Strong market fundamentals are boosting operational performance across the capital, enticing a number of large international hotel groups

A bounce-back in Egypt’s tourism market has provided significant improvement to hotel operational performance

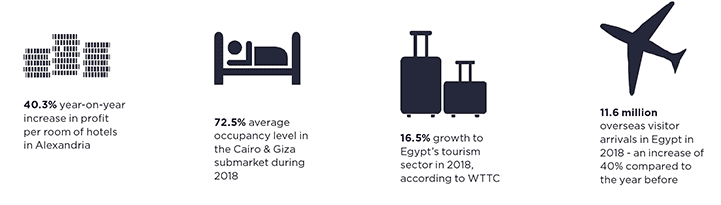

The recent surge in tourism has provided a substantial uplift to the hotel market in Egypt. In 2018, the Cairo and Giza submarket significantly outpaced the wider Africa and Middle East and Northern Africa (MENA) regions in terms of occupancy and average daily rate. The graph below highlights the extent to which this submarket has grown over 2018, with RevPAR increasing by 23.1% compared to the year before.

A region which has proven to outperform the MENA region as a whole is Alexandria, situated to the north-west of Cairo. The Mediterranean port-city saw RevPAR increase to $59 in January 2019. As a result, hotels in Alexandria saw profit per room soar by 40.3% year-on-year mirroring the resurgence in the wider Egypt economy. The positive growth story has not been a recent phenomenon, in-fact Alexandria has experienced 31 months of consecutive growth and this has resulted in robust profit conversion for hotels in the region. Alexandria currently has a total of 4,200 hotel rooms (as at January 2019) and this number is forecast to increase before the end of 2019.

.png)

Operational performance in the wider MENA region

Source: Savills Research, STR

Growth opportunities arise across Cairo’s hotel market

Cairo has witnessed considerable pick-up in hotel operational performance in 2018, with occupancy figures reaching 72.5% on average for the year – the highest experienced since 2008, according to STR. While stock growth has resulted in headwinds across some of the markets within the wider MENA region, it appears that Cairo and Giza have efficiently absorbed new stock additions. This is particularly positive given the level of stock growth seen within this region last year, with the introduction of a number of large hotels. This includes the Hilton Cairo Nile Maadi Towers. The project comprises of two towers consisting of 23 floors, the first is a residential tower and the second is a 256-room five-star hotel managed by Hilton, which is under construction.

Cairo’s hotel market now consists of over 18,800 rooms (as of December 2018) with major international groups accounting for the lion’s share of this. For example, Marriott and Hilton groups collectively account for a 37% share of hotel supply in the capital.

Looking ahead, hotel stock growth is projected to continue, with a number of large international hotel groups due to increase their presence in the capital. For example, IHG are scheduled to introduce a 187-room Crowne Plaza hotel in Sheikh Zayed City (West Cairo), forecast to open in 2021. Likewise, Rotana Hotels and Resorts are due to increase the luxury offer available in New Cairo City, recently signing a deal to launch a 200-room five-star hotel in the area.

Furthermore, Radisson Hotels and Resorts have signed an agreement to open a further six hotels in Egypt – four of which will be located within Cairo. Radisson have also committed to capitalising on the rapidly growing appeal for serviced apartments in the region, with a 163-apartment Radisson Blu Serviced Apartments Cairo Helipolis due to open in the third quarter of this year.

While extensive stock growth could produce further headwinds in terms of operational performance within some markets in the MENA region, it is expected that Cairo’s hotel sector will continue to improve given the strong market fundamentals comprising of improved connectivity, visitor arrival growth as well as a positive wider economic outlook and political stability.

.jpg)