There is continued caution in London’s prime housing market despite increasing realism

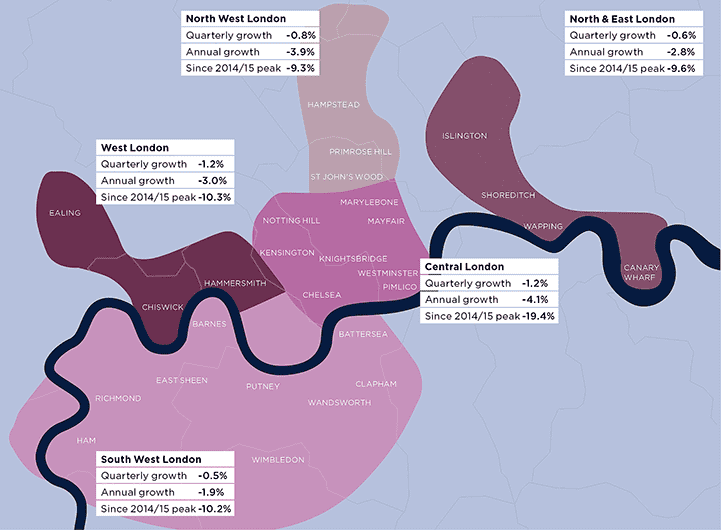

House price movements to end of 2018 Buyers remain wary due to ongoing uncertainty

Source: Savills Research

Values in London’s prime housing markets continued to ease back in the final quarter of 2018. Given both the political machinations of the past three months and speculation about the impact of a possible no-deal Brexit, a lack of urgency among home buyers is no surprise.

In central London, the proposal of a 1% to 3% stamp duty surcharge for overseas buyers briefly dampened sentiment. However, the Budget made clear that this would be introduced at the bottom end of this range – suggesting a more benign impact than some had feared.

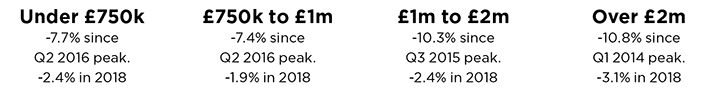

The aggregate effect of the price adjustments in prime central London, since mid-2014, leaves average values almost 20% below their peak. Meanwhile, in the other, more domestic prime London markets, total price falls that were slightly later in coming, have now hit double-digit territory. Where committed sellers have adjusted their price expectations to reflect this, the market has continued to tick over.

Experience of previous downturns indicates that these price falls leave prime London housing relatively good value. In time, we expect this to bring buyers back to the market, with the prospect of a return to price growth post-Brexit. Until then, we expect the market to remain price sensitive.

Definition of prime property This market consists of the most desirable and aspirational property by location, aesthetics, standards of accommodation and value. Typically, it comprises properties in the top 5% of the market by house price.

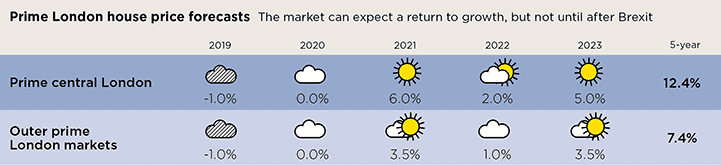

Source: Savills Research

Note: These forecasts apply to average values in the secondhand market. New build values may not move at the same rate

.png)

Price sensitive Key statistics for house price growth

Source: Savills Research

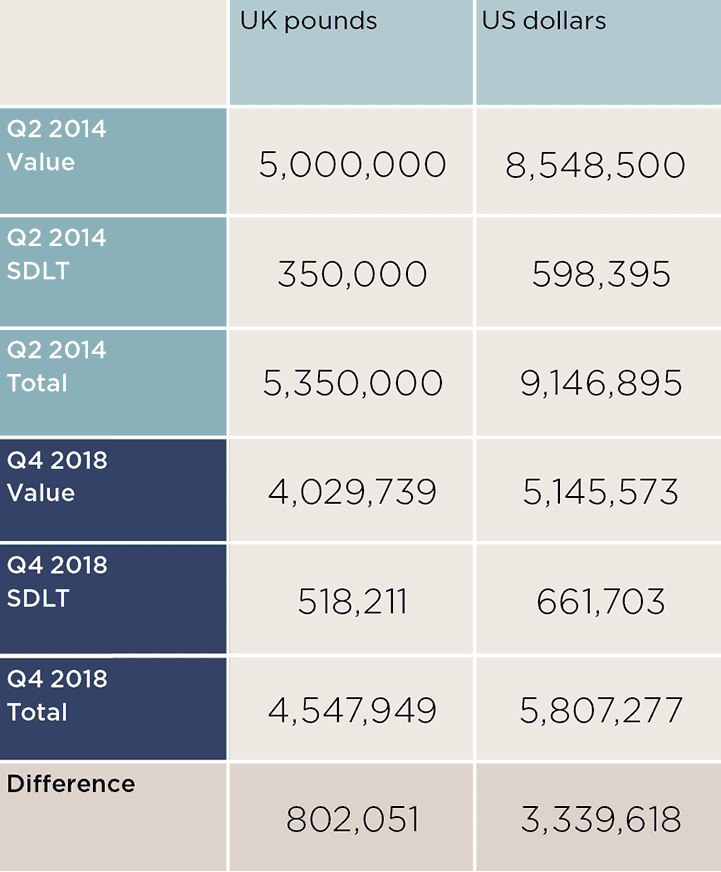

Double the discount in central London

We estimate that a central London property worth £5 million at the height of the market in 2014 would now be purchased for closer to £4.03 million. That adjustment far outweighs the additional stamp duty payable, even as a second home or investment purchase.

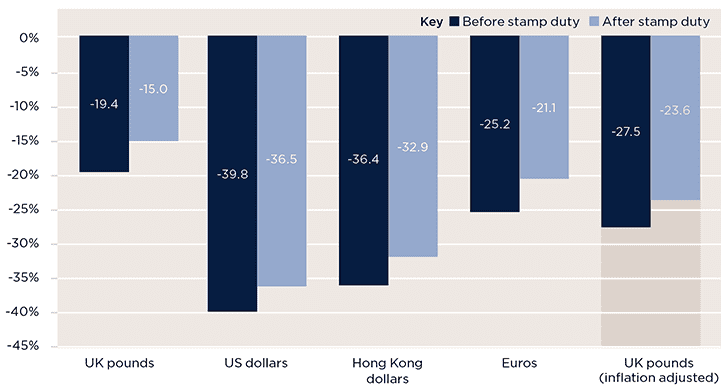

The net 15% cut in combined cost of purchase is much higher for overseas buyers with a currency advantage. Historically, this has motivated overseas buyers to buy back into central London residential. To date, such buyers have been more reluctant because of the political backdrop, but, once uncertainty clears, this discount should underpin a bounce in values.

Discount for a £5m central London second home The price drop since 2014

Source: Savills Research

Good value? Price change for a £5m prime central London property since June 2014

Source: Savills Research

Across the outer prime London market Price drops elsewhere across the capital

Beyond central London

The Nationwide house price index suggests prices fell by an average of 0.8% across Greater London in 2018, to just short of £467,000 (but still 2.2 times the UK average). That reflects Brexit uncertainty and the effect of mortgage regulation on how much households can borrow. Prime housing markets such as Clapham, Chiswick and Canary Wharf are generally less mortgage reliant, especially in the higher price bands – but debt still plays a part. That suggests gradual interest rate rises are likely to constrain house price growth more than in central London in the medium term, with a muted bounce in values as sentiment improves.

Interested in other areas of the UK?

View all of our latest prime Market in Minutes research here.