1. Land

Lack of land is an increasing limitation for housing associations with ambitious development aspirations. In last year’s survey, respondents said it was as important as government policy in influencing the number of homes they could build. This year, it is the standout factor, followed by a lack of subsidy from central government.

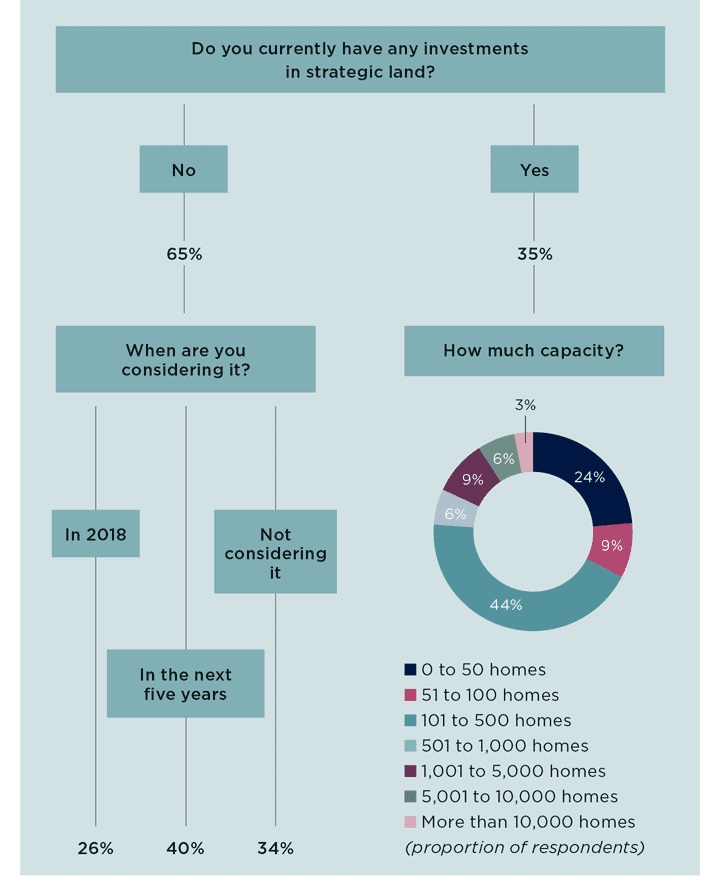

As in last year’s survey, 35% of associations say they have some strategic land already, and a similar proportion are looking to acquire some. However, they are pursuing these opportunities more urgently. Of those currently without any strategic land, 26% say they are looking to acquire some in the next year, compared with 13% in 2017.

.jpg)

.jpg)

.jpg)

.jpg)