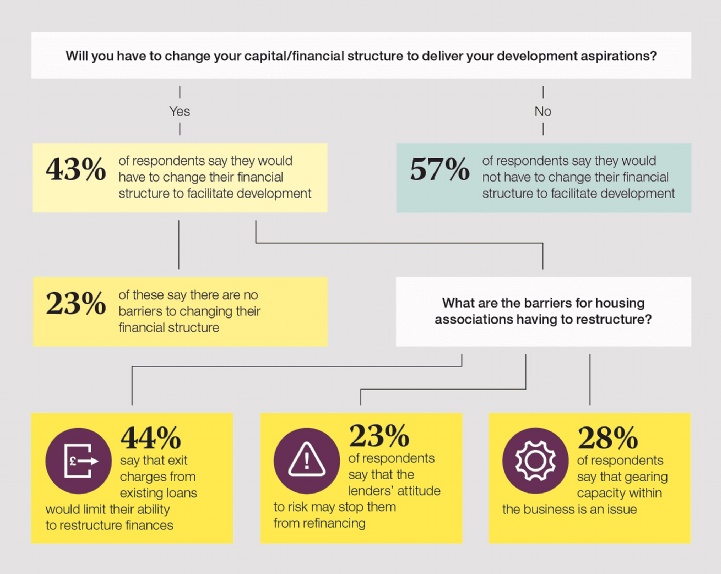

Ambitious housing associations may have to change their financial structure to deliver their development aspirations. Some 43% of respondents said that changes would have to be made. One-fifth viewed this as a straightforward process, but, for many, there are obstacles.

The most common barrier cited by respondents was exit charges from existing financial arrangements rather than their inherent financial capacity. This is consistent with the findings from our Spotlight: Housing Association Financial Capacity, which found that many housing associations had spare cash flow and gearing capacity. Although these were mentioned, they were less significant barriers than exit charges.