Despite a more uncertain economic outlook and two years of a global pandemic, the appetite from domestic and international students to study in the UK remains very strong.

According to the latest population data from HESA, 2020/21 saw the UK’s total full-time student population grow by 8.0 per cent. 2021 was also a record year for UCAS applicants, reaching almost 750,000. Of these, there were over 560,000 acceptances – the second-highest number of acceptances on record.

In fact, the last two application cycles are the only ones on record to see more than 600,000 applicants by the January deadline (616,000 and 611,000, respectively). As a result, we project there will be a total of 1.75 million full-time undergraduates in 2022, which will result in an enormous need for beds.

With so much demand from students, the purpose-built student accommodation (PBSA) sector continues to be an asset class of choice for investors, who spent £4.1 billion in the sector in 2021 alone.

But which are the best UK cities to invest in?

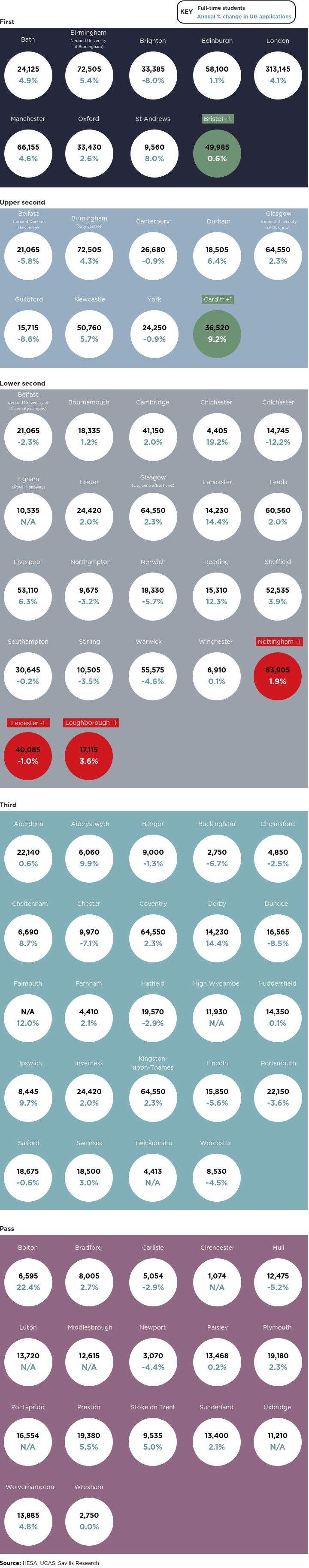

Each year we publish our PBSA Development League Table, showing the locations we believe are the most attractive for PBSA development (see below). Read our full report here.

This year our top tier cities include Bath, Birmingham and Brighton, which have all seen a combination of strong student population growth, a high student to bed ratio and a limited pipeline of new beds. Bristol, which has moved up to the top tier of our league table, presents a strong case for development. While it has a reasonable pipeline, the University of Bristol has well-publicised struggles accommodating its first years locally.

Cities in the upper and lower second tiers also have strong demand scores, but typically have more standing stock and/or a larger pipeline. Cardiff has moved up the table, as recent development has already been well absorbed, and its pipeline is now limited. Nottingham has moved down to the lower second, owing to its large pipeline of circa 10,000 beds.

But, while the league table can help with prioritising development opportunities, it doesn’t mean that lower-tiered locations should be ignored.

A well-located scheme in a lower tier, close to campuses or other amenities, with the right design specification and at the right price point, can perform as robustly as a scheme in a higher-tiered city.

Contact our Student Accommodation team to discuss the market further.

PBSA development league table

.jpg)

.jpg)

.jpg)