Overview

Bristol has experienced two decades of strong growth, but there are signs that the city is entering a new phase

Bristol has experienced two decades of strong growth, but there are signs that the city is entering a new phase

Bristol has been one of the success stories of the last two decades. The city has benefitted from a fast-growing economy, city centre regeneration and a thriving reputation that has attracted many people to the area. According to census data, between 2001-2011, its population grew by 12.5%, behind only Manchester and Nottingham in the 10 core UK cities.

This strong rate of growth is a result of multiple factors. The city has long benefitted from a strong external marketing effort, with an Economic Development Officer promoting the city in Silicon Valley and Boston from 1979. More recently, successful place branding tied to sustainability, culture and regeneration of the waterfront has provided a foundation for growth based around tourism and leisure.

Bristol’s productivity outstrips that of Birmingham, Manchester and Cambridge, and it has been climbing relative to other UK cities since the early 2000s. The city is one of the few in the South of England to retain over 25% of its graduates, making it an attractive location for employers.

A diverse and resilient economy

The city also benefits from a very diverse economy, which has made it more resilient and well placed to weather shocks. The largest single contributor to the city’s GVA is the banking and insurance sector, but advanced manufacturing and creative industries are also strong.

Key to Bristol’s success has been its ability to retain its historic industry while also attracting new businesses. Home to aeroplane firms since 1910, the city region has retained three world leading firms in aerospace (Rolls Royce, Airbus and GKN Aerospace). The aerospace cluster directly supports 14,200 jobs and is one of the largest of its kind in Europe.

Bristol has had a long association with the BBC, but at the turn of the century only 2% of employment was in arts and media. There are now an estimated 11,500 jobs in creative industries and the city has international reputation in film and TV production, animation and digital media.

Beyond this, the city has been able to provide a conducive environment for entrepreneurship. Start-up rates are high, notably in the business services and retail sectors. Support of the region’s universities has been crucial; for example the SETsquared Partnership works with researchers at Bristol University to commercialise their work.

The partnership occupies incubator space in the Engine Shed in the Temple Meads Enterprise Zone, supporting over 80 start-ups, and was named Established Incubator Space of the Year by UKBI. The zone has attracted 3,000 new jobs since it was established in 2012. Patent applications per 100,000 of population are double the national average, although they still lag far behind those of Oxford or Cambridge.

Proactive development

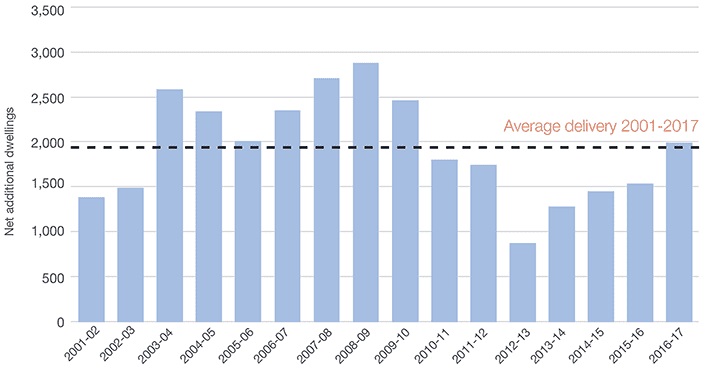

Population growth has also been supported by high levels of housebuilding. Between 2003 and 2011, new homes were delivered annually at a rate of at least 1% of existing stock. The city core has particularly benefitted from apartment construction and office to residential conversion, bringing residents back into the city centre, which has in turn stimulated demand for retail and leisure.

The city has also had continuing delivery of diverse commercial space. Since 2011, the West of England LEP has concentrated on six major development areas, notably delivering incubator space around Temple Meads, and industrial and logistics at Avonmouth.

However, this has failed to keep up with strong demand for office space in the City, and the surge in office to residential conversions that has been seen in recent years.

There are no signs that the demand for office space in Bristol is slowing, with take-up of office space in 2017 being 6% above the long term annual average. This has continued into 2018, with take-up this year in the City up on last year’s total for the same period.

Looking ahead, the City’s office market is facing a surge in lease expiries at a time when supply has fallen to a record low level. We estimate that as at the end of Q1 2018 there was less than 500,000 sq ft of office space to let in the City centre, an 83% fall on the level that there was in 2010.

FIGURE 1 | Annual Housing Delivery

Source: MHCLG

Trouble ahead?

However, the city’s rapid expansion seems to be drawing to a close and new stresses are emerging. Bristol’s growth has been strong for a core city, but recently it has been outstripped by smaller south east settlements such as Reading and Slough.

The sustained period of expansion during the 2000s is coming to a close. While GVA per capita remains 15 points above the national average, GVA growth has been flat for the past five years.

Another potential cloud on the horizon is Brexit. Bristol's economy has the third highest dependence on European markets of any city in the UK. Clarity around the UK's exit from the EU will be key for maintaining confidence.

The final challenge is increasing unaffordability in both commercial and residential markets. In 2017, prime office rents reached their highest ever level, driven in part by a recent shortage of supply.

Housing affordability is also becoming increasingly challenging, as average house prices in Bristol have risen from being 7.5 times more than average household incomes in 2007 to being 9.11 times higher than incomes in 2017. This poses a threat to continuing economic growth if employees are priced out of the area and alternative tenures such as PRS are not delivered.

4 other article(s) in this publication