Greenfield and urban development land values flatten in the UK during the final quarter of 2018

.png)

Focal points Development news and analysis in brief

Static values

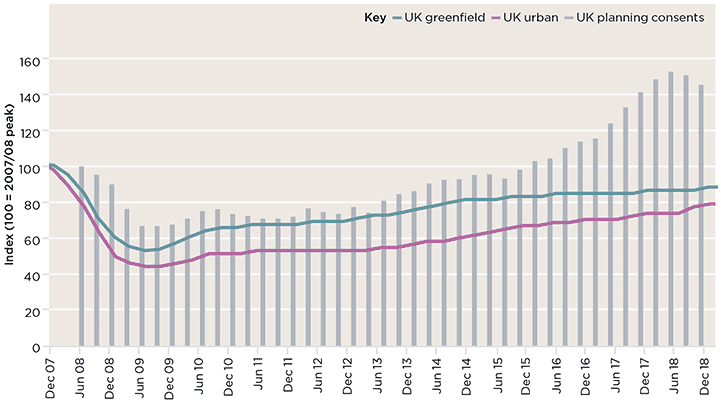

During the last quarter of 2018, values have flattened for both greenfield and urban development land in the UK, bringing annual land value growth to 1.9% for greenfield sites and 6.2% for urban sites. While there is still interest for sites, it is balanced by some Brexit-related uncertainty, steadying sales rates and rising build costs. The South East has been most affected by these pressures, reflected in the first fall in land values in two years.

Slower land value growth Values flatten for UK greenfield and urban development land

Source: Savills Research, HBF, Glenigan

UK land value growth

Source: Savills Research

South East slows

Greenfield land values in the South East fell by 0.6% during the last quarter. House price growth in this region has been slowing all year with Nationwide reporting falls of 0.5% and 2% in the outer South East and outer Metropolitan regions respectively in 2018.

This is partly the consequence of the cyclical slowdown in house prices that we are currently experiencing, which is concentrated in London and the South East. These are the areas with the greatest affordability constraints and pressure on values.

By contrast, greenfield land values in Scotland and the Midlands rose slightly in the last quarter where house prices have grown notably in the past year too.

In 2018, house prices in Scotland, East Midlands and West Midlands rose by 1.7%, 2.9% and 1.6% respectively, all surpassing the UK average of 0.5%.

.png)

House price growth in 2018

Source: Nationwide

The backdrop of Brexit

Despite prevailing political uncertainty, sentiment has remained resilient with 97% of Savills land agents reporting positive or neutral sentiment in the land market. Savills trading of land has also remained robust this year.

As reported, housing associations are continuing to expand their presence, as they are competitively bidding on sites across the country.

The UK’s forthcoming withdrawal from the EU has injected uncertainty into the economy, and this is feeding through into the land market. Due to the ambiguity surrounding the outcome of Brexit, some land buyers have adopted a wait and see approach, deferring activity and delaying deals and transactions. However, this may prove short-lived if there is greater clarity on Brexit.

In addition, high levels of supply of development land and increasing build costs have suppressed land value growth. The supply of permissioned land remains well ahead of national delivery as 362,000 homes were granted consent in the year to Q3 2018. Build costs increased by 3.9% in the year to Q3 2018 and initial results show they continued to rise in Q4 2018, according to the BCIS Private Housing Construction Price Index. This compares with house price inflation during 2018 of 0.5% according to Nationwide.

Despite prevailing political uncertainty, sentiment has remained resilient with 97% of Savills land agents reporting positive or neutral sentiment in the land market

Savills Research

Steady sales rates

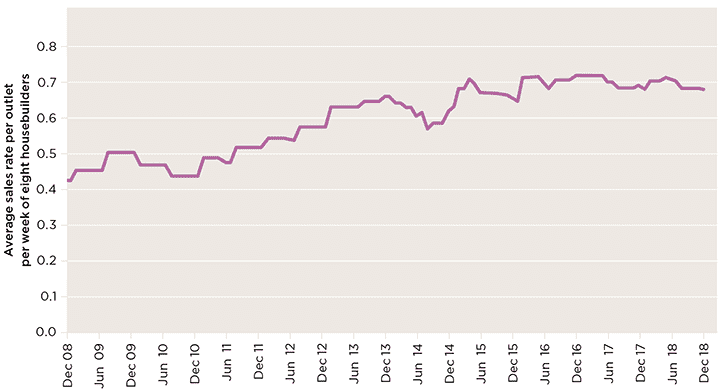

Steady sales rates Most housebuilders are reporting stable sales rates

Source: Savills Research using Housebuilder reports

Sales rates are relatively stable, but there are signs of new build buyers being more cautious.

Taylor Wimpey has reported higher sales rates per outlet than last year. However, many of the other major housebuilders have reported stable or, in some cases, modest falls in sales rates.

There is the most pressure on sales rates in London and the South East where affordability is most stretched.

Buyers are showing signs of being more cautious and using more incentives. In Q3 2018, 40% of housebuilders surveyed by the HBF considered buyer confidence to be a major constraint to development, up from 15% in the equivalent period in 2017.

The survey also reported fewer site visitors and net reservations compared with last year.

More buyers are using sales incentives too. The use of sales incentives increased for the sixth month in succession, with the monthly net balance coming in at 56%, compared with 30% in the equivalent period last year.

Undoubtedly, the affordability pressures on buyers are leading them to make greater use of sales incentives, and the uncertainty due to Brexit and slower house price growth in some markets are taking their toll.

Interested in other areas of the UK?

View all of our latest residential Market in Minutes research here.