With above-average growth forecasts for homes and a new wave of city centre regeneration schemes, the signs are encouraging for Newcastle

Residential

With house prices in the North only recently returning to pre-credit crunch levels, there is more capacity for both household finances and mortgage lenders to support growth over the next five years than in other regions across the UK. Smaller deposits for first-time buyers and lower home-mover loan-to-income ratios compared with most of the rest of the UK are expected to underpin demand in the owner occupier market.

Meanwhile, we expect the ability to achieve higher income yields in the northern cities to underpin investment demand from both institutional and private investors. We forecast five-year compound house price growth of 17.6% in the North East, outperforming the UK.

There is more capacity for both household finances and mortgage lenders to support growth over the next five years than in other regions across the UK

Savills Research

Commercial

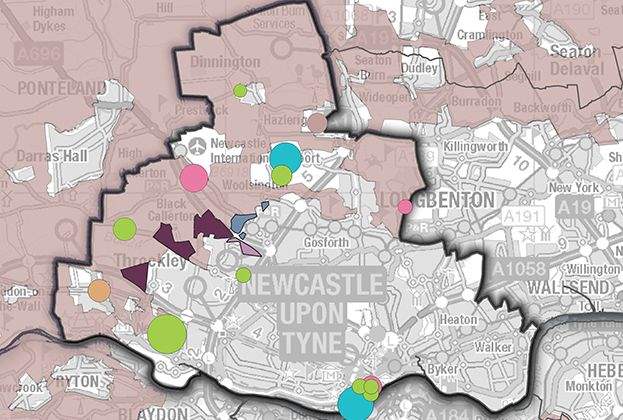

After a decade of limited developments within Newcastle’s core, the cranes are now firmly back on the horizon. Newcastle is seeing a new wave of mixed use city centre regeneration schemes, including the Helix, East Pilgrim Street and Stephenson Quarter, which is revitalising the urban core and enabling it to expand outward. Each of these schemes is offering something different providing space which will complement one another rather than compete. While top rents have remained static at around £23 per sq. ft. over the last five years, we expect to see rental growth of 6% by 2020 as new developments complete.

The implications of a forward-thinking and targeted approach to enhancing mixed use schemes will have a positive impact on people wanting to live, work and play there and ultimately strengthens the demand for the existing commercial space located there.

.png)

Residential values annual change forecasts

Source: Savills Research

.jpg)