Stamp duty

Since the decision to raise stamp duty rates for higher value properties from December 2014, the prime markets have been battling headwinds. From the 2014 peak of the market we have seen prime properties across all of London fall -5.8%. In the most expensive parts of prime central London values are now -12.5% from their 2014 peak.

The prime country markets have remained more robust, due to more modest price rises and sustained demand, though annual growth has slowed to just 1.8% from the stronger 2.3% seen at the end of 2015.

The subsequent 3% stamp duty levy on ‘additional homes’ brought in from April 2016 has also restricted the prime market, especially in the capital where these properties have accounted for almost a third of second hand Savills sales over the last two years.

Having said this, overall stamp duty receipts for the year were up 17.3% on 2015, with almost £1 billion raised from the 3% surcharge in the second half of 2016. This suggests the extra tax was beginning to be priced into the market and buy to let investors haven’t been completely put off.

Seeking value

Factoring in these stamp duty increases has meant buyers are seeking better value for their money, often at the expense of location. Smaller, less expensive property has fared much better over the last year or so, where buyers are looking for this value, but demand has remained for those ‘best in class’ properties.

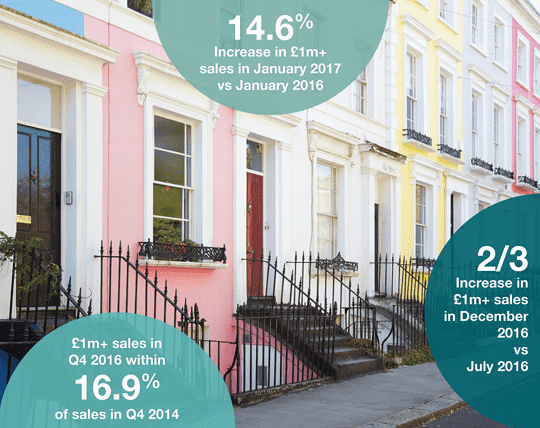

With domestic buyers concentrating on value, and the fall in the exchange rate of sterling following the Brexit decision, an opportunity has arisen for international buyers who are willing to take a medium-term view on pricing. In the second half of 2016 we saw international buyers of second hand properties increase slightly across the prime London market, helping to keep transactions moving.

Prime rents

The prime rental market, both within London and its commuter belt, has also experienced falls over the last year of -5.1% and -0.9% respectively. This is mainly due to high levels of stock on the market as well as weaker corporate demand stemming from the uncertainty surrounding Brexit.

Again, tenants (like buyers) are seeking value for their money and are willing to look further afield to get this. Whilst viewing numbers have remained high, it is the stock that is most appropriately priced and in the best condition that has remained popular.

What happens next?

With values softening, appropriate pricing has become the key to success across both the prime sales and prime rental markets.

In London we are forecasting for rents to fall slightly further and capital values to remain broadly flat over 2017, before both markets pick up again in 2019 when our position over leaving the EU becomes clearer.

Country markets are expected to fare better. These lower value areas have been less affected by stamp duty, and with both buyers and tenants seeking value we may see increased demand as people move out of the capital.

Most importantly, as this realistic pricing begins to feed into the market we can already see confidence improving, with both viewing numbers and transaction levels up.

.png)

.png)

.png)

.png)