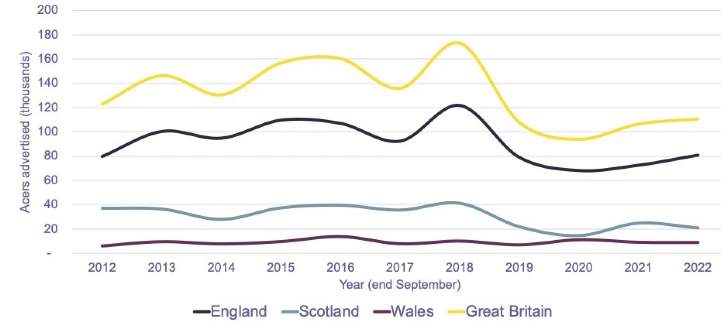

While supply has increased from last year, this is not being seen evenly across the country. In the East Midlands, the number of acres publicly marketed during the first three quarters of this year was down 40 per cent on the equivalent period of 2021, while Scotland’s supply is down 16 per cent. On the other hand, the East and North of England have seen supply rise by 81 and 18 per cent respectively. Multiple large farms and estates have entered the market here, offering a good market indicator that there is strong demand for 1,000 plus acre estates. Several of these recently launched estates are now under offer.

Even without the Coldham Estate, the single largest estate marketed at 4,000 acres, supply in the East would still have increased by 39 per cent showing that the trend is not simply due to an anomaly.

With the lump sum exit scheme’s application window only recently closed on 30 September, it is unlikely we will see any consequent increase in supply this year, but it may lead to some additional launches onto the market in spring 2023. This being said, Savills Research anticipates that in reality the impact will be fairly small, with the majority of retirees meeting the scheme rules by surrendering rented land to their landlord or if owned, transferring it to their successors, or renting it out under a Farm Business Tenancy.

Values

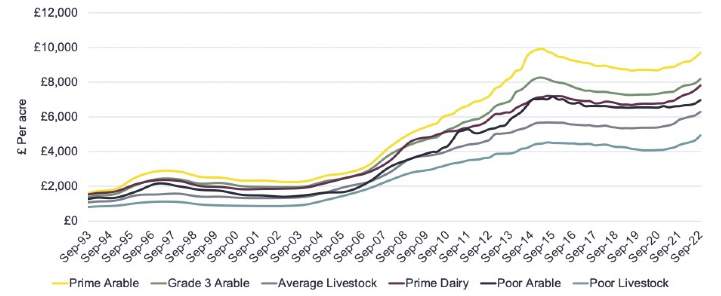

The constrained supply, while beginning to return to normality, has impacted the market with a growing pool of buyers frustrated by the lack of opportunity. Values are supported by the continued supply and demand imbalance. Savills agents are finding that this has generated such a demand that land can be under offer for up to 20 per cent more than its guide price, from smaller farms to larger commercial estates.

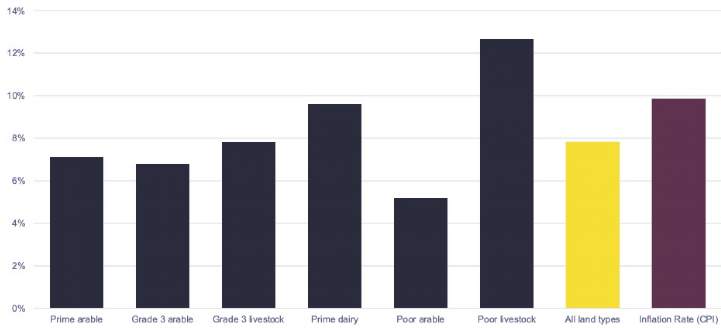

This quarter, land prices have continued to rise, with the overall average farmland value in Great Britain increasing by 3.3 per cent to £7,600 per acre. The average values for prime arable and grade 3 grassland across Great Britain are now around £9,700 and £6,300 per acre respectively.

Great Britain – by land type values

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)