We explore why the prime markets beyond London’s commuter belt have performed more strongly in the recent past and whether we anticipate this to continue

The prime markets remain cautious: Our analysis starts by examining the prime wider South market in a national context

Uncertainty surrounding the UK’s exit from the EU, and what this means for the economy and household finances, has resulted in continued caution among both buyers and sellers of prime residential property.

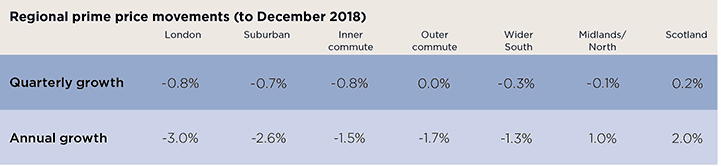

In the final quarter of 2018, values across the prime regional housing markets of the UK fell by 0.3%, leaving them 0.9% below where they were at the start of the year. Although this decline in values is small, it is the fourth consecutive quarter that values have softened.

The ongoing price-sensitive nature of the market has meant property has had to be priced realistically to attract buyers. Where this has been the case, deals have continued to be agreed. Stand-out and unusual properties that don’t often come to the market have commanded the strongest interest.

The prime markets closest to the capital have felt the effects of a weaker London market. While they have experienced greater falls in value than areas further from London, prices in the suburban and commuter markets still only fell by 2.6% and 1.6% respectively in 2018.

Values of other prime properties in the wider south have reduced by an average of 1.3% in the past 12 months. By contrast, in Scotland and the Midlands & North, prices have risen modestly by 2.0% and 1.0% respectively over the past year.

On average, prices for smaller, less expensive properties have held up best. Property worth £1 million or less has maintained modest annual price increases of 0.4% while £2 million-plus properties have fallen by an average of 3.1%

Definition of prime property This market consists of the most desirable and aspirational property by location, aesthetics, standards of accommodation and value. Typically, it comprises properties in the top 5% of the market by house price.

Source: Savills Research

.png)

Price monitor Key statistics for house price growth

Source: Savills Research

.png)

Growth in the prime wider South market by location in the past five years

Source: Savills Research

Prime wider south in focus: Urban outperforms rural

The wider South in focus Sentiment is a constraint, but we expect a return to growth

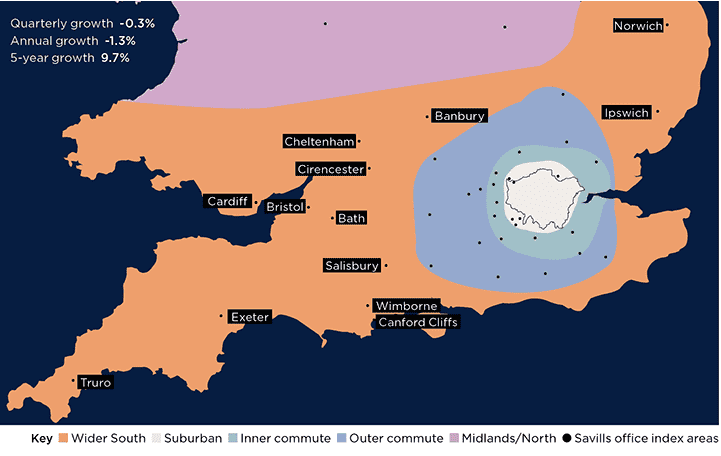

Values across the wider South of England and South Wales fell by an average of 0.3% in Q4 of 2018, leaving them 1.3% below where they stood a year previously. Unsurprisingly, there is significant variation in performance across this broad band of the country, with the coastal markets seeing growth of 1.2% on average over Q4 compared with the high-value markets of Bath and Cheltenham, which had falls of 1.7% and 1.2%, following a period of higher growth. Stamp duty is still subduing the top end of the market, with prices for £2m+ properties falling 3.8% since 2014.

Over the past five years, prime property in desirable towns/cities (13.3% growth) has outperformed its village (8.9%) and rural (7.3%) counterparts as townhouses have risen in popularity relative to the traditional farmhouse, rectory or manor house. However, annual price growth has been more or less muted across all these locations.

Outlook

The relative value offered in the regional prime markets compared with London will underpin future growth. However, in the short to medium term, we expect the prime markets to remain price sensitive and to be driven by needs-based purchasers. Quality is key in this cautious market – vendors must present stock of the best possible condition.

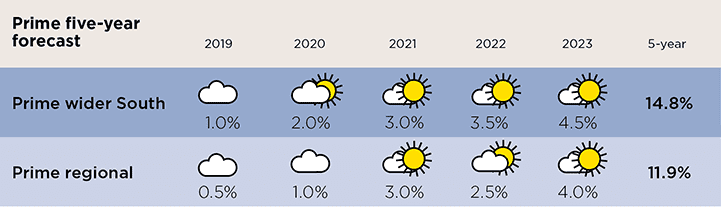

Beyond London’s commuter belt, we are expecting higher house price growth than the markets closest to the capital. Much of this market is less affected by stamp duty changes and not as reliant on equity out of London. The wealth generated in the local economy and, in some cases, demand from second home buyers, are stronger drivers of price growth.

Source: Savills Research

Note: These forecasts apply to average prices in the secondhand market. New build values may not move at the same rate

Interested in other areas of the UK?

View all of our latest prime Market in Minutes research here.