Serviced office growth

A record 73,000 sq ft of serviced offices was taken in Leeds city centre during 2017, the highest level on record. Tenants are increasingly in search of more flexible lease terms (average regional lease length fell 6% during 2017), as Regus signed for 10,200 sq ft at the Pinnacle during Q3 2018.

Indeed, 4,915 startups were created in Leeds during 2017, according to Startups UK. It is these high growth companies who we expect to be looking to expand into either traditional office space or serviced office space in 2018.

Traditional offices must continue to reinvent themselves in order to remain attractive and compete with serviced offices. Landlords must also adapt as tenants demand increasingly flexible lease terms. Savills forecast c.150,000 sq ft of space will be taken by serviced office operators in Leeds during 2018.

Talent

One of the reasons we expect Leeds to benefit from further northshoring over the next three years is the number of skilled professionals in the city. Savills estimate that companies save around £20,000 per employee per year by relocating their London based roles into the regional cities- £10,000 in wage costs and £10,000 in property costs. Global law firm, Reed Smith is tapping into the Leeds talent pool as it is on course to open its first UK office outside London at Platform, in early July this year.

Leeds currently retains 29% of its graduates upon graduation, but to further boost this, Leeds' developers need to provide the right level of follow-on space in the city centre.

Out of town recovery

With a shortage of pipeline developments in town, occupiers who are looking to increase their floorspace will soon be forced to look out of town. There were 23 out of town deals during the first quarter of 2018, 38% above the five-year quarterly average of 17 deals, including Perform Group taking 40,000 sq ft at Munroe K's White Rose Office Park.

Amenity provision is becoming increasingly important in attracting occupiers out of town and it is the business parks with the best infrastructure links which are demanding a rental premium.

Park and Ride schemes are becoming increasingly utilised among workers on business parks, with a large proportion of Leeds' workforce living to the north-west of the city, around Horsforth and Headingley. Zenith signed for c.63,000 sq ft at Phase One of Kirkstall Forge last year, for example. The scheme is only six minutes away from Leeds station by train and Northern Rail have recently doubled the train frequency to two per hour.

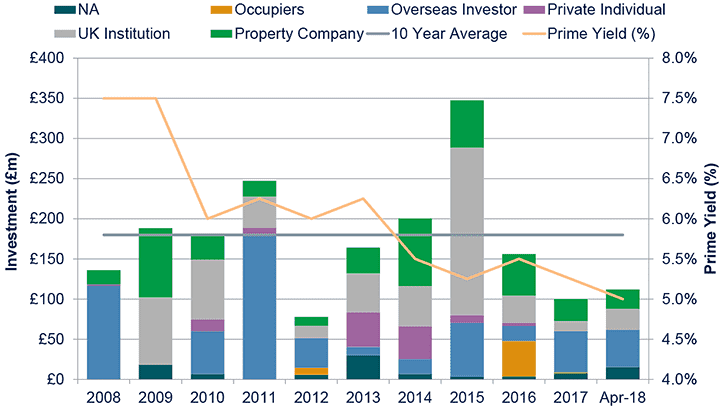

Investment

Whilst 2017 was a fairly quiet year for Leeds' office investment, with volumes reaching £100 million, three Leeds offices changed hands during the first quarter of 2018 for a combined £53 million. The key deal was Mayfair Capital acquiring 6 Queen Street for £37.2 million, representing a 5.4% yield after Burberry signed for 46,000 sq ft of space across four floors last year on a 10-year lease.

.png)

.png)

.png)