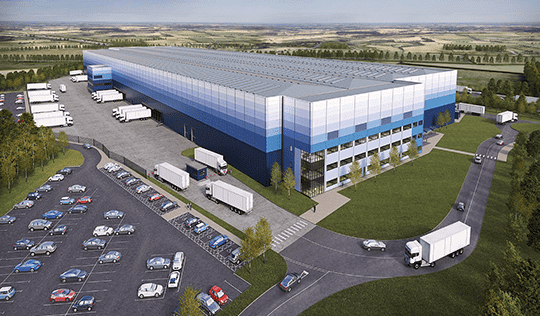

▲ Altitude being developed by IDI Gazeley

Whilst there has been a paucity of transactional evidence in the first half of 2017 requirement levels are generally strong, meaning we expect a strong second half of the year, as was the case in 2016

Supply

■ Falling from 5.5m sq ft at the start of 2016 there is currently 4.7 million sq ft available in the London & the South East across 27 existing units. Supply has increased by 18% from Q4 2016 after a flurry of speculative developments reached completion.

■ The vast majority of supply is sub 200,000 sq ft, indeed there are just six units on the market larger than this, spread across the region from Milton Keynes, to London Gateway and to Andover where he largest unit in the region is Angle 340 at 336,800 sq ft, which was speculatively developed by Goodman and completed in 2016.

■ Due to the number of speculative starts in 2015 and early 2016 units there are now 10 speculatively developed units on the on the market totalling 1.9 million sq ft. The region has the highest amount of speculatively developed space available in the UK totalling 2.0 million sq ft which equates to 44% of the total available supply.

.jpg)

FIGURE 3Supply by grade

Source: Savills Research

Take-up

■ 1.3m sq ft of deals signed in H1 2017 which represents a subdued start to the year as this is 29% below H1 2016 and 46% below the long term average. There were ten deals recorded in H1 2017 which was marginally below the long term average.

■ Given the lack of poorer quality space it is no surprise that 79% of the space transacted in the first half of the year is classified as grade A. There were three deals which involved speculative units being let in H1 2017 which totalled 312,247 sq ft. The quality of the units transacted is reflected in the average rent in the region increasing to £8.09 per sq ft.

■ The largest deal in H1 2017 was Eddie Stobart leasing 180,000 sq ft in Dagenham in a build-to-suit deal. There have been no deals above 200,000 sq ft in 2017 which is reflected in the average deal size in the region which is 129,561 sq ft.

.jpg)

FIGURE 4Take-up

Source: Savills Research

Development Pipeline

■ There are four units currently under construction in the region totalling 900,660 sq ft. The largest unit being Altitude in Milton Keynes where IDI Gazeley is speculatively developing 574,000 sq ft, due to reach completion in early 2018. This is also the largest unit under construction across the whole of the UK.

.jpg)

FIGURE 5Development pipeline by size

Source: Savills Research

.png)

TABLE 1Key stats

.png)

.png)

.png)