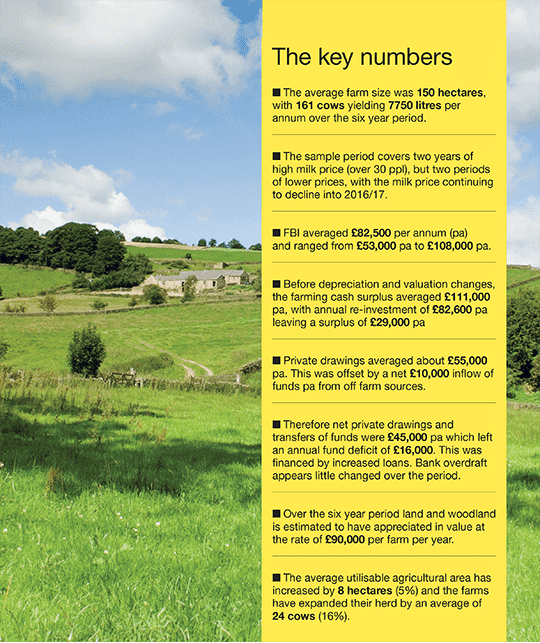

Our research shows from the sample of dairy farms in the South West of England that there has been a considerable fluctuation in Farm Business Income (FBI) over the six years 2010/11 to 2015/16. This is largely due to the volatility of the milk price. The results suggest that new technology and a general increase in herd size has driven investment in land, buildings and machinery.

Farm Business Income, for sole traders and partnerships, represents the financial return to all unpaid labour (farmers and spouses, non-principal partners and directors and their spouses and family workers) and on the capital invested in the farm business, including land and buildings.

Dairy FBI in this sample performed at a higher level (including milk price) than the average across England, but followed the same pattern of income changes. Herd and farm size for the South West farms gradually increased over the six years. There was a dip in production in 2012/13 as a result of a poor grass growing season, and the milk price rose to a peak in 2014/15, before a sharp decline in 2015/16 (see Fig 1).

.jpg)

.jpg)

.jpg)

.jpg)

.png)