A more stable and considered market is expected this year

Edinburgh remains the jewel of Scotland’s housing market, making up 37% of prime and 61% of million pound transactions in 2018. Transactions above £400,000 reached 1,931 during 2018, an increase of 12% compared to 2017, as more stock became available. Million pound transactions reached 128, the highest since 2007 and up nearly 20% from 2017.

At 7%, annual price growth in Edinburgh’s prime market was the highest in the UK according to the Savills index. Strong premiums and record prices per square foot continue to be achieved.

Whilst some buyers are waiting for the political dust to settle, there remains a surplus of motivated buyers and sellers

Savills Research

The capital of Scotland’s international profile and economy underpins its strong housing market. Economic growth has increased more over the last five years than most UK cities, with a higher percentage of the working-age population in employment. Edinburgh also has a large proportion of workers in high-skilled occupations, such as the finance and insurance sector, which currently makes up 20% of Edinburgh’s economic output.

Looking ahead, we expect a more stable and considered market in 2019, driven by realistic pricing. Whilst some buyers are waiting for the political dust to settle, there remains a surplus of motivated buyers, despite an increase in the number of sellers.

Prime hotspots

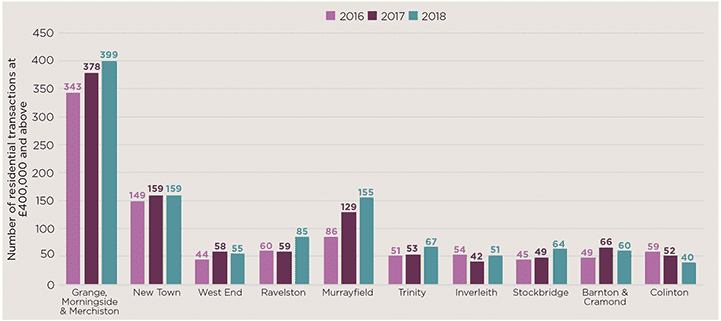

Our prime market analysis of Edinburgh covers 10 hotspots that make up the majority of transactions above £400,000. Edinburgh’s inner suburbs were the star performers in 2018. These include the Grange, Morningside and Merchiston area, south of the City Centre, where prime activity reached 399 last year, supported by a strong second hand market.

Ravelston was the stand-out area, where prime transactions, mostly second hand, increased by 44% from 59 in 2017 to 85 in 2018. Neighbouring Murrayfield witnessed 155 prime transactions, up by 20% from 2017, supported by new build activity at Donaldson’s and Westerlea Gardens. Meanwhile, prime activity in Trinity, Inverleith and Stockbridge increased from 144 in 2017 to 182 in 2018.

The central hotspots of the New Town and West End remained stable last year. Despite an increase in second hand activity, there were fewer new build transactions due to a number of sites reaching completion, resulting in a slight drop in overall prime activity.

A similar trend was also witnessed in the outer suburbs of Barnton, Cramond and Colinton where stable second hand activity was offset by a drop in new build transactions.

Prime transactions at £400,000 and above The market continues to grow across Edinburgh’s inner suburbs

Source: Savills Research

Wider Edinburgh market

Whilst Edinburgh’s prime transactional market increased last year, it was offset by a drop in supply and (subsequently) transactions below £400,000, thus leading to an overall 9% fall in Edinburgh City transactions across all price bands.

However, some areas bucked the trend, including the second hand market in the EH3 9 postcode, which includes the Quartermile development, and the EH10 6 area covering Fairmilehead.

Meanwhile, the new build market supported transactional growth in Currie, Gilmerton and Liberton. The new build market in Leith also stimulated the local second hand market.

The Lothians

The overall number of transactions in the surrounding Lothians area fell slightly last year, mainly due to a lack of supply below £200,000. However, an increase in transactions above £200,000 led to a 7% annual rise in the average transaction price last year.

The prime market, especially in East Lothian and Midlothian, continued to rise, with transactions above £400,000 reaching 470 during 2018, which was higher than the number in the Aberdeen area. The increase was mainly due to more new build transactions in North Berwick, Dunbar and Haddington in East Lothian and also Bonnyrigg, Loanhead and Roslin in Midlothian.

Interestingly, prime transactional growth across the Lothians was limited to £700,000, with a drop in activity above this level. As a result, the average prime transaction price above £400,000 fell by 8%, from £564,811 in 2017 to £519,903 in 2018.

Whereas activity above £700,000 during 2017 across the Lothians was widespread, most of the transactions in 2018 took place in the East Lothian hotspots of North Berwick and Gullane.

.jpg)

.jpg)