Facebook's acquisition of 600,000 sq ft at King's Cross boosts take-up to new monthly record

Market comment and notable deals

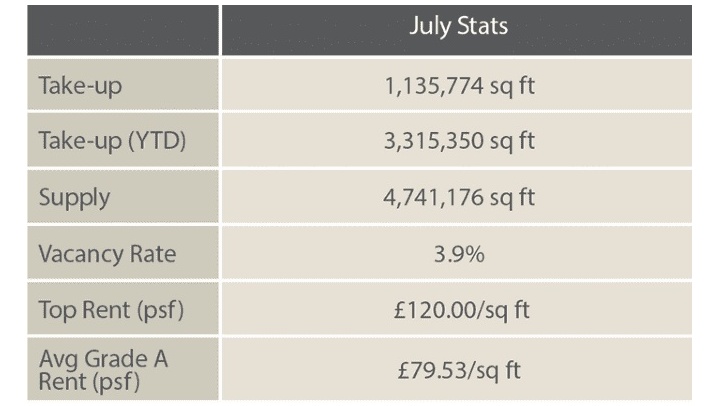

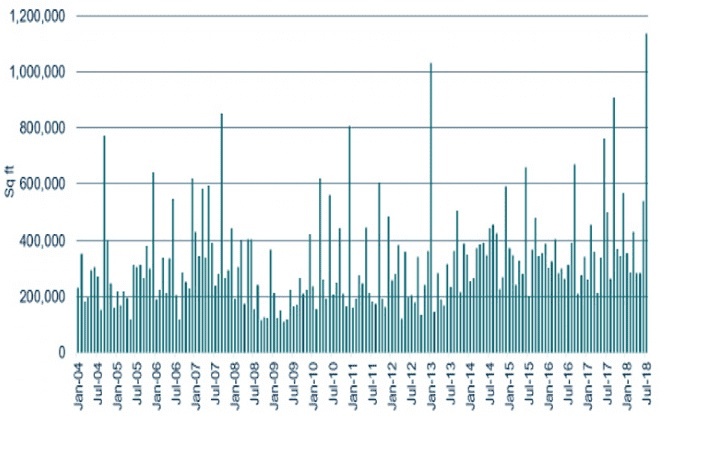

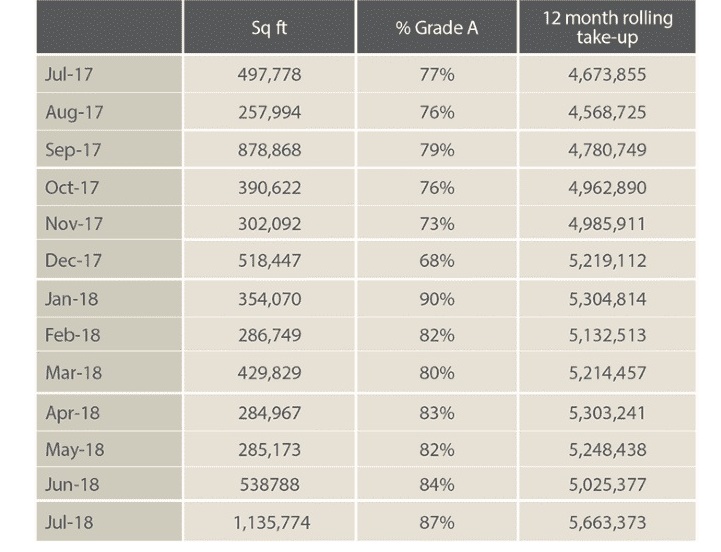

- Take-up in July reached a new monthly record of 1.13m sq ft, with pre-letting activity driving take-up 14% up on the previous monthly record of 1.03m sq ft in January 2013.

- This brought year-to-date take-up to 3.3m sq ft, already surpassing the long-term average for take-up at the end of the third quarter by 14%, with two months still left to go.

TABLE 1 | Key July stats

Source: Savills Research

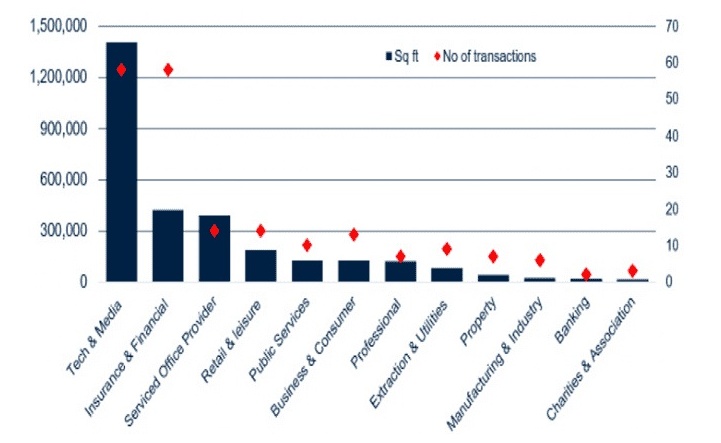

- Pre-lets have accounted for 42% of space let out over the year so far, and almost 80% of space transacted over the month. The most notable pre-let was Facebook's acquisition of 600,000 sq ft at King's Cross on confidential terms. This contributed substantially to increasing the Tech & Media sectors market share to almost half of take-up (47%), for the year so far.

- PThere were two other notable pre-lets to complete over the month. Publicis Media pre-let 2 Television Centre, W12, taking 212,000 sq ft across seven floors, at a rent believed to be in excess of £50 per sq ft, and Nike took 63,000 sq ft at S1, Handyside Street, N1C, on a 10-year lease at a rent believed to be in the late £70s.

GRAPH 1 | West End monthly take-up

Source: Savills Research – July 2018

- Whilst these three pre-lets dominated take-up in terms of overall sq ft, the number of transactions to complete over the month, at 50 was the largest volume in over three years, also making this the busiest July on record. Insurance and Financial sector occupiers accounted for the largest number, (30%) of transactions to complete over the month.

- Despite the Insurance and Financial sector accounting for 14% of overall take-up, at 58 transactions they have accounted for the same number of transactions as there has been to Tech & Media occupiers (see Graph 2).

GRAPH 2 | Year-to-date take-up by sector

Source: Savills Research – July 2018

- Outside of the Tech & Media sector, which accounted for 72% share of take-up for the month, the Insurance & Financial sector accounted for the next largest share with 7% (80,395 sq ft).

- July was particularly active in the St James's and Mayfair sub-market, which saw 17 transactions completing. This was the largest volume for over three years, with Private Equity, Investment and Asset Management firms continuing to drive demand.

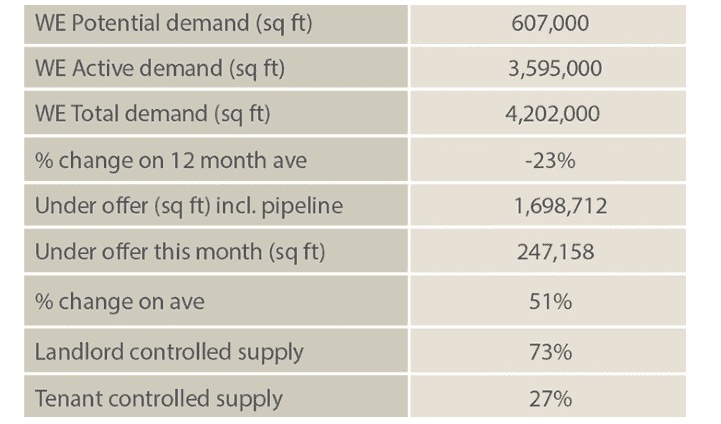

- Space under offer continued to remain at a high level and was above the long-term average for the 15th consecutive month, with 1.7m sq ft under offer at the end of July.

- Supply has remained broadly stable since December 2016, only mostly experiencing monthly variations of 10 pbs at the most. However at the end of July supply stood at 4.74 m sq ft, equating to a vacancy rate of 3.9%. This was up 20 bps on the previous month and was the first upward movement since the end of 2017 with an additional 600,000 sq ft of space coming onto the market.

- Current supply equates to 13 months’ worth of take-up at the average rate we have seen over the past five years.

Analysis close up

TABLE 2 | Take-up

Source: Savills Research

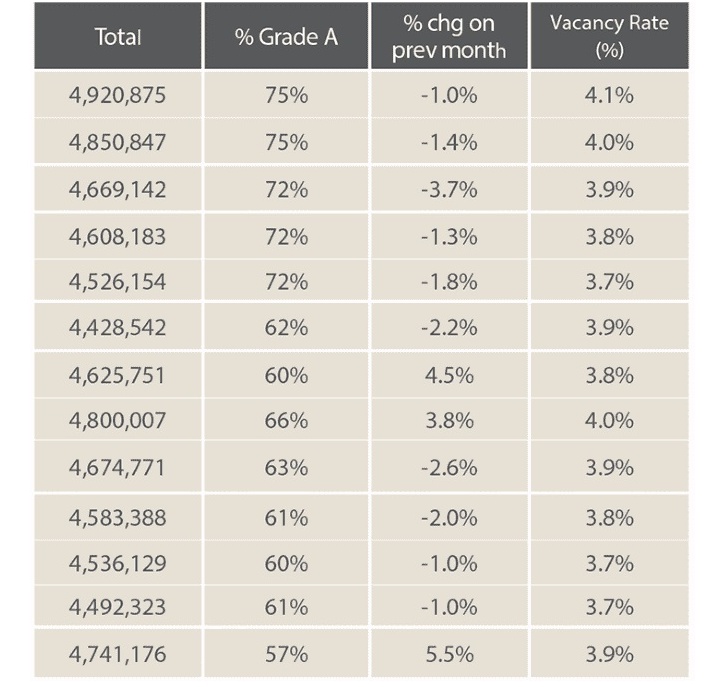

TABLE 3 | Supply

Source: Savills Research

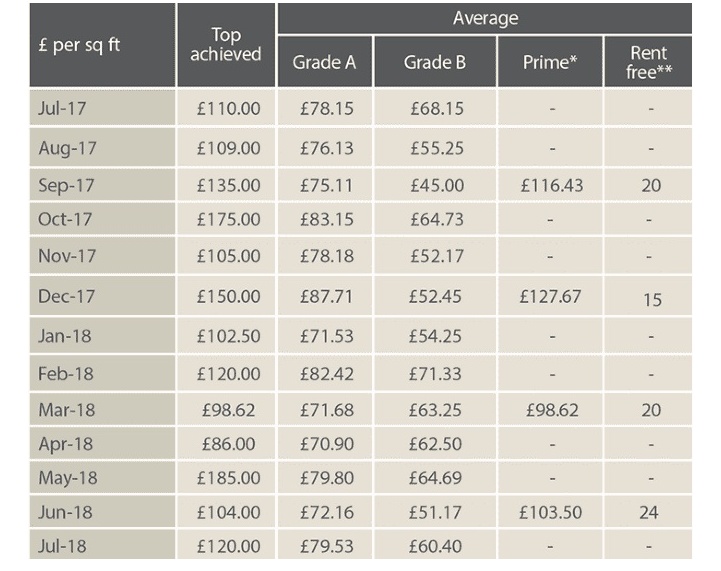

TABLE 4 | Rents

Source: Savills Research

TABLE 5 | Demand & Under Offers

Source: Savills Research

Demand figures include central London requirements

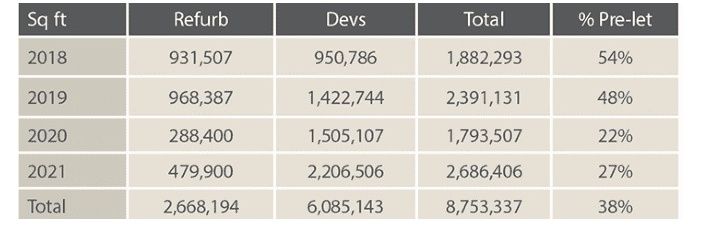

TABLE 6 | Development pipeline

Source: Savills Research

Completions due in the next six months are included in the supply figures

*Average prime rents for preceding three months

** Average rent free on leases of 10 years for preceding three months

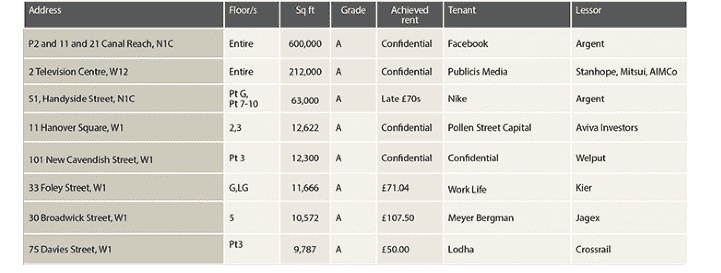

TABLE 7 | Significant July transactions

Source: Savills Research

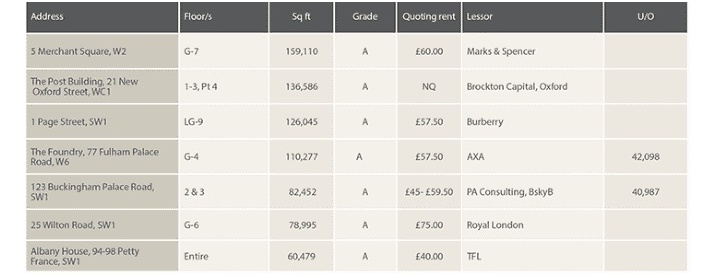

TABLE 8 | Significant supply

Source: Savills Research

.jpg)