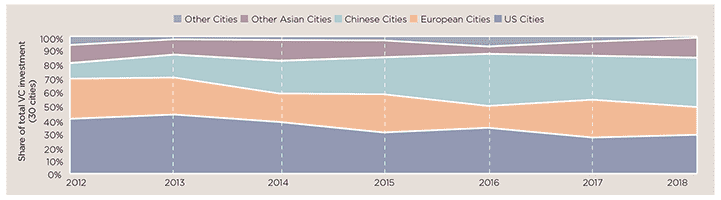

Chinese Tech cities now account for a higher share of VC investment than their US counterparts

Chinese Tech Cities have risen rapidly on the global stage, and now account for a higher share of VC investment than their US counterparts.

VC investment volumes across the 30 Tech Cities rose from $37 billion in 2012 to $207.8 billion in 2018. While the scale of overall investment has risen, the US-city share of these volumes has dropped from 40% to 28% (see chart). Chinese cities, by contrast, have seen their share rise from 11% to 36% over the same period.

Figure 3 | Chinese cities take a higher global share of VC investment*

Source: Savills World Research using Pitchbook | *Across our 30-city sample

For every US tech giant there is a Chinese equivalent. The US has ‘FAANG’ (Facebook, Amazon, Apple, Netflix, and Google). China has ‘BAT’ (Baidu, Alibaba and Tencent), and more recently the mobile-driven ‘TMD’ (news app Toutiao, group-buying service Meituan-Dianping, and ride-sharing firm Didi Chuxing).

Tapping into a vast, internet-enabled domestic market they have risen fast, and thanks to integrated payment systems, revolutionised the way business is conducted in the country. China is also a global leader in AI.

.jpg)

VC investment volumes across the 30 Tech Cities rose from $37 billion in 2012 to $207.8 billion in 2018

Savills World Research

Already established as a centre of tech manufacturing, home-grown hardware firms are now making global moves.

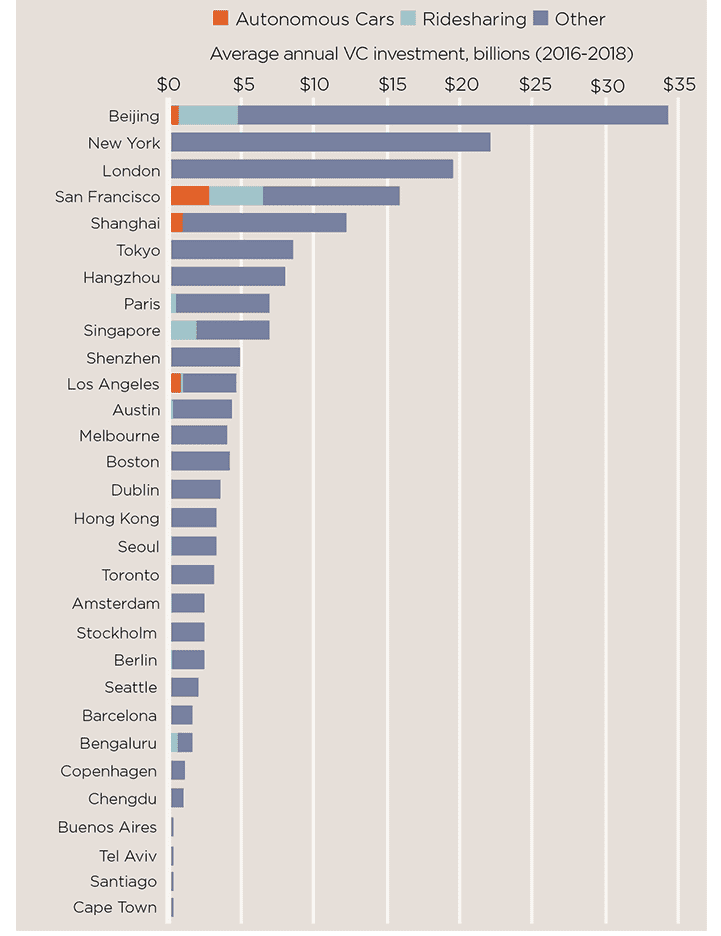

Beijing sees by far the greatest VC investment, an average of $34 billion per annum in the last three years, with volumes higher even than New York and San Francisco. Close to regulators some of China’s largest tech firms are headquartered in Beijing.

Our ranking puts Shanghai ahead as a more ‘global’ tech city, however, thanks to an international business environment and better of quality of life for residents (Beijing’s air quality is the worst of any of our Tech Cities).

Elsewhere, Shenzhen, an exceptionally youthful tech city, benefits from strengthening links with Hong Kong (just 15 minutes away via high-speed rail) and a new tech-stock exchange, ChiNext. Hangzhou, home to Alibaba, stands out as a lower cost ‘smaller’ city (population 9.5m), famed for its West Lake UNESCO World Heritage site. Chengdu’s tech economy has risen on outsourcing, its government is pro-business and tech investment is rising.

Figure 4 | VC investment volumes by city

Source: Savills World Research using Pitchbook

Chinese Tech cities now account for a higher share of VC investment than their US counterparts

Savills World Research

.png)

Figure 5 | Chinese Tech Cities rankings

Source: Savills World Research using Pitchbook | *Average annual venture capital investment between 2016 and 2018.

.jpg)

.jpg)