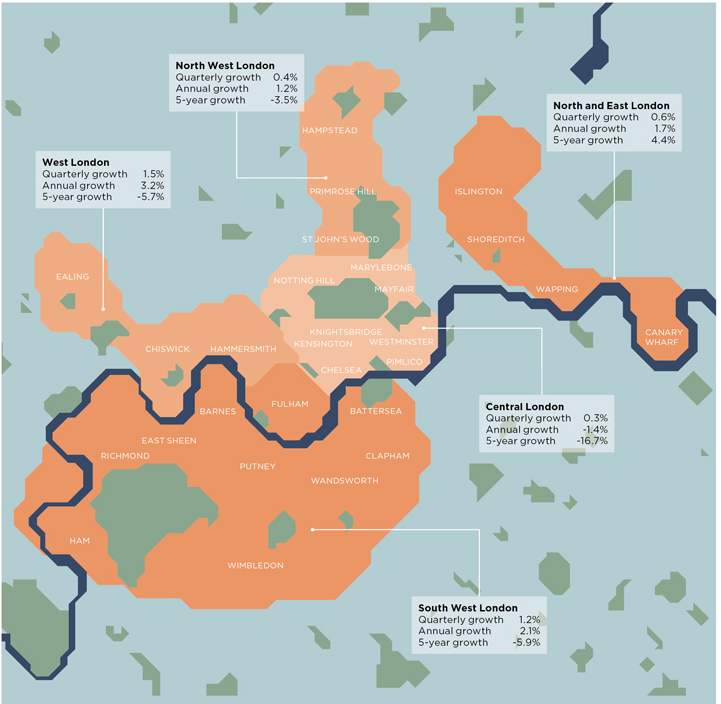

Prime rental values to September 2019

Source: Savills Research

Rents of prime property across London have seen growth for the first time since 2016. In the year to September 2019, rents of such properties grew by 0.9% on average, fuelled by strong activity over the summer and low levels of stock, often in the more domestic markets.

In particular, over the past year prime rents have increased by 2.1% in South West markets, stretching from Clapham to Richmond, and by 3.2% in areas such as Brook Green and Chiswick in West London.

This has been driven by strong demand for family houses. Accordingly, the best-performing properties have been those located close to good schools and transport links as families have looked to relocate before the start of the school year.

Condition continues to be a major differentiator across London. In markets from St John’s Wood to Highgate, properties in immaculate condition have seen stronger growth over the past year compared with those requiring a refresh. And demand from corporate tenants in markets such as Canary Wharf has supported growth for smaller modern properties.

The prime central London market has been most impacted by rental falls since March 2016 – when the 3% stamp duty surcharge was introduced – with rents down by 15.0% on average. During the past year, rents have continued to fall, although we have witnessed modest growth of 0.3% over the most recent quarter.

While activity remains strong in the lower end of this market, and the top end continues to see some big-ticket lets, it is the mid-market where stock levels remain high and demand more fickle. Properties worth between £1,500 and £3,000 per week have seen rents fall by 2.5% during the past year and are down by 22.2% over the past five.

This part of the market has seen an increase in stock from accidental and boomerang landlords who are waiting out the sales market amidst the ongoing Brexit negotiations.

The changing face of demand

Corporate demand remains strong across London, with volume now being driven by tech companies relocating employees from overseas. Since 2015, the proportion of Savills London tenants employed in media, technology or the science sector has increased from 12% to 17% of the market. Unsurprisingly, there has also been an increase in diplomats being relocated to London, but budgets remain conservative.

Tenant demand across London is primarily being driven by product and value rather than location

Savills Research

These tenants continue to be driven by product, particularly for new build stock, and are willing to be flexible on location. Over the past 18 months, 97% of Savills tenants renting at Television Centre in White City had relocated from outside of the borough of Hammersmith & Fulham. The amenities associated with new build continue to attract those looking for concierge services and on-site working space.

There has also been a shift in the age profile of renters, again particularly in the new build market. The proportion of those aged 30 to 39 renting new build across London has increased from 27% of the market in 2015 to 47% in the first half of 2019. This reflects more of a lifestyle shift towards renting, with more people looking for flexibility and convenience.

Outlook

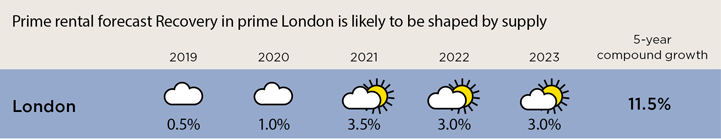

Rental recovery over the next few years in prime London is likely to be shaped by supply. As Brexit negotiations continue to weigh on sentiment in the sales market in the short term, there may be an increase in accidental landlords – or indeed boomerang landlords who take stock out of the rental market to sell but then bring it back if that sale fails to materialise. New build stock coming to completion may also provide competing supply for landlords in some markets.

However, demand remains strong from corporate tenants as well as families. We expect this to feed through into more robust rental growth as a more fluid sales market materialises to reduce competing supply. In the meantime, the key to capturing this demand is through providing value for money and high quality stock.

Source: Savills Research | Note: These forecasts apply to average rents in the second-hand market. New build values may not move at the same rate

Interested in other areas of the UK?

View all of our latest prime Market in Minutes research here.

.jpg)