Market activity in Scotland and some English regions was delayed due to the weather. What effect did this have on supply and values during H1 2018?

Supply

The farmland market so far this year follows a difficult winter, then a wet spring and is now in the grips of a long dry spell. In addition there is the uncertainty surrounding the future of trade deals and the direction of farm subsidies.

Despite this, our research shows that across GB supply in the first half of 2018 was comparable, up by just one per cent, to the same period of last year at just under 97,000 acres.

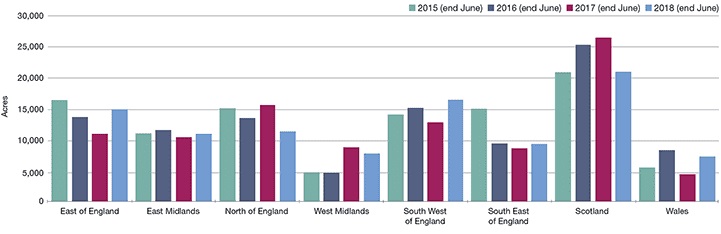

However, there were significant variations in activity between countries and across the English regions (see Figure 1). The weather was particularly influential in Scotland where the supply of publicly marketed farmland was down by a fifth compared with the first six months of 2017 at 20,500 acres.

Across England overall activity increased by 5% to include 70,000 acres of publicly marketed farmland but there were distinct regional differences. In Wales, where traditionally volumes traded are low, supply increased by 64% to 7,000 acres.

Putting the turnover of farmland during the past few years into perspective it is clear the market continues to follow the now established trend of a relatively small turnover. The current turnover volume is equivalent to a farm sale, depending on which region, somewhere between every 150 to 200 years.

FIGURE 1 | Regional supply over the past four years (end June)

Source: Savills Research

Values

The decline in average farmland values over the past three years is well documented and there are now clear signs that values for most regions and land types are settling with only minor price adjustments.

The latest results of our Farmland Value Survey show that average values across GB are relatively stable, falling by just -0.6% during the past six months. The exception to this pattern is Wales where average values continue to soften falling just over -2% over the past six months.

There is also widening disparity between pure commercial productive ground and holdings with higher amenity value. This is clearly seen in average arable values in the eastern regions and the West Midlands. In contrast average values in the South West of England increased by 3.2% over the past six months showing the strength of the amenity farmland market.

Buyers and sellers

Analysis of transactions during the first half of 2018 where Savills acted for either the buyer or seller indicate that farmer buyer activity has improved when compared with the past couple of years; expansion is cited as the reason to buy in most cases.

In contrast the proportion of purchasers, who have cited investment as the principal reason to buy, has weakened possibly due to investment in alternative asset classes.

There was a slight increase, compared to the past 10 years since the Global Financial Crisis in 2008, in activity from overseas buyers suggesting the weakness of the pound against other currencies is continuing to generate opportunities.

Sales data for the first six months of the year indicates the proportion of farmers selling has reduced. There are a few factors that could be at play here including; the adoption of a ‘wait and see’ position in the current political and agricultural policy climate and the weather which delayed or prevented the marketing of some farms.

Debt is always a driver behind some sales but our data does not show any increase in the number of debt related sales during the past six months.

Average values across GB are relatively stable, falling just -0.6%

Savills Research

Market outlook

The shape of future agricultural policy is currently uncertain although the evidence is building and we know that after 2022 any subsidy system will be on a very different basis to the direct BPS payments.

We believe in the short to medium term demand for farms with a variety of income streams will continue, which in turn will support values. However, commercial units in need of investment, without the scope to diversify, are more likely to come under pressure unless there are neighbours looking to expand. In the current market creative packaging of farms into lots may attract wider interest from buyers and value for sellers.

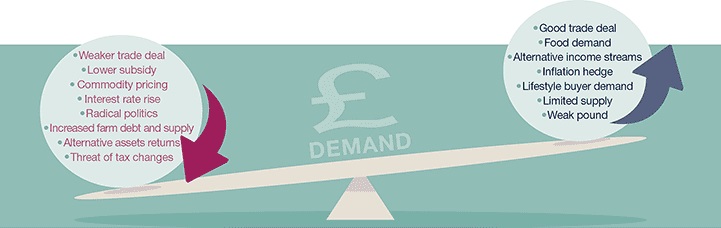

Many factors contribute to the performance of farmland values and it is the balance between them that determines the outcome for each sector of the market. For our thoughts on the current balance for average farmland values across GB see Figure 2.

FIGURE 2 | Strength of key demand factors

Source: Savills Research

With the annual supply of farmland traded only equating to 0.5 percent of the total land supply and farm earnings often only comprising part of the income return from owning agricultural land, our modelling takes into account over 30 different variables which have the potential to influence farmland values. The drivers are dynamic and can shift sentiment quite quickly. There are already signs commodity prices are rising but potentially balanced by the news of an Inheritance Tax (IHT) review by the Office for Tax Simplification (OTS).

Although in the longer term we don’t anticipate a repeat of the significant price increase recorded in the decade to 2014 we do expect the market to return to its long term historical real-term growth of around over 1% per annum (i.e. 1% above inflation).

More detail of our current forecasts can be found in our Spotlight: GB Agricultural Land published in February 2018.

Market commentary

England

Alex Lawson

Inevitably there is a degree of apprehension given the ongoing uncertainty over Brexit. Quality of product and sensible pricing of farmland continues to be crucial in achieving successful sale outcomes. While there have been minor adjustments in market dynamics against last year, supply and demand statistics are broadly in line with longer term trends. In the less commercial farming areas, interest in lifestyle farms and amenity estates has improved.

Scotland

Charles Dudgeon

Supply in Scotland is down 21% on last year as farmers took until June to catch up with one of the longest winters for 10 years. The wide range of prices offered for farmland continues with some arable farms making over £10,000 per acre but it depends on location and size. At a regional level the market is active in Aberdeenshire but less so in the Borders and South West Scotland.

We are currently seeing three scenarios in the market place.

● Around 30% of farmers, especially those with the next generation wanting to farm, are pushing to buy or occupy more land

● 30% are prepared to move to a similar sized farm which has more flexibility for diversification and other income streams especially opportunities for renewables, supplying anaerobic digester plants or leisure

● The remaining 40%, possibly more in some areas, are sitting tight until the picture is clearer.

Wales

Daniel Rees

After the wet winter the market in Wales only got underway in the second quarter. Farms coming to the market so far have been due to retirement. A feature of this year’s market has been the return of farmer buyers either looking to expand their holdings or purchase second units or completely relocate from other areas of the UK. Lifestyle buyers are still active for the smaller less commercial units. Values have remained steady for the best equipped farms with productive land.