Market impact

Three ways in which the housing market cycle will have an impact on affordable supply

.png)

Three ways in which the housing market cycle will have an impact on affordable supply

Low levels of grant funding, by historical standards, have led housing associations to develop a cross-subsidy model in recent years. The number of homes built for market sale by housing associations grew 24% between 2016/17 and 2017/18. Housing associations are increasingly reliant on proceeds from market development to fund affordable housing through the crosssubsidy model. They have never been more exposed to a cyclical slowdown in the housing market.

Particularly in London and the South, the cross-subsidy model has benefitted from strong house price growth, boosting the level of cross-subsidy generated. But the housing market is slowing down: price growth is decelerating and transaction volumes are falling, albeit that many new home sales are supported by Help to Buy.

This makes selling new homes on the open market more challenging. Housing association activity is likely to become constrained by a tightening housing market as the generation of cross-subsidy will slow. This cyclical slowdown in house prices is concentrated in London and the South, the areas with the greatest need for affordable housing.

The slowdown in new homes sales rates has created opportunities for housing associations to acquire market sale homes from housebuilders to switch into shared ownership.

.png)

Figure 1 House price growth

Source: Savills Research using Land Registry

Sir Oliver Letwin noted in his review that there is “virtually limitless” demand for affordable housing. This is where the housing association crosssubsidy model, supported by grant, has the most potential to contribute to housing delivery.

Grant funding can support the cross-subsidy model, helping to reduce sales risk. Figure 2 illustrates a sectorwide cross-tenure delivery programme based on £5 billion of working capital. It shows the greater the amount of grant, the more new homes can be built.

More importantly, it shows that increased grant helps rebalance the cross-subsidy model: it shifts the balance of tenures away from market sale to more counter-cyclical submarket rented tenures.

Help to Buy

New market housing completions are closely related to underlying market activity: over the last 40 years, there has been approximately one new market home built for every 10 homes sales.

But currently, the number of new homes being built is increasing, while the total number of homes being sold is falling. This deviation from the longterm trend is due to the competitive advantage given to new build by Help to Buy and the growing number of Build to Rent schemes.

The Chancellor confirmed in the 2018 Budget that the phasing out of Help to Buy in its current form will start in 2021. To keep new housing delivery on track to meet the Government’s target of 300,000 per year by the mid-2020s, the additional sales supported by Help to Buy will need to be replaced. This could be achieved through increasing the use of higher loan to value mortgage products, which are increasingly available, and through a greater diversity of tenure, including shared ownership.

.png)

Figure 2 Grant can rebalance a development program away from sales

Source: Savills Research using Land Registry

Assumptions: Based on a high-level appraisal of standard greenfield development in a market like Milton Keynes. Assumes nil land value for up to 17.5% of the affordable housing; grant paid at £28k per unit of shared ownership, £50k per unit of affordable rent. This excludes social rent, which would require more grant per unit in higher value markets. In 2016, we calculated that the housing association sector could, in theory, increase gearing supported by existing cashflow to raise £7.4bn of working capital (see Spotlight: Housing Association Financial Capacity).

The amount of nil grant Section 106 delivery has moved to a new level since 2013. It has increased to over 8% of all housing delivery, up from under 4% in 2012/13 and in the previous peak years of 2006 to 2008.

This has been enabled through stronger sales rates, following the introduction of Help to Buy, and rising house prices and land values. The number of social rented homes delivered by Section 106 has remained broadly constant, but there have been big increases in tenures that require less capital subsidy, affordable rent and shared ownership.

Section 106 is an important source of new affordable homes for housing associations, particularly for those with limited development and construction capacity. But competition is increasing.

New entrants to the market, such as for-profit providers Sage Housing and Heylo have added to demand for Section 106 units. Sage Housing has committed to buying 20,000 Section 106 units over 4.5 years; the number of nil grant Section 106 homes reached a new peak in 2016/17 at c.18,000 homes.

Section 106 is also vulnerable to market cycles. Annual completions fell 50% between 2006–09 and 2009/10. The same fall from current levels would cut delivery to c.9,000 homes per year. This is a major risk for housing associations reliant on Section 106 to meet their development targets, unless grant funding were increased.

In its current form, Section 106 can only be a small proportion of affordable housing supply. Affordable housing delivered through Section 106 has averaged around 8% of total delivery in recent years.

.png)

Figure 3 Section 106 has reached a new high

Source: MHCLG

Assuming this level remains constant and the Government housing target of 300,000 homes is met by the mid 2020s, there would be c.24,000 Section 106 completions per year.

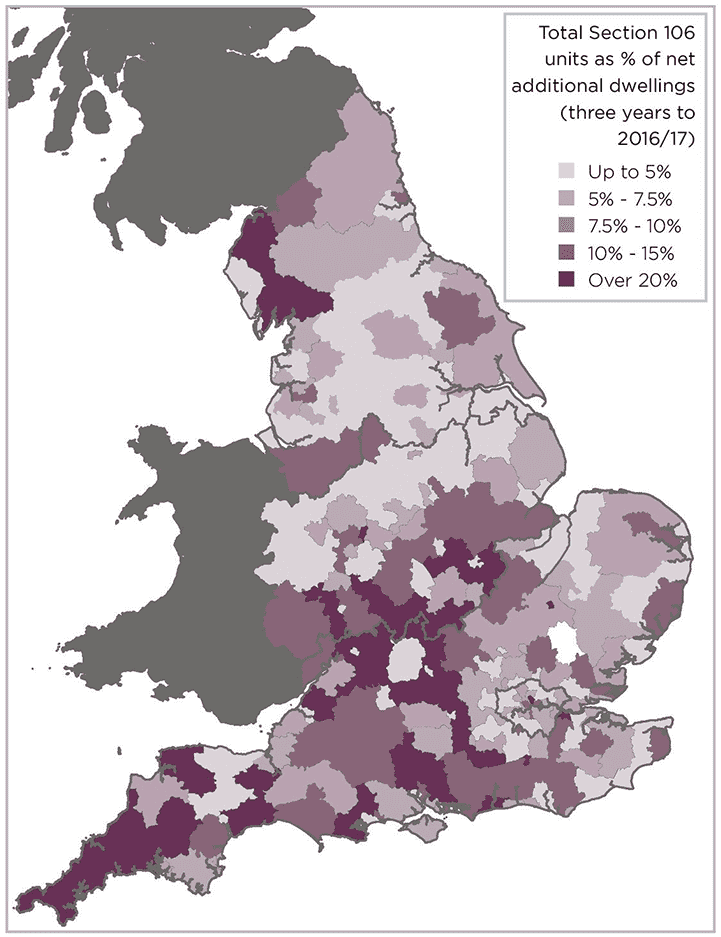

Figure 4 shows the pattern of Section 106 delivery over the last three years. There have been many homes delivered via Section 106 in the middle belt of the country, particularly parts of the southern Midlands where greenfield development dominates.

In London and the South East, there has been a huge lack of Section 106 despite high house prices. But high existing use values for residential development land and a scarcity of greenfield land supply limits the capacity for land value capture. Many of the local authorities in London’s greenbelt do not have up-to-date Local Plans (Spotlight on Planning: New Measures To Increase Delivery), so lack modern policy requirements for affordable housing.

This is beginning to change in parts of London. Residential land values have fallen by 4.9% in central London, as a result of decelerating house price growth and increasingly complex policy requirements (Market In Minutes: Residential Development Land, October 2018). Falling residential land values sounds like a good thing for developers, but if they fall below the land values for other uses, then less land will come forward for housing.

Late cycle price growth in the North will create some opportunity for further affordable housing delivery via Section 106 capture of land value. But with lower house price growth forecast over the next five years (Residential Property Forecasts) and continued build cost inflation, the trend of an expanding pool of land value uplift is unlikely to continue (Spotlight: What Next For Housebuilding?).

Figure 4 Local variation in Section 106

Source: MHCLG

2 other article(s) in this publication