In a hurry? Everything you need to know on the Western Sector (M4 Corridor) office market in under two minutes…

Slough is a key office centre in the Thames Valley with corporate demand present in 2018 and set to continue in 2019

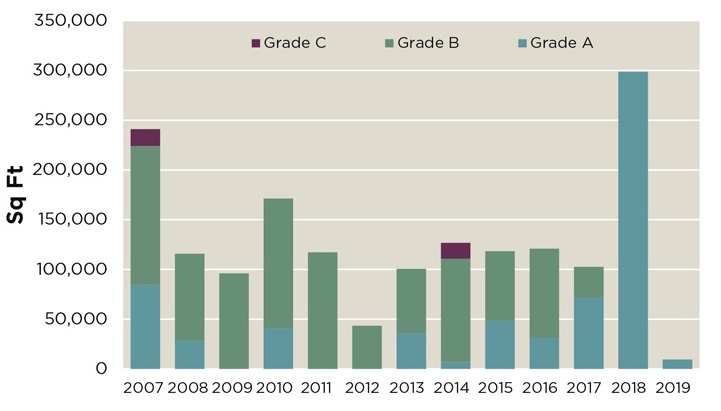

Slough experienced strong levels of occupier demand in 2018 with 299,000 sq ft transacted and was the highest level since 2005. This was a 191% increase on 2017 and 169% above the long-term average. The high levels of take-up were driven by Slough Borough Council purchasing 25 Windsor Road which comprises 110,000 sq ft for their own occupation. Furthermore, Stanley Black & Decker, Orange and Indivior all each leased over 20,000 sq ft in 2018 highlighting the corporate demand present in the market. At the end of Q1, only 9,429 sq ft has been transacted in Slough.

Take-up in 2018 was 191% above 2017 and 169% above the long-term average

Source: Savills Research

The new developments in the town centre and at Bath Road Central have experienced good levels of demand. Slough has the highest concentration of global headquarters outside of London and these occupiers are loyal to the town and willing to upgrade their current office space and pay higher rents in order to remain in Slough. This was exemplified by the three aforementioned deals with each occupier previously being based in Slough and they have committed their long-term future to the town. The theme of existing occupiers in the town, upgrading their office space has continued into 2019 with Page Group leasing 9,429 sq ft at LaSalle Investment Management’s The Switch. They are relocating from Wellington House.

The high specification of the new developments delivered in the current cycle is unprecedented in Slough. These new buildings have attracted both existing occupiers and inward movers to Slough

Savills Research

There was a rise in activity from serviced office operators in Slough in 2018 with four new centres opening. Citibase, Central Working, Spaces and Orega all opened new centres totaling a combined 83,000 sq ft, which accounted for 28% of all market take-up in 2018.

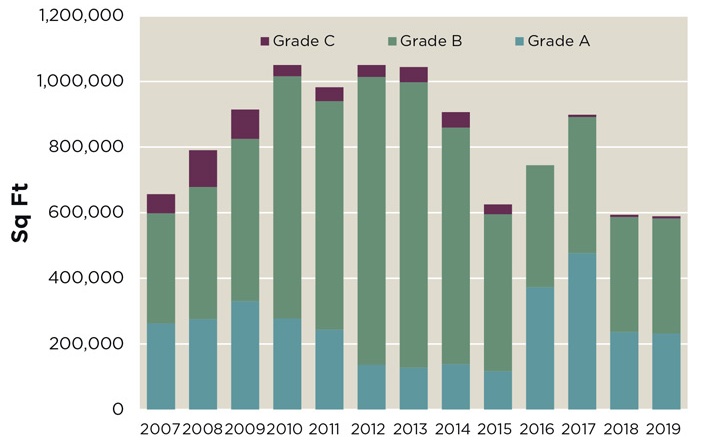

Supply in the market is at its lowest level since 2000 with 589,000 sq ft of all grades currently available. It is expected that supply will continue to fall in the market as there is currently no speculative development taking place and there are limited office development sites in the town centre. The specification of the new development has resulted in higher than expected rental growth. Prime rents currently stand at £36.00 per sq ft which is a 22% increase from 2016.

Supply has fallen by 36% from 2017 with further falls anticipated in 2019

Source: Savills Research

Key data points

Data for deals and supply above 5,000 sq ft

Key Occupational Deals

- Slough Borough Council, 109,000 sq ft, 25 Windsor Road

- Stanley Black & Decker, 47,000 sq ft, 270 Bath Road

- Spaces, 32,000 sq ft, The Porter Building

- Orange, 22,000 sq ft, The Porter Building

- Indivior, 21,000 sq ft, 234 Bath Road

Investment overview

There have been no investment deals recorded in Q1 19 and there were only two office buildings traded in Slough in 2018. These were Charter Court which was bought by M&G Real Estate for £13.25 million and The Porter Building which was a bought as a part of a portfolio by Spelthorne Borough Council. The Porter Building which is a new building was speculatively developed by Landid Property and Brockton Capital. Slough is highly regarded by investors. This is reflected in the long term average annual investment volumes totalling £72 million.

Slough continues to undergo its comprehensive regeneration with approximately 30 acres of the town centre being redeveloped in the project called “The Heart of Slough” by Slough Urban Renewal. This £450 million investment will create a new commercial and mixed-use district for the area. Furthermore, there are plans to redevelop the Queensmere and Observatory Shopping Centre into a new mixed-use scheme, which will improve the retail offering.

What to expect from Slough in 2019?

- After very strong demand in 2018, we expect take-up to be more in line with the long term average. The above average demand from the serviced office sector is unlikely to be replicated in 2019.

- Corporate demand is set to continue in Slough in 2019. AkzoNobel are set to be active in the market.

- We expect premium rents on smaller deals in 2019. Yitu paid £37.50 per sq ft at The Porter Building in 2018 where they leased 4,749 sq ft which was a record headline rent for the Slough market.

- The telecoms industry is strong in Slough with Orange, O2 and HTC all headquartered in the town. Three Chinese technology companies have recently opened new offices in Slough these are Yitu, Oppo Mobile and ZTE. There could be further activity from the sector in 2019 as the sector seeks to realise potential synergies by clustering together.

- Occupiers are loyal to Slough as there are attracted by the fast connections to central London, and the ability to recruit from a highly skilled talent pool. This provides a continued opportunity for investors to buy existing stock with asset management potential and take advantage of the current supply shortage.

.jpg)

Click here to read our Thames Offices reports

.jpg)