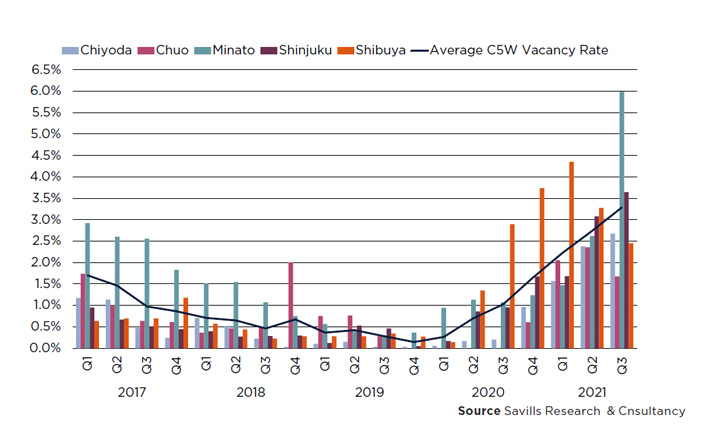

In the central five wards (C5W)1, Grade A rents and vacancy have continued to deteriorate although many listed companies, the typical tenants of Grade A buildings, attained new highs in profit margins in Q2/2021 and will likely report better FY2021 results (ending March 2022) than the pre-pandemic FY2019. The decline of the office market appears to stem partly from the ongoing proliferation of telework. Indeed, there have been multiple announcements of large companies consolidating and shrinking their office space in accordance with their low in-office attendance. Furthermore, according to a survey conducted by the Japan Productivity Center, the implementation of teleworking by large companies2 increased to 37.1% in October from 34.7% in July despite the recent plummeting number of COVID-19 cases.

The Grade B market should stabilise soon

With its large pool of potential tenants and the flexibility of filling vacant space on a smaller scale, Grade B office rents should stabilise before those of the Grade A market as the pandemic winds down. This may make Grade B offices a more attractive investment option.

-idea-2.jpg)

-austin-li-s5wyoksayo0-unsplash-1(1).jpg)

-dreamstime-21760946(1).jpg)

-shutterstock-152517785.jpg)

-cover-seoul-logistics-2h-2021-acr(1).jpg)

-shutterstock-1098787424(1).jpg)

-shutterstock-1021476730(1).jpg)

-shutterstock-427983895(2).jpg)

-shutterstock-603745277(1).jpg)

-shutterstock-175136171(1).jpg)

.jpg)

-national-cancer-institute-ffganob1cx4-unsplash(1).jpg)

-cover-photo-21h2(1).jpg)

-shutterstock-382411990(2).jpg)