- ESG has gained traction in the real estate industry as both investors and prospective tenants have recognised the growing importance of ESG integration.

- Existing properties, especially older ones, have a narrower range of feasible actions that can incorporate ESG initiatives, and investors need to understand what options are realistically available.

- Major initiatives in offices, the largest commercial sector, include incorporating renewable energy systems and using timber as the primary structural material.

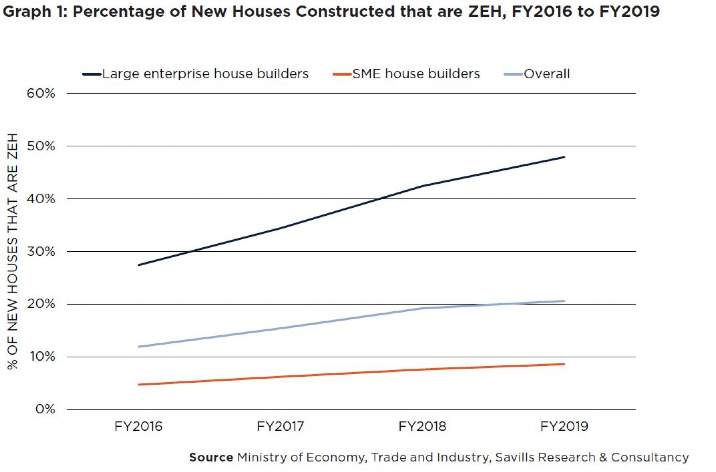

- The residential sector has seen net zero energy house (ZEH) condos increase in popularity. Some investors have also turned to more niche sectors such as healthcare facilities and student housing for socially responsible investments.

- The retail sector has pursued ESG goals like implementing energy and water conversion systems, and creating social spaces that support local communities.

- In addition to initiatives involving the usage and generation of renewable energy, large brand new logistics facility campuses are being designed as towns to be integrated into the community that provide a range of services.

- Although many hotels are still suffering from the pandemic, some have seen environmental and social initiatives on a manageable scale. HR related initiatives are also likely to accelerate as many hotels start to recruit new staff.

- Going forward, the dichotomy between “green” and “non-green” assets will likely become more apparent, impacting valuation and pricing within a few years.

ESG sees rapid proliferation in Japanese real estate

Graph 1 | Percentage of New Houses Constructed that are ZEH, FY2016 to FY2019

ESG initiatives have rapidly gained traction, and new features and practices are emerging across all sectors. However, ESG metrics do not presently appear to be fully reflected from an economic standpoint yet. Hence, prescient asset managers and investors may be looking for opportunities to rebalance their portfolios with these factors in consideration.

Savills Research & Consultancy