New records have been set in the Channel Islands office investment markets, supported by a deeper pool of international capital

As established international centres of business and finance, Jersey and Guernsey have a strong occupier base of multinational occupiers providing excellent covenant strengths.

Jersey’s office stock, totalling around 3 million sq ft, is focused in St Helier, with substantial Grade A office buildings added to the Esplanade and International Financial Centre (IFC) in recent years. Guernsey’s office stock is concentrated in St Peter Port, the Glategny Esplanade, and Admiral Park, a mixed-use business park. Office stock in Guernsey totals around 1.7 million sq ft.

Take up in both islands has predominantly come from on-island businesses transitioning from older and lower specification buildings into new, BREEAM rated, offices or newly refurbished offices. Requirements have been the result of organic growth, mergers or acquisitions.

.png)

Investment

The investor demand base for office investment is deepening in the Channel Islands, with major investment sales attracting bidders from the Middle East and Asia for the first time. Market liquidity is improving as new investors look to the islands, attracted by comparatively high returns, new investment-grade stock, long leases and good covenant strengths. Institutional investors and private funds are present, as well as HNWI investors.

In November 2018, Jersey’s Gaspé House was sold by Savills on behalf of Dandara to a Seaton Place Ltd for £90m, the largest ever single commercial property transaction in the Channel Islands, at a net initial yield of 6.16%. The sale of the 164,000 sq ft building attracted interest from a wide range of institutional and HNWI investors from around the world.

The same month, the sale of IFC 1 for £42.7m set a sub-6% yield, underlining the strength of the commercial property investment market on the island.

In April 2019, Guernsey’s Dorey Court and Martello Court, totalling 89,000 sq ft, were sold, again by Savills, to a private overseas buyer in April 2019 for £60.65m, at a net initial yield of 6.35%.

.png)

Major Channel Islands investment sales

Source: Savills Research

Prime yields have moved in, and stand at 6.25% in Guernsey and 6% in Jersey. Yields are still, on average, more than 100bps higher than UK regional offices, and substantially higher than some European and Asian global financial centres (see chart).

.png)

Prime office rents and yields, selected cities

Source: Savills Research

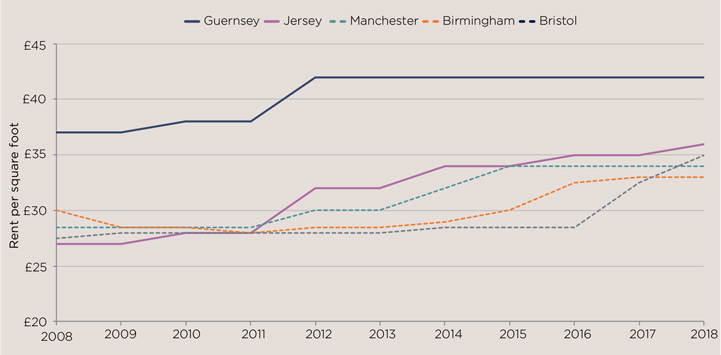

Prime headline office rents, trend

Source: Savills Research

Supply and take-up

Guernsey hasn’t seen any new office construction since 2011 and there is now a shortage of Grade A office space on the island. This means that options for existing and new occupiers are extremely limited, but has worked in landlords’ favour, sustaining rents at £43 per sq ft.

The leasehold take-up of prime offices in Guernsey was in the region of 50,000 sq ft in 2018, with a further 15,000 sq ft taken by owner-occupiers.

St Helier’s flat topography and better availability of development land has enabled the delivery of some substantial new office buildings in recent years. New construction, focused at the Esplanade and the IFC, is reflected in take-up volumes which we estimate at 140,000 sq ft in these areas alone last year.

Tenants have had a choice of buildings and developers have had to work hard to entice occupational tenants. Rents are lower than in Guernsey, but increased steadily since 2011 to an average of £36 per sq ft in 2018.

Both islands are characterised by low vacancy rates among Grade A stock, at 5% in Jersey, and just 2% in Guernsey.

Office market outlook

- A shortage of supply will continue to characterise the Guernsey office market. Planning permission is in place for a 61,000 sq ft office building at Admiral Park, but it requires a significant pre-let to commence. Longer term, the island’s government is aware of the lack of developable space, and beginning to explore opportunities to address this.

- Jersey saw exceptionally high levels of take-up last year, driven by the completion of three major office buildings within 12 months of each other, and the consolidation of some major occupiers. We do not expect levels to be sustained at this level in 2019, particularly now there are no major office completions in 2019.

- With more investment grade office stock in the islands and increased investment activity, a deeper pool of investors is attracted to the market than ever before. Yields may move in further as investor competition increases, but pricing will still be attractive compared to other major centres.

Retail

St Helier and St Peter Port are successful retail centres, but in common with other locations, the shift to online shopping is changing the nature of demand. Many UK internet retailers automatically deduct 20% UK VAT for Channel Island residents, making online shopping in the islands attractive.

Nonetheless, there are few significant voids on the main high streets, aside from a unit vacated by Next in St Helier’s King Street, following relocation to a larger store. Recent new entrants include Schuh and Superdry in Guernsey, and USC in Jersey. Rents are likely to track downwards, however, as retailers continue to evolve their models and consolidate their brick and mortar operations. Food and beverage (F&B) continue to be important retail occupiers and remain a bright spot; the islands have a vibrant restaurant and bar scene.

Read the other articles within this publication below

.jpg)

.jpg)