- The recovery that the country has seen and the probable stability going forward should further solidify Japan’s appeal as a destination for investors.

- The overall high levels of activity in the market demonstrates the opportunities present, and the optimistic outlook with the pandemic waning may fuel greater confidence.

- With this in mind, the report represents some of our views on investment strategies for Japanese real estate.

Japan’s real estate shines amidst ongoing uncertainty

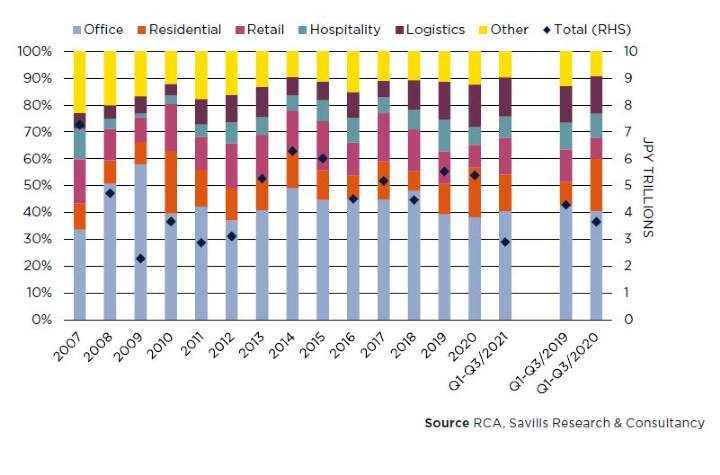

Graph 1 | Investment Volumes And Cross-border Share, 2007 to Q3/2021

There are plenty of lingering risks globally: new variants, likely interest hikes from the tapering of asset purchases, and a possible economic slowdown originating from China. However, amidst these circumstances, Japan’s market has remained attractive as a stable destination for real estate investment. Furthermore, the large amounts of unallocated capital worldwide and higher allocation targets for real estate should serve as a tailwind for the market going into 2022, further boosting investments into Japanese real estate.

Savills Research & Consultancy