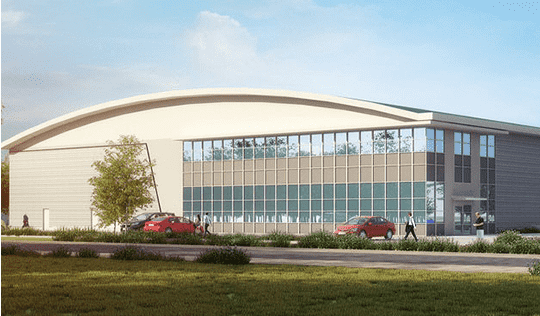

▲ Suffolk Park, Bury St Edmunds

Demand remains stable in the region as occupiers are attracted by cost effective rents along with the willingness of landowners to release parcels of freehold land

Supply

■ Supply in the East of England has remained relatively static since the turn of the year with just 718,857 sq ft available representing a 3% decrease from Q4 2016. Indeed, there are just four existing units available in the entire market, demonstrating the supply issues which have hampered growth in the market in recent years are set to continue.

■ There are currently no grade A units available in the region and three of the four units that are currently available are between 100,000-200,000 sq ft. The largest unit on the market is the CDC Building where 274,951 sq ft is currently available.

.jpg)

FIGURE 21Supply by size range

Source: Savills Research

Take-up

■ Take-up reached 389,699 sq ft in H1 2017 which represented a positive first half of the year for the market. Whilst H1 2017 take-up was 22% below H1 2016 take-up it was still 122% above the long-term average.

■ The largest deal in the region in H1 2017 was Treatt acquiring 200,000 sq ft at Suffolk Park near Bury St Edmunds. This was the first deal at Jaynic’s scheme which has outline planning for 2m sq ft of business, industrial and distribution space.

■ The only other deal to take place in the region in H1 2017 was Darts Product Europe leasing 189,697 sq ft at Kingston 189 in Peterborough. The lack of Grade A space available in the region has hampered take-up from further increasing as there is clear occupier demand for Grade A space exemplified by the deals in H1 2017.

■ The lack of Grade A units available in the region will result in build-to-suit units being the only viable option, in the the short to medium term, for occupiers who are seeking to secure Grade A warehouse space.

■ Manufacturers continue to be the most active business sector in the region. The sector accounted for 100% of take-up in H1 2017 and was the most active acquirer of space in both 2015 and 2016.

.jpg)

FIGURE 22Take-up

Source: Savills Research

Development Pipeline

■ There are no units under construction in the East of England which will mean that the supply constraints that the market are experiencing will continue in the short term.

.jpg)

FIGURE 23Take-up by grade

Source: Savills Research

.png)

TABLE 7Key stats

.png)

.png)

.png)