A spotlight on London’s Waterfront sales and lettings markets

Introduction

The Thames has always played a pivotal role in the historical success of London’s economy. Today, it is the uniqueness of waterfront living and the associated lifestyle that has come to define the city’s river.

The housing stock available along the Thames varies dramatically and for this reason, there is also a diverse mix of buyers and tenants.

Between Teddington Lock and Putney Bridge in the south west, period property dominates the waterfront market, characterised by large houses, many with gardens stretching right to the riverbank.

By contrast, the riverside market in the east mainly consists of new build schemes in amongst industrial and warehouse conversions.

The central markets differ still. Period properties were built back from the waterfront, which means newer developments are located right on the edge of the Thames.

Riverside living

Homes come with a premium

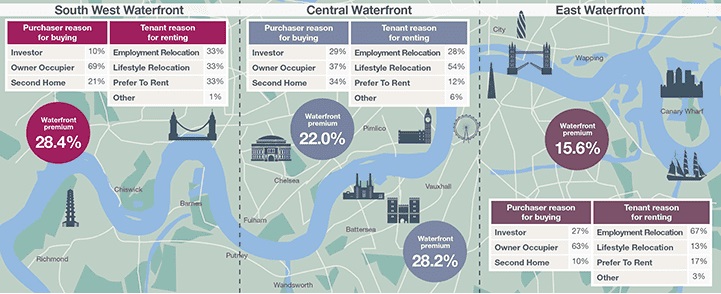

The desirability of London’s waterside appeals to a variety of residents. Overseas buyers and tenants make up 59% and 61% of the prime sales and lettings markets, respectively. In central London, traditionally a more international market, those from overseas accounted for more than two thirds of riverside buyers in 2016 and 2017.

Attracted by the unique lifestyle the river has to offer, more than half of prime buyers are owner occupiers with the other half split evenly between investors and second home buyers. Indeed, many decide to retain a pied-à-terre waterfront property in the capital whilst purchasing a main property elsewhere. Others may be releasing equity for family members who are first time buyers by downsizing to a riverside property.

Almost half of riverside tenants are renting due to lifestyle relocation. A further 37% are relocating due to employment, with the River Bus providing an increasingly popular option for commuters. In particular, over two thirds of tenants on the eastern stretch of the river have cited this as their reason for renting, attracted by the close proximity to the key financial districts of Canary Wharf and the City.

International students also play an important role in the super prime rental market, and luxury riverside developments offer the standard of accommodation they're looking for.

FIGURE 1 | On the waterfront The premium and second hand buyer and tenant profile for each area of the river in 2016/17

Source: Savills Research | Note: these premiums are based on the average second hand sale price of flats located within 100m of the river bank, compared to those located up to 1km away

The prestige of living on London’s riverfront comes at a price. Along the 27-mile stretch of the Thames between Teddington Lock and the Royal Docks, buyers are willing to pay, on average, 14.6% more for second hand flats located within 100m of the shore, compared with those up to 1km away. However, this figure does vary depending on location.

The riverfront of the central stretch of the Thames, between Putney Bridge and Waterloo Bridge, is the most expensive in terms of average second hand flat sale price. Here, buyers can expect to pay a premium of 22.0% on the north bank and 28.2% to the south.

The south west, however, commands the highest waterfront premium of 28.4%, when compared to properties located further inland. Historically, the Thames played an important role in the growth of the South West London corridor helping areas such as Putney, Barnes, Chiswick and Richmond to become the prime residential markets they are today.

To the east, where average values tend to be lower as the development of prime markets such as Canary Wharf and Wapping has been more recent, the premium is 15.6%.

River views are not the only thing buyers are willing to pay more for. Other benefits such as private moorings, large outside spaces, state of the art residents' facilities and penthouses will command higher prices but at a more variable and location specific rate.

Outlook

Market to remain sensitive in 2018

Since 2014, house prices across prime London, including those on its waterfront, have been gradually declining. The main causes of these price falls are increases to stamp duty, political and economic uncertainty as a result of the EU referendum, and, in the more domestic markets, mortgage regulation.

For London's waterfront, the high levels of new build supply being brought to the market means buyers have greater choice and sellers will need to be realistic on price in order to secure a sale.

We anticipate that the market will remain price sensitive for the rest of this year and next before a return to growth in 2020. This should happen once we have more clarity on Brexit negotiations and confidence returns to the market.

For the prime London lettings market, high levels of supply means that rents have also been falling. The current supply imbalance is likely to suppress rental growth for the remainder of this year.

By 2019, confidence should return to the market and this would usually translate into the stabilising of rental values, but as the number of new build completions across the capital is anticipated to peak in 2019, this will limit any significant rental growth.

Landlords are therefore advised to take a longer-term view regarding the value of their assets and be aware that tenants look for properties of the best quality and are more flexible on location.