February transaction levels improve but volumes below average

Market comment and notable deals

Following a particularly slow start to the investment year with just two sales in January, February has generated turnover of approximately £345m across seven transactions, and takes 2019 turnover to date to just over £475m (see Graph 1). Although broadly similar to activity in February 2018, year-to-date volumes are down materially on the five-year average (£1.03bn), which was boosted by the exceptionally strong starts we observed in 2016 and 2017, where around £1.5bn exchanged in January and February of these years alone.

.jpg)

GRAPH 1 | Monthly turnover January 2018 to February 2019

Source: Savills Research

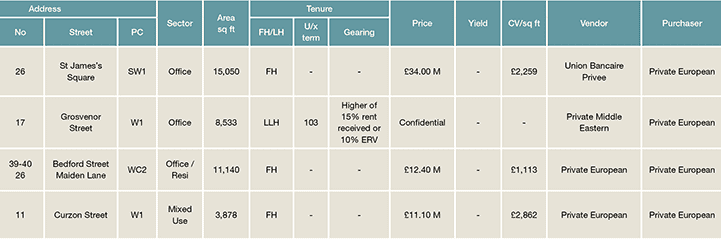

On behalf of a Private Middle Eastern investor, Savills has sold the long leasehold interest in 17 Grosvenor Street and 17 Brook’s Mews, W1, having quoted £20m for the core Mayfair office and residential opportunity. The office element totals 8,533 sq ft, has planning consent for an additional fifth floor of 1,100 sq ft and vacant possession is achievable within six months. 17 Brook’s Mews is a purpose-built residential building with a gross internal floor area of approximately 4,554 sq ft.

Capco has continued to expand its ownership within Covent Garden. Following their 2018 purchases on Maiden Lane and Wellington Street, the REIT has acquired The Lady magazine building, 39-40 Bedford Street and 26 Maiden Lane, WC2. The freehold totals 11,140 sq ft and occupies a prominent corner position on the southern boundary of their core estate, with Capco paying £12.4m at auction, reflecting a capital value of £1,113 per sq ft.

26 St James’s Square, SW1, a freehold office totalling 15,050 sq ft and where vacant possession is achievable by January 2020, has been sold to a Private European investor. Continuing to demonstrate appetite for value-add and core plus opportunities, the owner-occupier and Swiss private bank Union Bancaire Privée, who also constructed the property in 1990, has sold for £34m, reflecting a capital value of £2,259 per sq ft.

TABLE 1 | Key deals in February 2019

Source: Savills Research

Our records show approximately £590m across 11 deals as under offer, however importantly eight of these are hangovers from last year with the marketing of these starting in Q3 and Q4 2018. Of the £930m of assets (15 opportunities) that we have recorded as available since the new year only two have exchanged following brief open marketing periods. UK investors continue to dominate in the West End by number of transactions.

.jpg)

GRAPH 2 | Vendor nationality by volume (January & February 2019)

Source: Savills Research

We tend to take a backwards glance, primarily into the past month’s activity, within these bulletins. However, given the wider ongoing political noise around the critical end of March date it would be sensible to assume that no records will be broken in Q1 2019 especially considering we are experiencing muted sales levels.

The MSCI average net initial yield remains at 3.60%, a level at which it has hovered around since June 2018, and the equivalent yield has shifted out marginally to 4.76%. Given the market mood Savills prime yield now stands at 3.75% (see Graph 3).

.jpg)

GRAPH 3 | West End yields

Source: Savills Research, MSCI