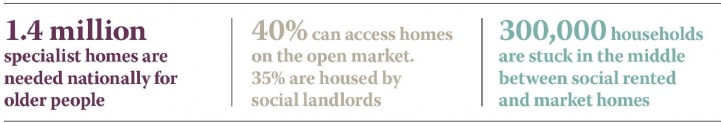

Despite the variety of developments that are coming into the sector, the perception of housing associations’ core purpose remains in its social roots.

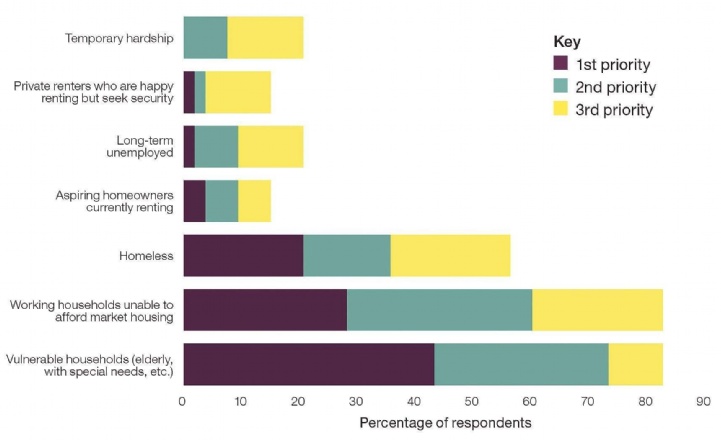

The priority for most respondents is to offer housing to vulnerable households and working families unable to access the private market. Few see the priority as accommodating those able to access market housing, whether for rent or purchase (see charts below).

But in a world with restricted grant, developing housing in the open market has an increasing part to play in generating the capital receipts and cash flow surpluses to financially support the sector’s core purpose.

What’s in the pipeline?

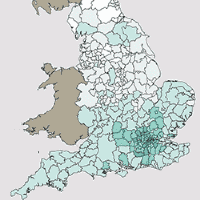

The government has loosened its position on the proportion of the £7 billion-plus pot of funding that will be allocated to shared ownership, yet it continues to be encouraged at unprecedented scale. So, it is driving the development programmes of many of our survey’s respondents.

As the political focus shifts to a wider range of tenures, there is more support for affordable rent and the build-to-rent sector. Attracted by its ability to generate ongoing profits that can cross-subsidise their core charitable objectives, 37% of respondents say their association plans to deliver market rent in the next five years. Importantly, the sector has vast experience developing and managing stock for rent. Given the strong growth of demand in the private rented sector, this presents a major opportunity.

An even greater proportion, some two-thirds of respondents, plan to develop stock to sell on the open market in the next five years, with sales receipts providing much-needed capital for expansion. This reflects that, as a rule of thumb, four or five market sale homes are required to fund one new social rented unit.

Respondents are happy they have the ability to deliver their current programmes: less than 10% mentioned skills as a barrier. The problem comes if and when there is a housing market downturn.

Relatively few respondents see the prospect of a downturn as either an existing constraint on this kind of delivery or as a future risk to expansion.

That risk is amplified where land is acquired after planning consent is achieved, at its full development value. That requires a change in the way land is secured for development, one which enables more control over delivery and opens up the possibility of flexing tenure to suit market conditions.

.jpg)

.jpg)