At end April 2018, Leeds office investment volumes have reached £112m, already 12% above the 2017 total. With strong investor demand, we expect yields to hold firm at 5% this year

Summary

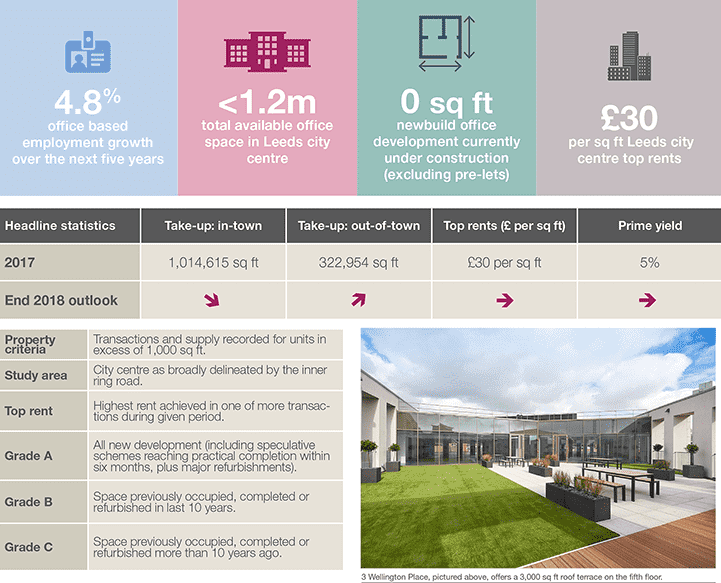

■ Leeds carried the strong momentum from 2017 into the first quarter of 2018, with 187,000 sq ft of space taken, 10% above the previous five-year quarterly average. Savills expect city centre take-up to reach 700,000 sq ft in 2018, with large requirements from the Government, professions and serviced offices.

■ However, availability is now at its lowest level since 2007 at only 1.2 million sq ft.

■ 4,915 startups were created in Leeds during 2017. It is these high growth companies who we expect to be looking to expand into either traditional office space or serviced office space in 2018.

■ Sustained investor demand for long income has driven prime yields down 25 basis points (bps) from 5.25% to 5% over the past six months. Leeds prime yields remain 25 bps above Manchester and Birmingham, and we expect this to hold firm through the remainder of 2018.

Headline stats and definitions