Market adjusts to lower land value in London

.png)

Focal points Development news and analysis in brief

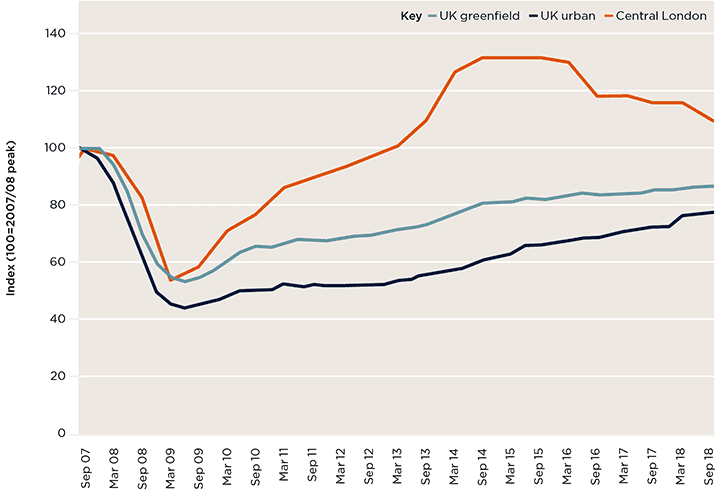

Residential development land values in central London have fallen, in contrast to office development land values which remain broadly flat.

In the past six months, residential land values in central London have fallen by 4.9%, taking them to 16% below their 2014/2015 peak. This is, in part, due to falls in house prices in the prime London markets, which fell 3.3% in the past year and are now 11% below their peak. It also takes into account other factors, including build-cost inflation, sales rates and an increasingly complex policy environment.

Recently, there has been a trend to lower numbers of land sales in London due to the uncertainty over the impact of Brexit and falling values. In 2017, there were 15% fewer sales in London than in 2016 (according to Molior) and the first half of 2018 has continued to be slow. However, vendors have become more realistic in their pricing and there are more sites under offer and on the market. As a result, we expect there to be more land sales in London in the second half of 2018 compared with the first half. It remains to be seen whether increased transactional activity will continue into Q1 2019.

In Westminster, and Kensington and Chelsea, development sites are increasingly being considered for alternative uses, such as hotel or office use rather than residential. This is due to falling house prices and more ambitious application of planning policies. Sites that have sold recently in this area have primarily been those with historic planning permissions that do not carry the same affordable housing requirements.

In contrast, office development land values in central London remain unchanged over the past six months. Supply and demand remain in balance with low levels of speculative office development, and vacancy rates remain at historically low levels due to many tenants staying in place.

Under pressure Central London residential land values continue to fall

Source: Savills Research

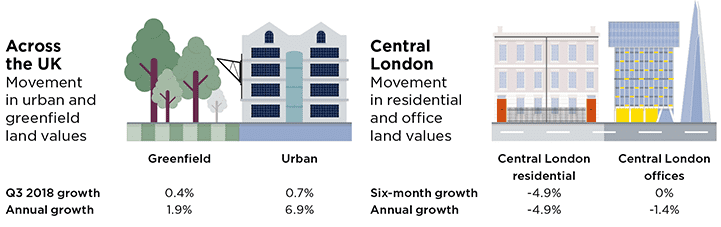

Scarcity of quality sites in Scotland

In the past quarter, greenfield and urban land values in the UK have grown by 0.4% and 0.7% respectively, taking annual growth to 1.9% and 6.9%. Much of this growth has been led by Scotland where greenfield land values increased by 1.0% and urban values by 2.5% during the quarter.

The increases in land value continue to be supported by house price growth. In the year to July, prices in Scotland grew by 4.8%, exceeding the national average of 3.8%.

A scarcity of high-quality developable sites in Scotland, particularly to the west of the country, has led to increased competition for development land. In Glasgow, house prices grew by 7.7% in the last year and around 6% for the Greater Glasgow area. Yet, homes are still relatively affordable with house prices 4.7 times average earnings in Glasgow and 5.1 in Scotland, compared with 7.6 for Great Britain. Limited availability of secondhand homes is also supporting demand for new build homes.

Having worked through their strategic land banks, housebuilders are now looking for more sites in the short to medium term across Scotland, increasing the competition for sites. There is particular demand for sites where homes will be priced up to the Scottish Help to Buy threshold of £200,000.

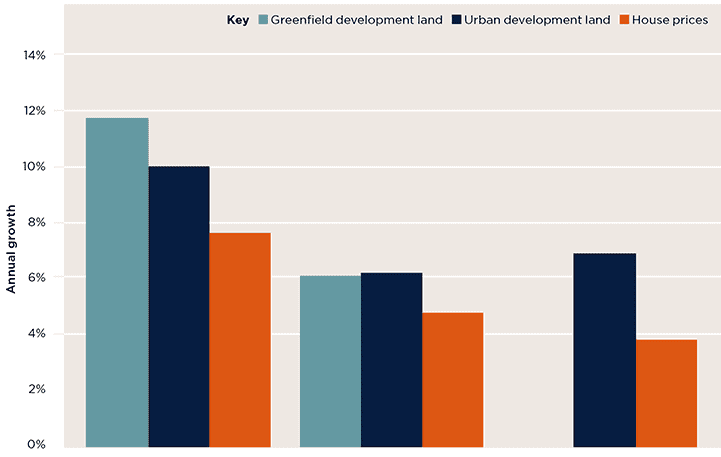

Land leader Glasgow has been at the forefront of growth in Scotland

Source: Savills Research, HM Land Registry

An increasingly crowded land market

Over the last year, the land market has become more crowded, with recent government funding announcements further opening up the market to housing associations, SMEs and local authorities.

In September, Theresa May announced £2 billion of additional funding for affordable housing from 2022, providing the HA sector with confidence to invest in longer-term development projects. The announcement builds on the Strategic Partnership programme and supports land-led development instead of Section 106 acquisition.

The government is encouraging HAs to be ambitious in ‘taking on and leading major developments’.

Homes England launched a partnership with Barclays Bank to provide £1 billion of development finance to small and medium- sized housebuilders.

By enabling greater access to finance, the Housing Delivery Fund aims to increase the number of new homes delivered by SMEs and the pace of delivery.

Across parts of the country, we are seeing smaller and medium-sized housebuilders bidding on more sites, particularly those of fewer than 100 units. With better access to finance, we expect their presence in the land market to increase.

The recent announcement by the PM of the lifting of the housing revenue account borrowing cap could remove a major constraint on council development. This could offer greater scope for local authorities to increase their building programmes, invest in larger sites and lead to more opportunities for partnerships and joint ventures. With local authorities able to set their own borrowing limits, Savills estimates that councils could build at least 15,000 homes a year (in the long term, subject to capacity) and will need land to do so.

See Steve Partridge’s blog for more commentary

.png)