In a hurry? Everything you need to know on the Western Sector (M4 Corridor) office market in under two minutes…

There are good levels of occupier demand although there are only two grade A buildings available in the town centre

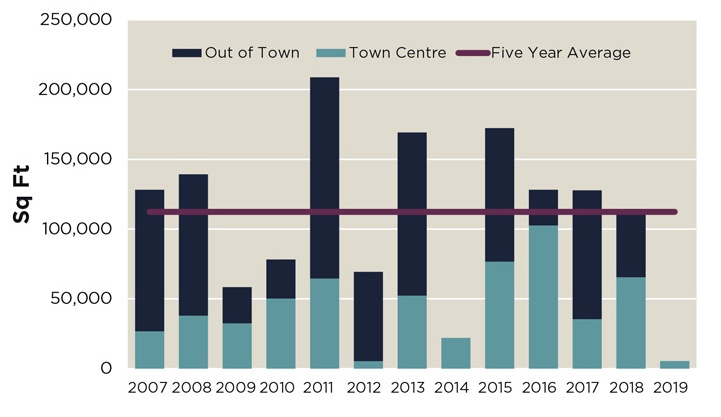

Maidenhead experienced steady transactional activity in Q1 2019, with only one deal above 5,000 sq ft which was Black Swan Analytics leasing 5,381 sq ft at The Place. This followed good levels of demand in 2018 with 111,000 sq ft leased which was on par with the five year average. The bulk of demand has been derived from smaller and medium size occupiers which is reflected in the median deal size in the last five years totalling 10,922 sq ft.

Take-up in 2018 was 13% below 2017 but on par with the five-year average

Source: Savills Research

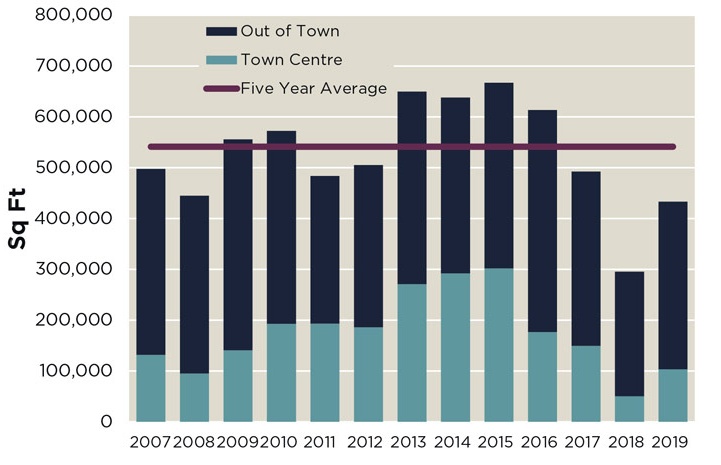

Supply in the town centre is limited with only two Grade A buildings available. These are The Pearce Building and Lantern where a combined 34,000 sq ft is available.

Supply has increased by 47% from 2018 although it is still 20% below the five-year average

Source: Savills Research

There are number of strategic sites coming forward in the town centre which should enable major development. The largest site is Squarestone Growth’s The Landing which is consented for 102,000 sq ft of new office space, 424 homes and 36,000 sq ft of retail. This will improve the quality of the public realm near the train station and enhance the arrival experience into Maidenhead from the station.

There are a number of strategic sites coming forward in the town centre which should enable a steady delivery of new town centre stock

Savills Research

Elsewhere, Aberdeen Standard Investments have secured consent for a new 80,000 sq ft development opposite the Train Station at King’s Chase. On Bell Street, Mayfair Capital have secured consent for a scheme totalling 40,000 sq ft and later this year, CLS Holdings intend to submit a planning application for a new development of 80,000 sq ft at St Cloud Gate.

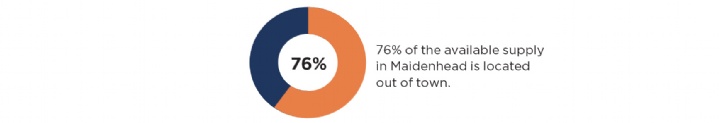

The out of town market offers large buildings with substantial car parking. There has been an improvement in the quality of the offering in the out of town market; Foundation Park which is owned by JP Morgan Asset Management has undergone various asset management initiatives. There are two large buildings at Maidenhead Office Park which are currently being refurbished by Aberdeen Standard and Kennedy Wilson respectively.

The rent disparity between the out of town market and town centre market is significant with town centre prime rents, 22% above the out of town market. This is notable when compared to Slough and Reading where the disparity is only 13% and 5%, respectively.

Key data points

Data for deals and supply above 5,000 sq ft

Investment overview

There was one investment deal in Q1 2019 which was Royal London buying Sita House for £12.75 million which reflected a yield of 4.70%. This followed a strong year of investment activity in 2018. The largest deal in 2018 was M&G Real Estate buying Tor for £35.02 million which reflected a yield of 5.75%. There was another deal above £30 million, Buckinghamshire County Council bought Voyager Place for £31.085 million which reflected a yield of 5.25%.

Maidenhead will continue to attract investor interest with the five year average annual take-up over 100,000 sq ft. Furthermore the town centre public realm is set to be improved and the Elizabeth Line will become operational in the town in 2020. There are also plans to redevelop the existing Nicholson’s Shopping Centre into a new mixed-use scheme which would improve the retail offering in town centre.

What to expect from Maidenhead in 2019?

- Supply in the town centre remains tight and The Lantern development could be the first scheme in the town to achieve in excess of £40.00 psf.

- There are at least five schemes either consented or proposed which could deliver in excess of 400,000 sq ft in the town centre over the next two to three years.

- Longer-term plans for the redevelopment of the Nicholson’s shopping centre will be a welcome boost in improving the retail and leisure offer in the town.

- Occupational demand from companies including Three, Mattel, Dun & Bradstreet and Sweco coupled with the arrival of the Elizabeth Line in 2020 is anticipated to be a catalyst for further occupational demand.

- We expect the technology and manufacturing and industry business sectors to continue to be the most active acquirers of space. Using the five year average, technology occupiers have accounted for 27% of take-up.

- By comparison to neighbouring Thames Valley markets Maidenhead is relatively under supplied in the provision of serviced and co-working space, so we expect increased take-up from the sector in 2019. Only 6,000 sq ft has been let to the serviced office sector since 2017. Whilst in Reading and Slough there has been 213,000 sq ft and 83,000 sq ft let to the sector since 2017, respectively.

Click here to read our Thames Offices reports