In a hurry? Everything you need to know on the Western Sector (M4 Corridor) office market in under two minutes…

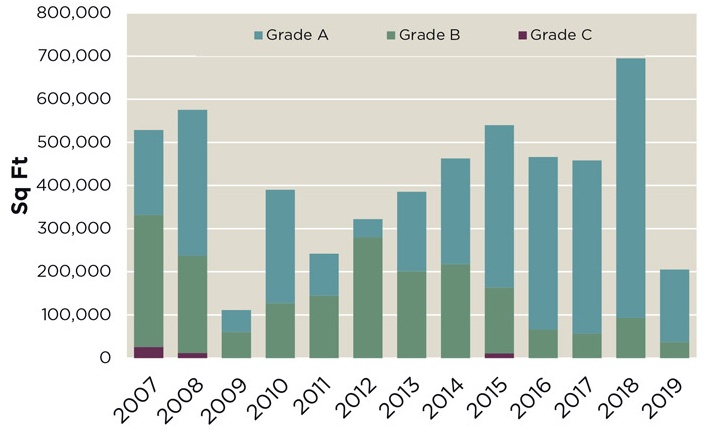

Take-up in the Reading office market during Q1 2019 was the second highest recorded for the first quarter in the last 10 years

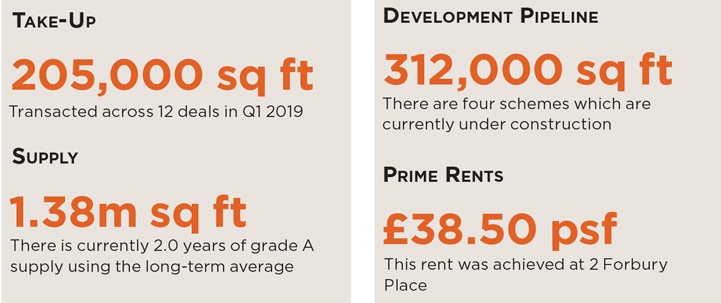

Despite the ongoing economic uncertainty, the Reading office market had a stellar year in 2018 and this has continued into 2019. It has been a very positive start to 2019 with 205,000 sq ft already transacted in Q1. Furthermore the town experienced its highest level of take-up in 2018 since 2000. There was 695,000 sq ft transacted in 2018 which was 52% above 2017 and a 76% increase on the long term average. This was driven by strong corporate demand and there were six deals above 30,000 sq ft in 2018.

Take-up in 2018 was 52% above 2017 and 76% above the long-term average

Source: Savills Research

Occupiers have been attracted to relocate to Reading due to the amenity, strong connectivity and the availability of Grade A office space. This was highlighted by Virgin Media, Sanofi and Ericsson who all moved to Reading in 2018, relocating from Hook and Guildford, respectively. The ability to recruit younger members of staff is a key consideration for corporates. Reading is well placed to attract younger staff with its excellent amenity offering and offers the second highest average wages in the UK outside of London.

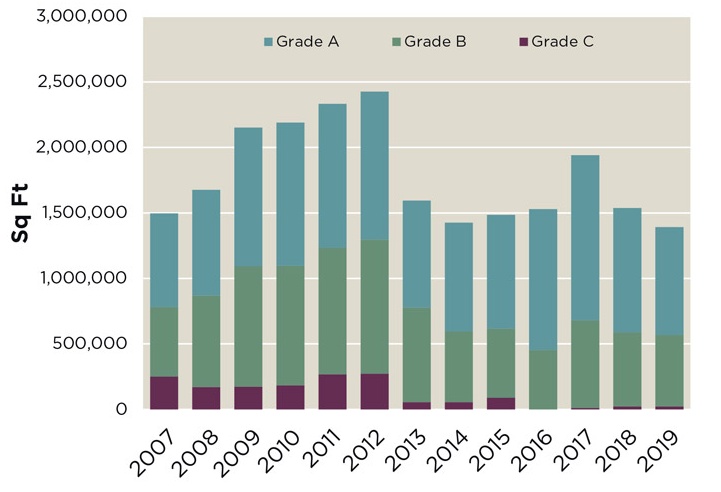

Reading is the largest office market in the South East and experienced take-up levels on par with some regional cities in 2018

Savills Research

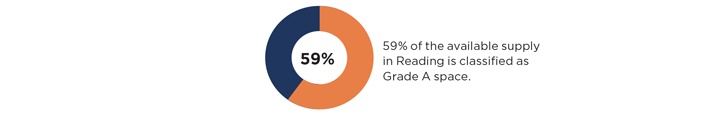

Supply has fallen after strong letting activity in 2018 and Q1 2019; it currently stands at 1.38 million sq ft which is 26% below the long term average. There is a lack of large buildings available in the town centre, the largest being 2 Forbury Place where 142,000 sq ft is available. As a result, the majority of the available supply is concentrated on business parks with 58% of available space being located out of town.

Supply has fallen by 28% from 2017 with further falls expected in 2019

Source: Savills Research

Developer confidence returned to the market in 2018. Mapletree are speculatively developing 400 and 450 Longwater Avenue, Green Park, both buildings will each comprise 114,000 sq ft. Furthermore, there are major refurbishments taking place at Arlington Business Park and Thames Valley Park. However, none of these schemes will complete in 2019 and we anticipate supply falling in the short term. It is expected that construction at Station Hill won’t start until 2020 where MGT, Lincoln and Baupost are planning to develop up to 600,000 sq ft of new offices and significant new residential.

Developer confidence returned to the market in 2018. Mapletree are speculatively developing 400 and 450 Longwater Avenue, Green Park, both buildings will each comprise 114,000 sq ft. Furthermore, there are major refurbishments taking place at Arlington Business Park and Thames Valley Park. However, none of these schemes will complete in 2019 and we anticipate supply falling in the short term. It is expected that construction at Station Hill won’t start until 2020 where MGT, Lincoln and Baupost are planning to develop up to 600,000 sq ft of new offices and significant new residential.

Prime rents continued to grow in 2018 and reached £38.50 per sq ft which is a 15% increase in the last five years.

Key data points

Data for deals and supply above 5,000 sq ft

Key Occupational Deals

- Virgin Media, 120,000 sq ft, 500 Brook Drive, Green Park

- Bottonline Technologies, 59,000 sq ft, Hive 3, Arlington Business Park

- Sanofi, 72,000 sq ft, Four10, Thames Valley Park

- KPMG, 45,000 sq ft, 2 Forbury Place

- HP, 30,000 sq ft, TVP2, Thames Valley Park

Investment overview

There were three investment deals in Q1 2019, the largest deal was Reading Borough Council buying Four10, Thames Valley Park for £38.73 million which reflected a yield of 5.20%. Investment volumes reached £318 million in 2018 which was 56% above 2017. The largest deal in 2018 was Spelthorne Borough Council buying Thames Tower for £123 million which was part of a wider portfolio. Thames Tower was speculatively developed by Brockton Capital and Landid Property. There has been 145,000 sq ft let at the building since it achieved practical completion in 2017.

Other notable deals in 2018 were The Valesco Group buying Microsoft’s headquarters at Thames Valley Park for £100 million and Aberdeen Standard acquiring The White Building for £51 million. We anticipate there being good levels of investor interest for refurbishment opportunities in the town centre given the current lack of supply of large Grade A buildings and the strong levels of occupier demand the market has experienced.

What to expect from Reading in 2019?

- We expect a drop in leasing activity in 2019 after strong levels of occupier demand in 2018. The lack of large Grade A buildings available for immediate occupation will limit corporate activity. This is notable in the town centre where there is only one building which can offer over 40,000 sq ft on continuous floors.

- We expect the 10,000–30,000 sq ft size band to the most active in regards to occupier demand in 2019 as this is the size band where the most Grade A space is available.

- There could be more inward movers into Reading from surrounding towns in 2019. This was a key theme in 2018. Three who are based in Maidenhead are currently searching for 200,00 sq ft in either Reading and Maidenhead and would represent a key occupier move in the Thames Valley.

- The technology sector was the most active business sector in 2018 and we expect this to continue in 2019. There was £487 million of corporate investment into technology businesses headquartered in Reading in 2018. This will create additional demand in the medium-term.

- We expect less activity from the serviced office sector in 2019. There has been 213,000 sq ft let to serviced office operators since 2017. It is clear that each centre will need a differentiator as there is a danger of saturation in the market.

Click here to read our Thames Offices reports