Prime Rents a Different Order

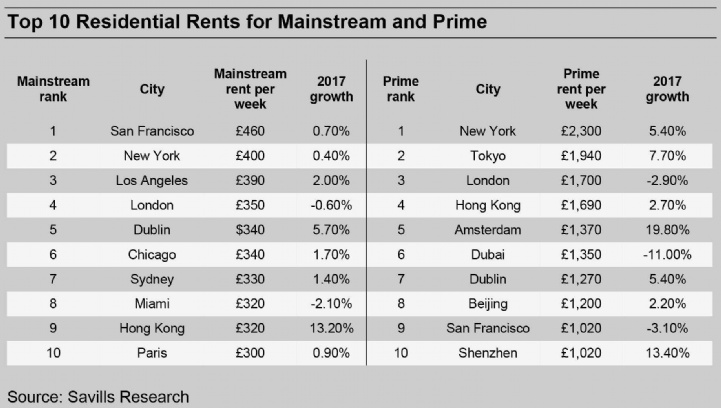

New York tops the table for prime, or luxury, rentals at £2,300 per week (over five times the mainstream rent). A raft of new supply in the prime segment has boosted the quality of prime rental markets in New York and so boosted rents overall, but concessions are increasingly offered to fill new buildings.

Tokyo, which doesn’t appear at all in the top 10 for mainstream rents is second most expensive global city for prime rents, at £1,940 per week. London and Hong Kong follow, at £1,700 and £1,690 per week, respectively and are higher up the table for prime than mainstream. Savills expects Hong Kong to overtake London in 2018 as rents are rising there but falling in London.

Amsterdam and Dubai also feature in the prime top 10, but not in the mainstream. This reflects demand for prestigious properties from global renters in these cities and the fact that a premium is being paid for relatively rare stock. Amsterdam’s prime rents increased by 19.8% in 2017, putting it fifth at £1,370 per week. A major and growing hub for the European headquarters of multinational companies, rents have been driven up by relocating expats coupled with a shortage of stock.

Two Chinese cities feature in the top 10, Beijing and Shenzhen, with prime rents of £1,200 and £1,020 per week respectively. They also attract global, premium tenants (particularly as overseas residents are unable to buy) and prime stock remains relatively rare enough to command a premium. Dubbed China’s Silicon Valley, Shenzhen’s population has risen from 300,000 in 1980 to 12 million today. Expats together with a rising number of wealthy domestic tenants have fuelled prime rental demand.

Methodology

Comparable rental values for each city are obtained by comparing the properties occupied by the same group of people but in different properties in each world city. Prime property is occupied by CEOs and directors and their families. Mainstream property is that occupied by administrative workers in the same company and their households.